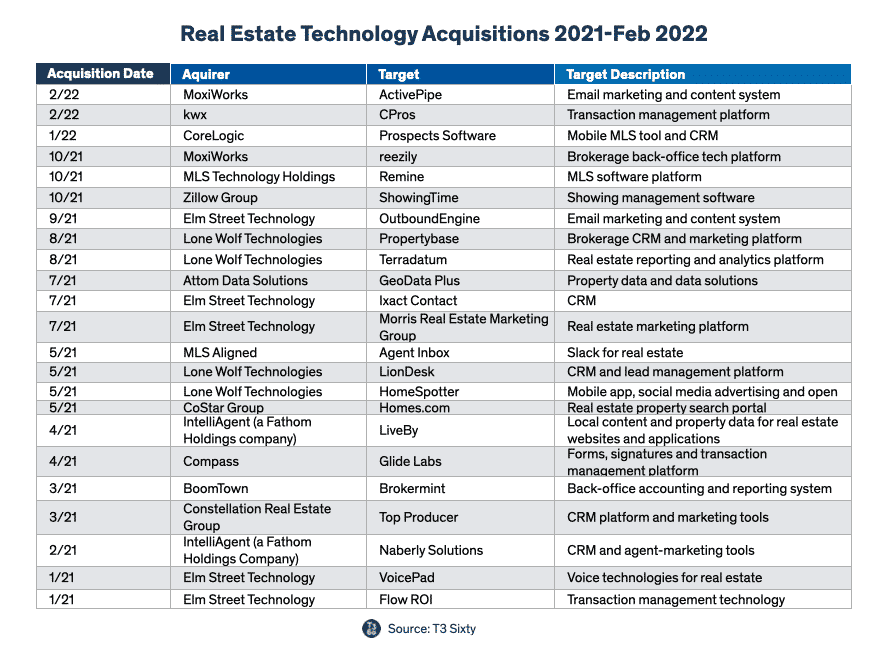

Since approximately early 2018, the residential real estate brokerage industry has experienced a steady drumbeat of technology acquisitions. Acquisitions, of course, are not new in the residential real estate industry – Zillow Group grew and diversified its business with many acquisitions over the years — but they are happening at an increased pace, reflecting the industry’s continued technological maturation.

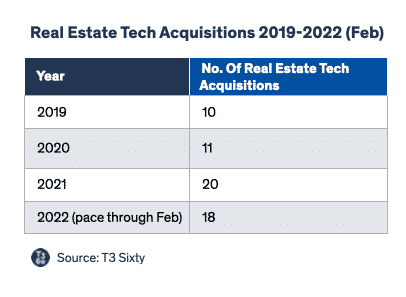

In 2019, the industry saw 10 significant tech acquisitions, in 2020 11, and in 2021 20. Through February in 2022, there have been three acquisitions, putting this year on pace for 18, which represents a continued elevated cadence of industry tech purchases. The pace of residential real estate technology acquisitions has clearly increased.

In many ways this consolidation is a natural extension of the great amount of venture capital that has poured into the industry over the last decade, and in the maturation of technology businesses that serve the industry.

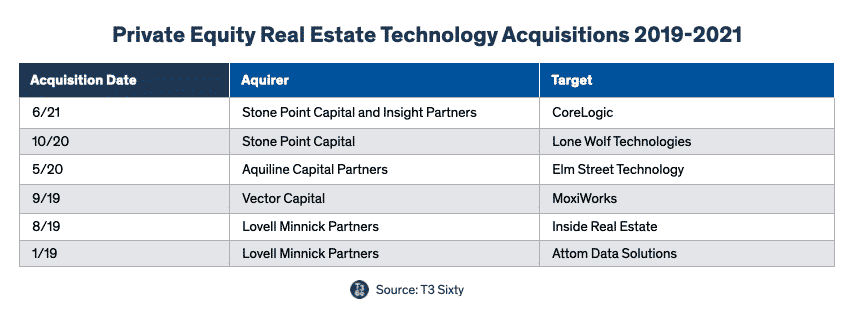

That venture capital, deployed to help launch and grow real estate tech startups, has built the companies now targeted for acquisition by private equity companies and the increasing number of public real estate companies.

For deeper context on how private equity works and its impact in real estate and a deeper analysis of the tech consolidation’s impact on brokerages, access the 2022 Swanepoel Trends Report chapters on T3 Intel.

Several real estate technology companies all now owned by private equity companies – MoxiWorks, Inside Real Estate and Lone Wolf Technologies – are leveraging acquisitions to build comprehensive real estate brokerage platforms. These three companies, alone, accounted for 10 of the total 43 real estate tech acquisitions that occurred from 2019 to February 2022, nearly a quarter (23.0 percent) of all acquisitions in that period.

Others, such as Constellation Real Estate Group and Elm Street Technology, are amassing diverse portfolios of real estate tech companies with their acquisitions. These two companies accounted for over a quarter (25.6 percent) of all real estate tech acquisitions in the last three years.

And, large public firm CoStar Group, jumped into the residential real estate sales side with its recent acquisitions of Homesnap and Homes.com.

These acquisitions have resulted in fewer companies providing more, broader tech offerings. This can be a double-edged sword – brokerages and teams get access to technology and providers with more resources to integrate and innovate, but also have fewer choices. Larger companies also can be less responsive to individual customers’ needs.

[Industry maturation can be seen in new MLS collaborations, too.]

Inside the wave

MoxiWorks provides a good example of the tech consolidation wave happening.

Recognizing that a real estate technology consolidation phase was coming, MoxiWorks’ CEO York Baur, a former manager at Microsoft, proactively went to the company’s board in 2018 to find a private equity partner to provide the capital and strategic push to acquire companies rather than be the acquired.

In September 2019, private equity company Vector Capital acquired the company.

“Real estate is going through the same tech phases other industries have,” Baur told T3 Sixty. While other industries have already matured in tech, the process has delayed in real estate because of the more complicated structure and relationship-heavy focus.

In 2018, the industry faced pressure from tech-forward industry participants such as Redfin and Compass, an immensely fractured tech landscape (with a plethora of smaller companies), and the overall real estate tech and data landscape maturing to a point where the economies of scale provided significant advantages to larger companies and nearly insurmountable challenges for smaller firms.

With the private equity capital in its sails, MoxiWorks has made three acquisitions since partnering with Vector Capital. It acquired real estate marketing platform Imprev in November 2019, back-office brokerage system reeazily in October 2021 and email marketing platform ActivePipe in February.

The acquisitions support a full-featured brokerage operating system vision that MoxiWorks is executing. It has invested heavily in building an integration system, MoxiCloud, in which third-party tech can plug into its system and network of clients. This also, allows it to visualize tech usage by partners and vet potential acquisitions.

Takeaway

More real estate tech acquisitions are undoubtedly in the works. T3 Sixty will be tracking each of them and analyzing the ongoing impact for real estate brokers and team leaders. For more insight and analysis, access the 2022 Swanepoel Trends Report on T3 Intel for more detailed analysis of this trend’s impact on brokerages.