Should I stay or should I go: The mortgage lock-in effect

With mortgage rates more than doubling to 6.7% since the start of 2022, buying and selling a home today means taking on a higher-rate mortgage. A recent survey from realtor.com noted that 82% of homesellers are reluctant to sell their home and give up the low interest rate on their current mortgage, known as the mortgage lock-in effect.

To see how this might play out, consider the following example.

For a homeowner with a $300,000 30-year mortgage at 3%, the monthly payment is $1,265. Purchasing a home and taking out a new mortgage of $300,000 at today's 6.7% rate raises the monthly payment to $1,936, adding $671 to monthly payments. Alternatively, if the homebuyer purchases a home requiring a larger mortgage of $400,000, the monthly mortgage payment would be $2,581, an increase of $1,316 due to the combined impact of a higher mortgage rate and loan.

While there are many reasons that homeowners choose to move, with today's combination of elevated mortgage rates and higher home prices, the financial impact is a significant factor in the decision of whether to sell and purchase home or simply stay put.

Sizing up the lock-in effect

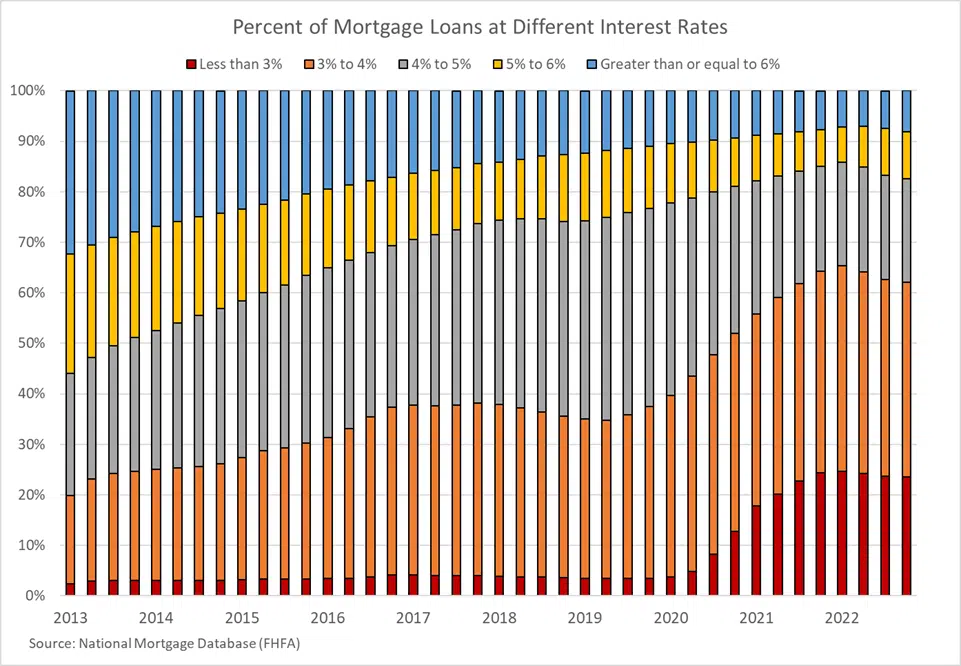

To show the lock-in effect significance, it is helpful to look at a number of mortgage loans at different interest rates.

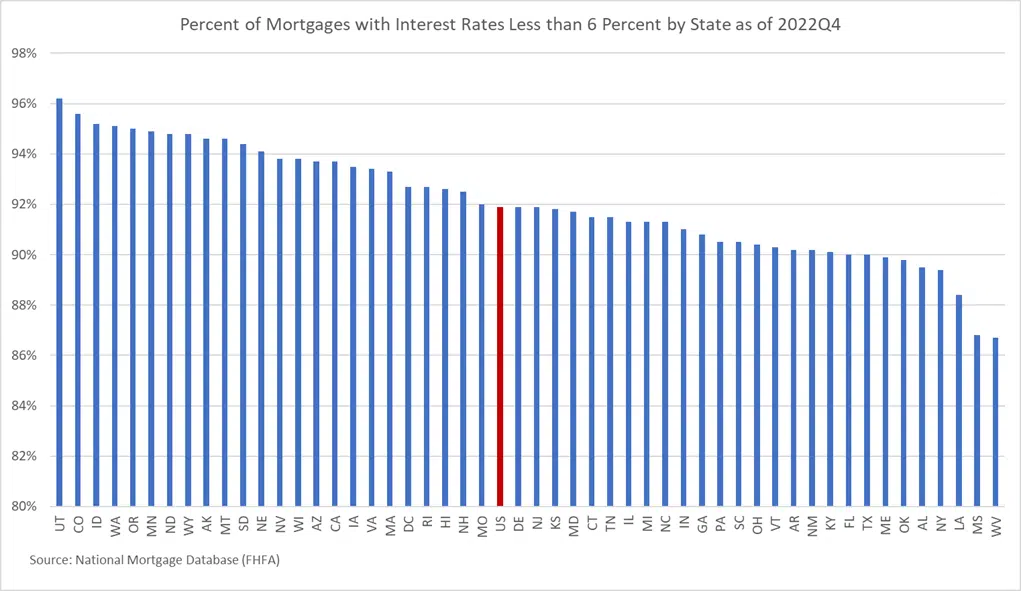

Data from the Federal Housing Finance Agency (FHFA) reveals that as of the fourth quarter 2022 (the latest data available), 24% of mortgage loans carried an interest rate of less than 3%, up from the low single-digit percentages prior to 2020. Overall, the most recent data illustrates that more than 90% of borrowers have a loan with an interest rate of less than 6%. In other words, nearly all of today's home sellers with a mortgage would give up a lower rate to take out a mortgage at today's 6.7% rate to buy their next home. Market differences The lock-in effect can vary geographically because there are more mortgage loans in areas with stronger home sales. When mortgage rates are low, as they were in 2020 and 2021, areas of the country with the most home sales capture the largest share of lower-rate mortgages.

As the chart illustrates, more than 96% of Utah borrowers have mortgages with a rate of less than 6%. In fact, 24 states are above the national average of 91.9%. At the other end of the spectrum, Mississippi and West Virginia had the lowest percent of mortgage borrowers with sub-6% mortgage rates. Even in these states the percentage is greater than 86%. One explanation for the variation is that many of the states with the highest percentage of sub-6% mortgages are home to metro areas that have experienced a rapid pace of home sales, especially in the past few years. Eight of the top 10 states are in the West, reflecting the long-standing pattern of strong in-migration to the Pacific Northwest and Mountain states. More recently, the pandemic-era work-from-anywhere shift made places like Salt Lake City, Boise, Denver, Bend (OR), and Phoenix particularly attractive to movers. In fact, more than 70% of mortgages in Utah and Colorado respectively originated during the four-year period through 2022 when mortgage rates reached a low of less than 3% --10 percentage points higher than the comparable nationwide share of 60%. Takeaway Home buyers have enjoyed low mortgage rates until recently. With the rise in rates during the past year, more than 90% of would-be home sellers must decide if the motivation to move is stronger than the desire to hold onto their lower-rate mortgage. This lock-in effect contributes to the low inventory level bedeviling buyers and is particularly strong in areas of the country witnessing the strongest pace of sales in the past few years.