T3 Sixty Unveils 2024 Organized Real Estate Rankings

Feb. 13, 2024, Ladera Ranch, Calif. – T3 Sixty, a management consulting and analytics firm in the residential real estate brokerage industry, today published its 2024 rankings of organized real estate in the United States. The annual report provides insights into multiple listing services (MLSs), and local and state Realtor associations, including current membership and subscription numbers, MLS and association counts and other key metrics.

2024: A Benchmark Year for Organized Real Estate

T3 Sixty's annual organized real estate rankings offer a crucial benchmark, providing industry stakeholders with a clear snapshot of the current landscape and setting a baseline for understanding industry dynamics in the coming years.

“This year’s rankings provide more than just a snapshot, they stand as a benchmark to guide MLS and Realtor association leaders to make informed decisions against evolving MLS ownership and access models,” said T3 Sixty President and CEO Jack Miller.

Tracking Ownership Structures: Changes on the Horizon

A notable addition to this year's rankings is ownership structure within MLSs. Recognizing potential industry changes on the horizon, T3 Sixty's data sheds light on Realtor association membership compared to MLS subscriber count to track the impact buyer brokerage compensation lawsuits and consolidation could have on the industry.

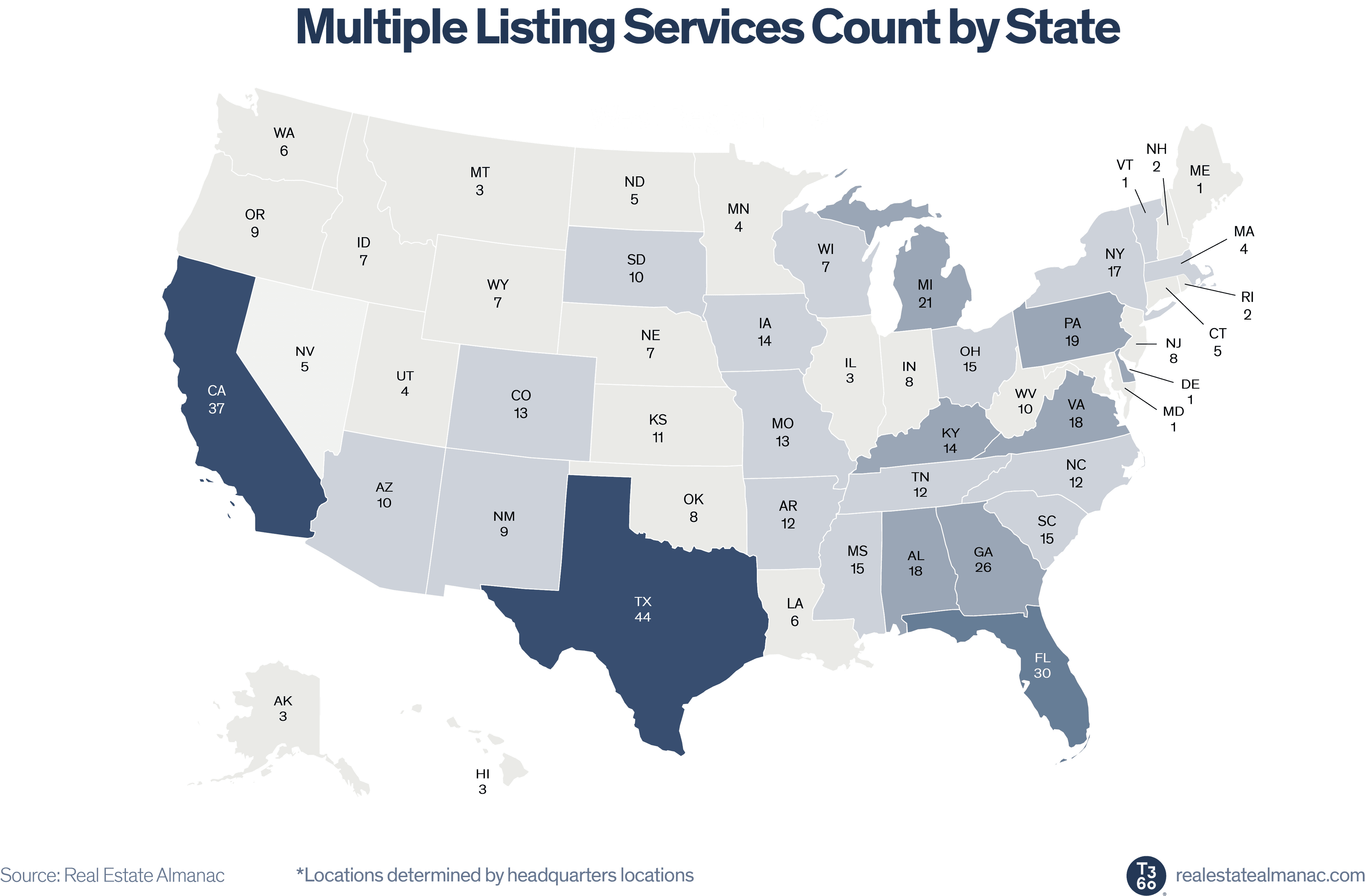

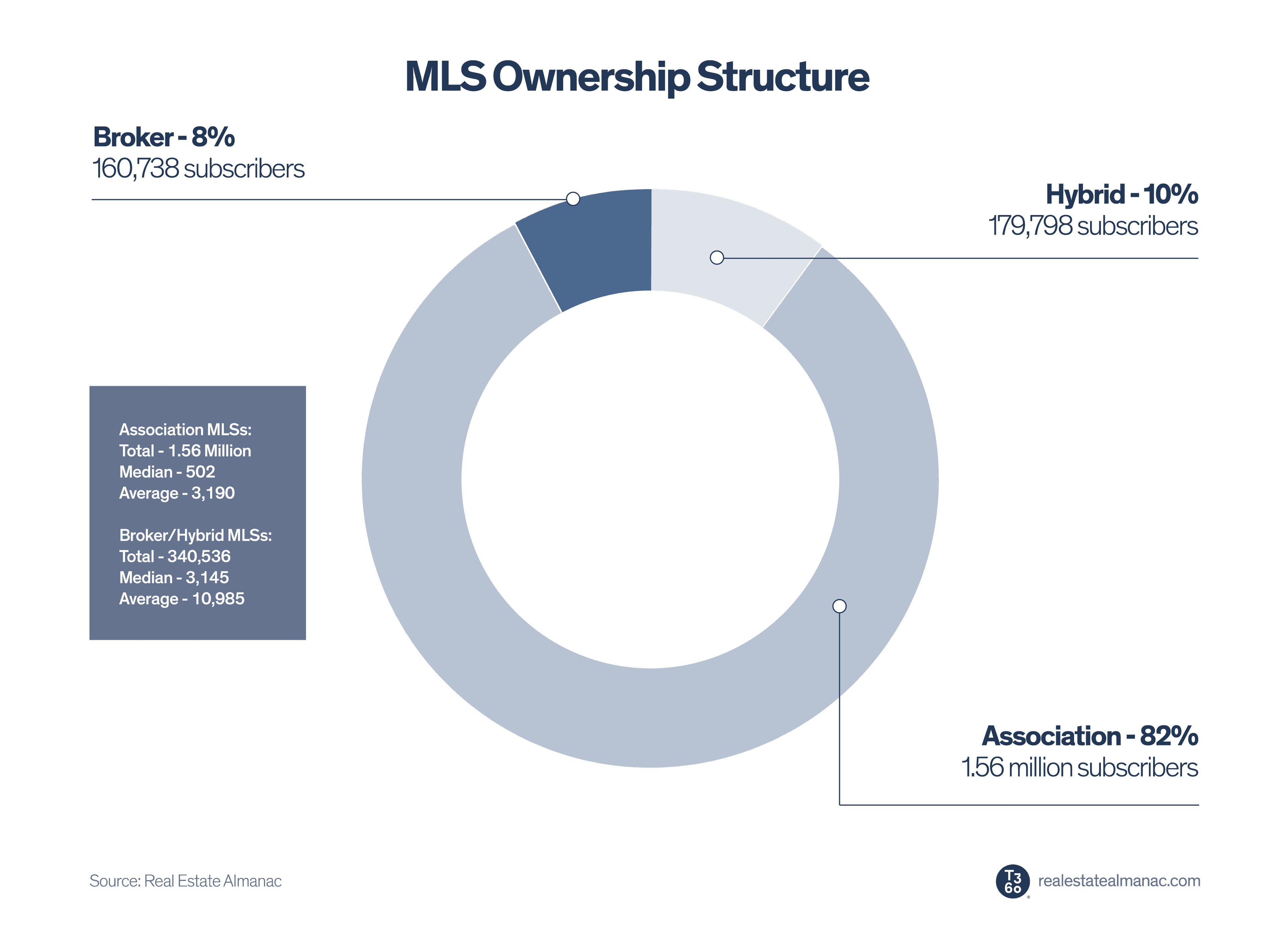

Today, there are 521 MLSs and the vast majority are owned by local Realtor associations. However, 20 are owned exclusively by brokerages and 11 are owned by a mix of brokerages and local Realtor associations, with one privately owned.

Currently, nearly 20% of Realtors must pay to access multiple MLSs. If ownership shifts away from local Realtor associations, Realtor counts may dwindle as agents will not be required to join a local association to access an MLS.

“Our dedication to tracking industry shifts is clear with the inclusion of ownership structure data this year,” said Senior Vice President of Organized Real Estate at T3 Sixty Clint Skutchan.

“We're the only ones who share subscriber data, enabling us to truly understand the impact on MLSs and who will have access to MLS data in the future,” Skutchan added. “It's important to note that going into this year one in five MLS subscribers either pay for more than one MLS or are accessing MLS services as a non-member. However, that number is likely to shift if more hybrid MLS models emerge and brokerages no longer require their agents to join the local association.”

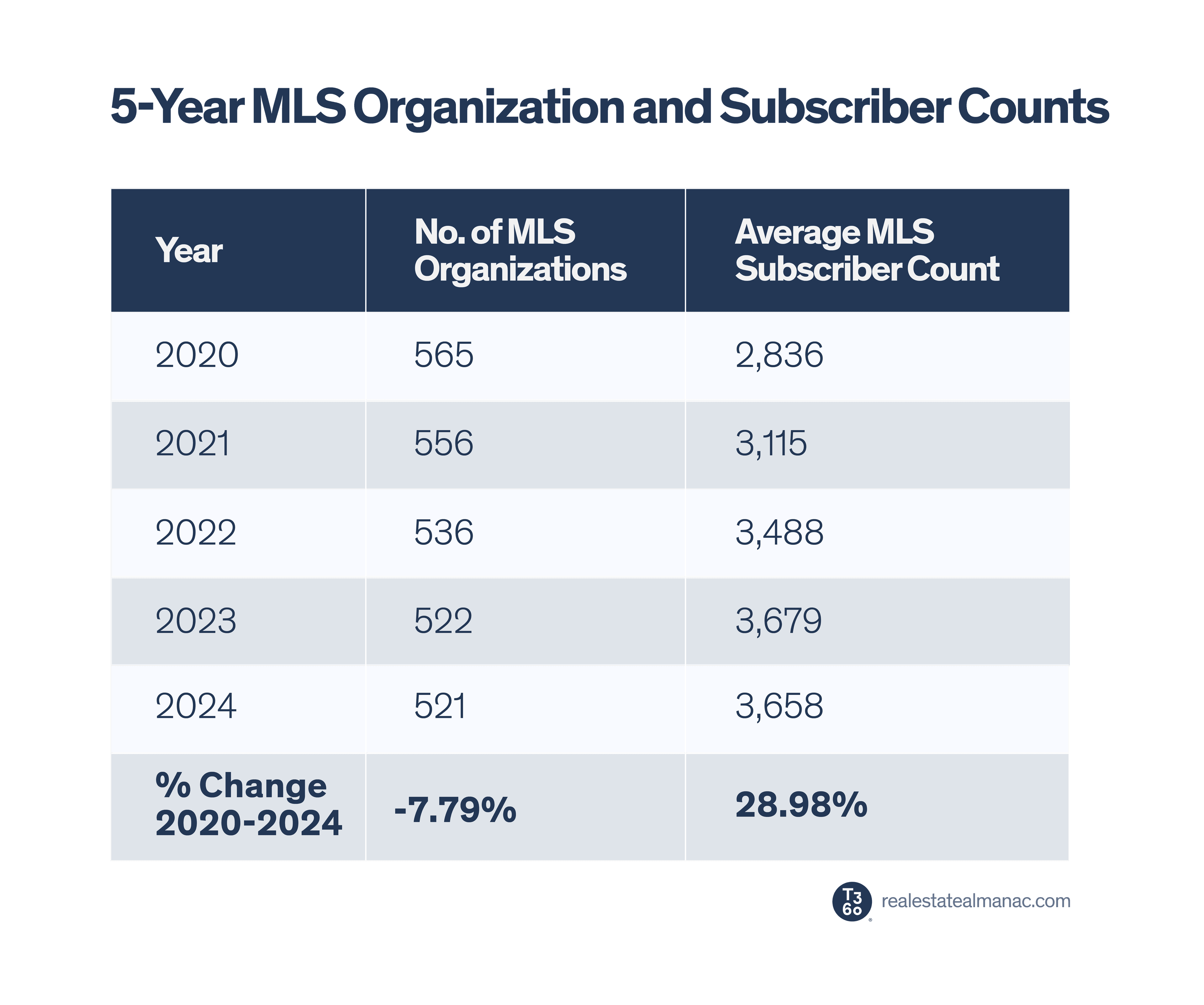

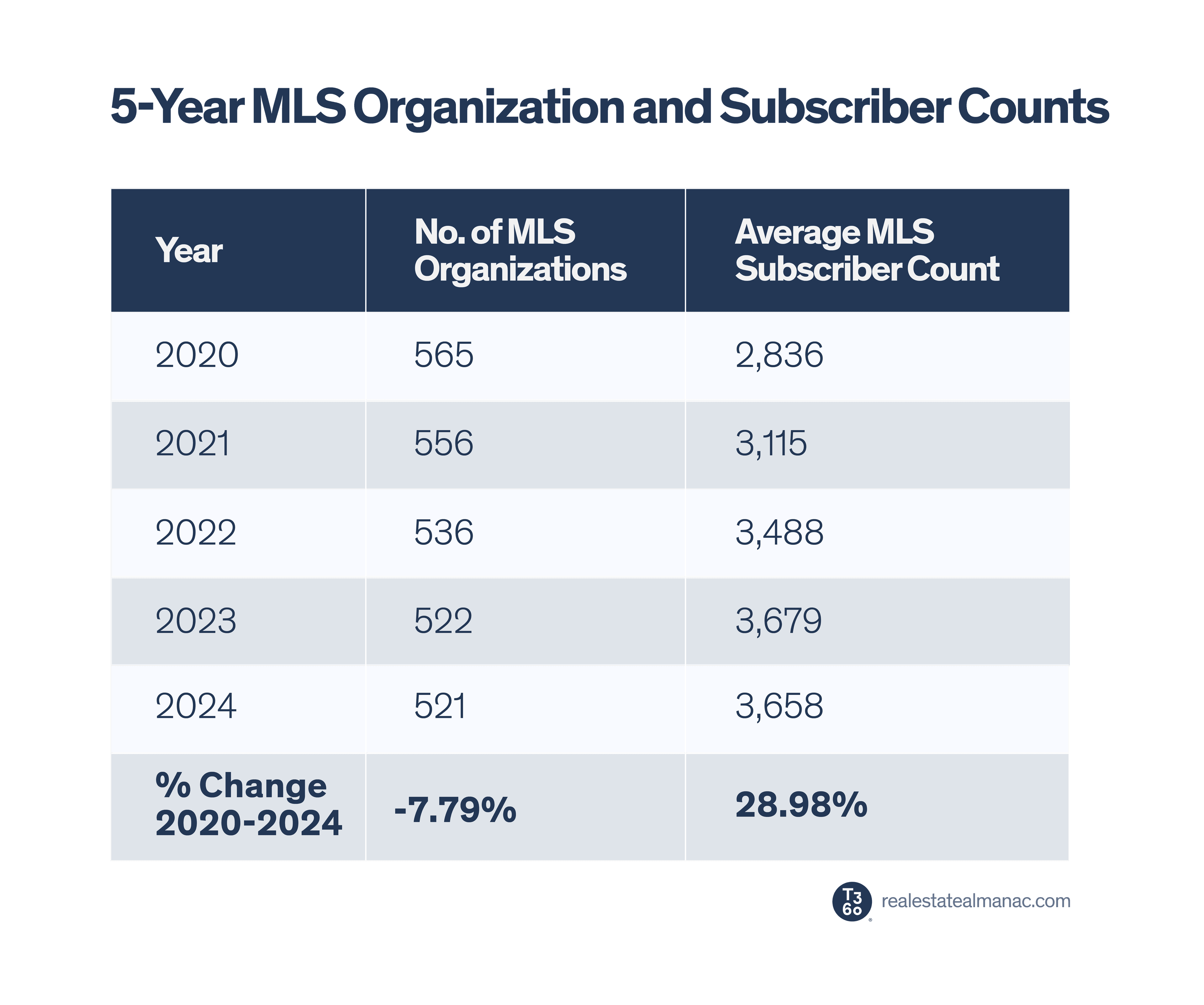

Five-Year Trendlines Continue

The data supports the five-year trendlines of concentration of subscriber count in regional MLSs and members in the largest associations, and MLS and association consolidation.

Organizations with more than 50,000 MLS subscribers or more than 25,000 residential real estate association members continue to grow.

Segment Size Data:

Seven MLSs with more than 50,000 subscribers, up from three in 2020

Four associations with more than 25,000 members.

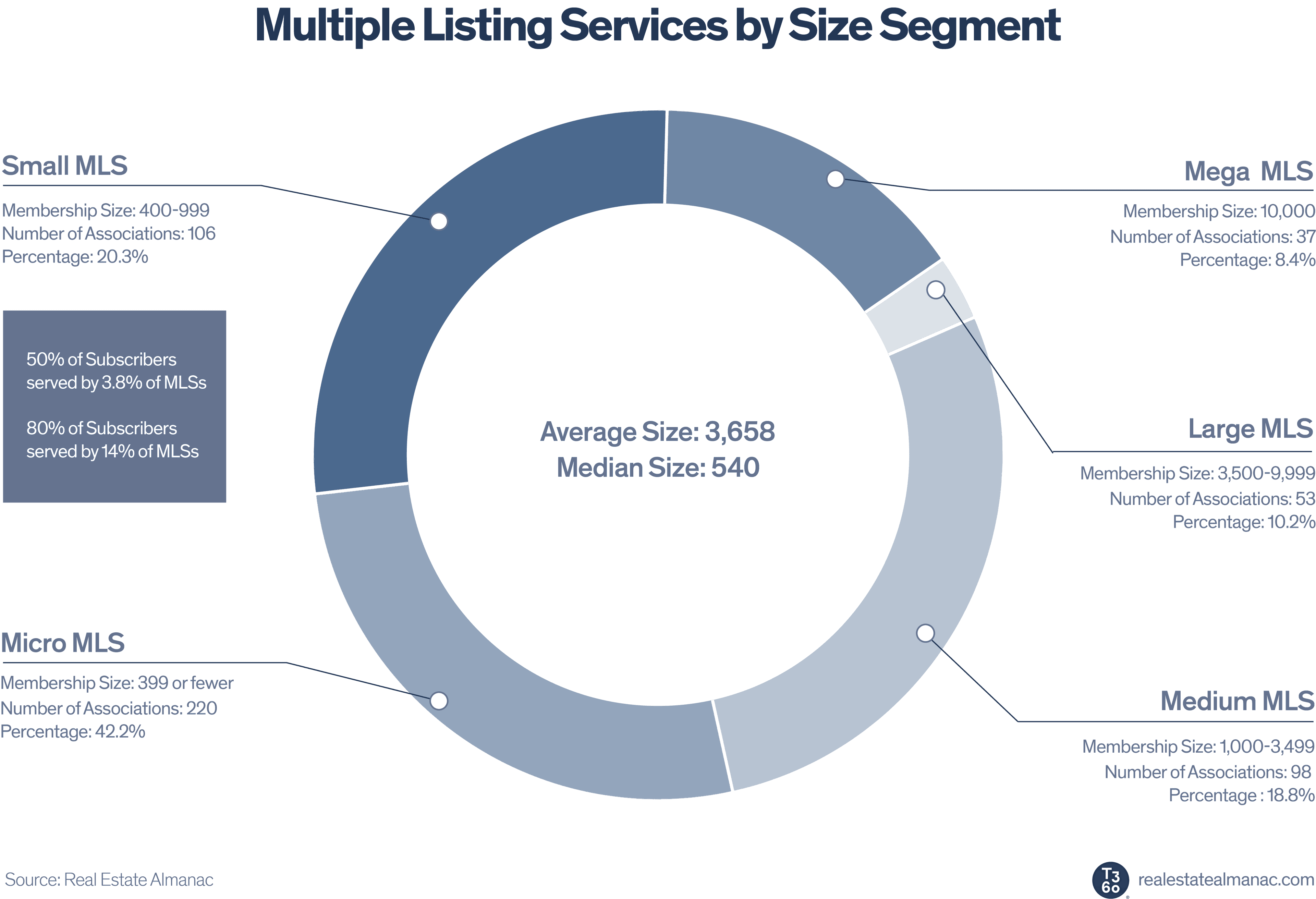

Since 2020, mega and large MLSs (more than 3,500 subscribers) have grown 9%, while medium, small and micro MLSs (3,499 and under subscribers) have declined by 10.4%.

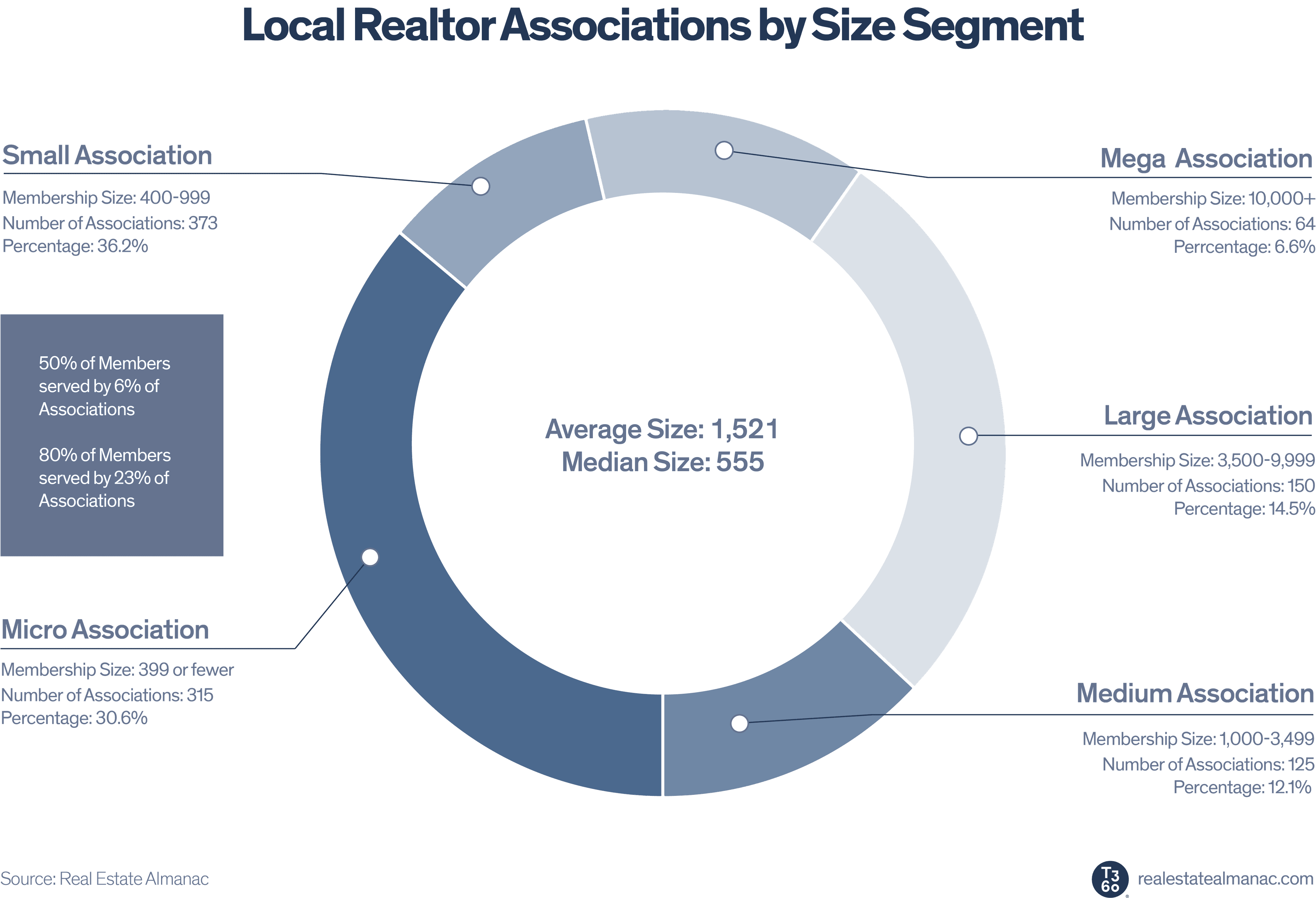

Similarly, since 2020, mega and large associations (more than 1,500 members) have grown 18.2%, while medium, small and micro associations (1,499 and under members) have declined by 9.8%.

From 2019 to 2023, there has been a 7.3% reduction in the number of MLSs, accompanied by a 29.7% growth in average MLS subscriber count.

Local Realtor associations are following a similar pattern — shrinking by 3.3% in numbers but growing their average member count significantly from 2019 to 2023. During the last year, the number of local Realtor associations dropped 1.5%, but the average member count grew 3.3%.

“Though not a new phenomenon, the consolidation trend remains a pivotal point to acknowledge. A compelling statistic reveals that 60% of local Realtor associations are served by a regional MLS, with the majority of local Realtor associations no longer directly controlling their MLS decisions and revenue,” said Skutchan.

2024 MLS and Association Data:

107 regional MLSs, compared to 108 the year before.

60%, or 621, of local Realtor associations are served by 107 regional MLSs.

414 local MLSs, compared to 421 the year before.

43% of the nation’s 521 MLSs have under 400 subscribers.

Half of MLS subscribers are served by 3.8% of MLSs, with 27% having more than 50,000 subscribers.

1,031 residential real estate associations compared to 1,047 the year before.

Half of association members are served by 6% of associations, with 11% having more than 25,000 members.

To view all MLS and association data, please visit realestatealmanac.com.

About The Real Estate Almanac

The organized real estate list is one of five annual, data-backed, researched lists and rankings from T3 Sixty's Data division, contributing to the Real Estate Almanac. This comprehensive compilation covers the most powerful residential real estate brokerage leaders (SP 200), the industry's leading technology products (Tech 200), the nation's largest holding companies and franchise brands (Corporations), and the 1,000 largest brokerage companies (Mega 1000). Learn more at Real Estate Almanac: realestatealmanac.com.

About T3 Sixty

T3 Sixty is a management consultancy in the residential real estate industry with business units in brokerage, technology, mergers and acquisitions, and organized real estate. The group also provides software and data, extensive research and reports, executive search and event management services. For more information, visit t360.com.