A spate of recent efforts by MLSs to acquire and own technology that they and their subscribers rely on stands in response to a growing feeling by many MLS leaders of a lack of control due to acquisitions of MLS technology by large technology companies.

Some of the recent acquisitions of technologies popular among MLSs by large firms include:

- December 2020: CoStar Group acquires Homesnap, which some MLSs adopted as their consumer-facing portal.

- February 2021: Zillow Group announces acquisition of popular showing service ShowingTime (the acquisition closed in October).

- April 2021: Compass acquires Glide Labs, the digital transaction management platform that over 60 Realtor associations in California provided as a member benefit at the time of acquisition.

- June 2021: Private equity firms Stone Point Capital and Insight Partners acquire CoreLogic, provider of Matrix, the nation’s most used MLS system.

These developments have, in part, spurred MLSs into action. Just last week, the nation’s two largest MLSs, California Regional MLS (CRMLS) and Bright MLS, which have over 213,000 subscribers combined, announced a technology agreement in which they’ll collaborate on technology initiatives, share data and work closely together to develop MLS industry tech.

“We want to control our destiny,” CRMLS CEO Art Carter told T3 Sixty. “MLSs need to face the reality that they’re a major hub for real estate data.” As such, the collaboration with Bright will focus on building foundational backend MLS technology that will better enable the two MLSs, and other MLSs who may use eventually it, to efficiently organize, track and present data that provide innovative insights for brokers and other users.

Carter describes the effort as building a technology foundation that other MLSs could eventually use, too, and give various front-end MLS systems the ability to plug in to a well-built system. By owning the technology, the MLSs – and others profiled in this article — ensure they have a seat at the table as technology rewrites the industry.

This sentiment echoes fairly widely among some of the nation’s most innovative MLS leaders.

“We’ve been sitting on the sidelines watching acquisitions of MLS technology occur,” Emily Chenevert, chair of MLS Technology Holdings and of the Austin Board of Realtors and ACTRIS MLS, told T3 Sixty. “We’re all concerned about the growing conglomerations of large partners acquiring more technology. If we don’t participate now, we may be left behind.”

Some of the technology efforts by MLS groups and MLSs in the last nine months include:

- May 2021: MLS Aligned acquires Agent Inbox to create a showing service

- June 2021: California Regional MLS, Bright MLS and MRED collaborate to develop MLS showing software service

- October 2021: New MLS joint venture, MLS Technology Holdings, acquires MLS software provider Remine

- November 2021: Realtracs launches Showing service Realtracs Showings and, separately, HAR launches ShowingSmart showing service

- December 2021: CRMLS launches venture fund and makes equity investment in real estate data platform Perchwell

- February 2022: CRMLS and Bright MLS announce deep technology collaboration agreement.

As MLSs look to take a more active role in the technology they rely on and seek to leverage new efficiencies, economies of scale and financial might with collaborations, a sketch of how the industry may evolve – one with a handful of large MLS collaborations or mega MLSs serving more subscribers and MLS partners, regardless of geography, is emerging.

With MLSs developing equity stakes in technology companies and building technology outright, MLS leaders say they can better align the long-term interests of those companies with that of their own and their subscribers.

In many cases, these MLS collaborations offer complementary services and are not exclusive, so MLSs could join more than one; membership opportunities vary for each, but all have plans to add additional members, either with MLS partners who have equity in the group or those who join solely as members.

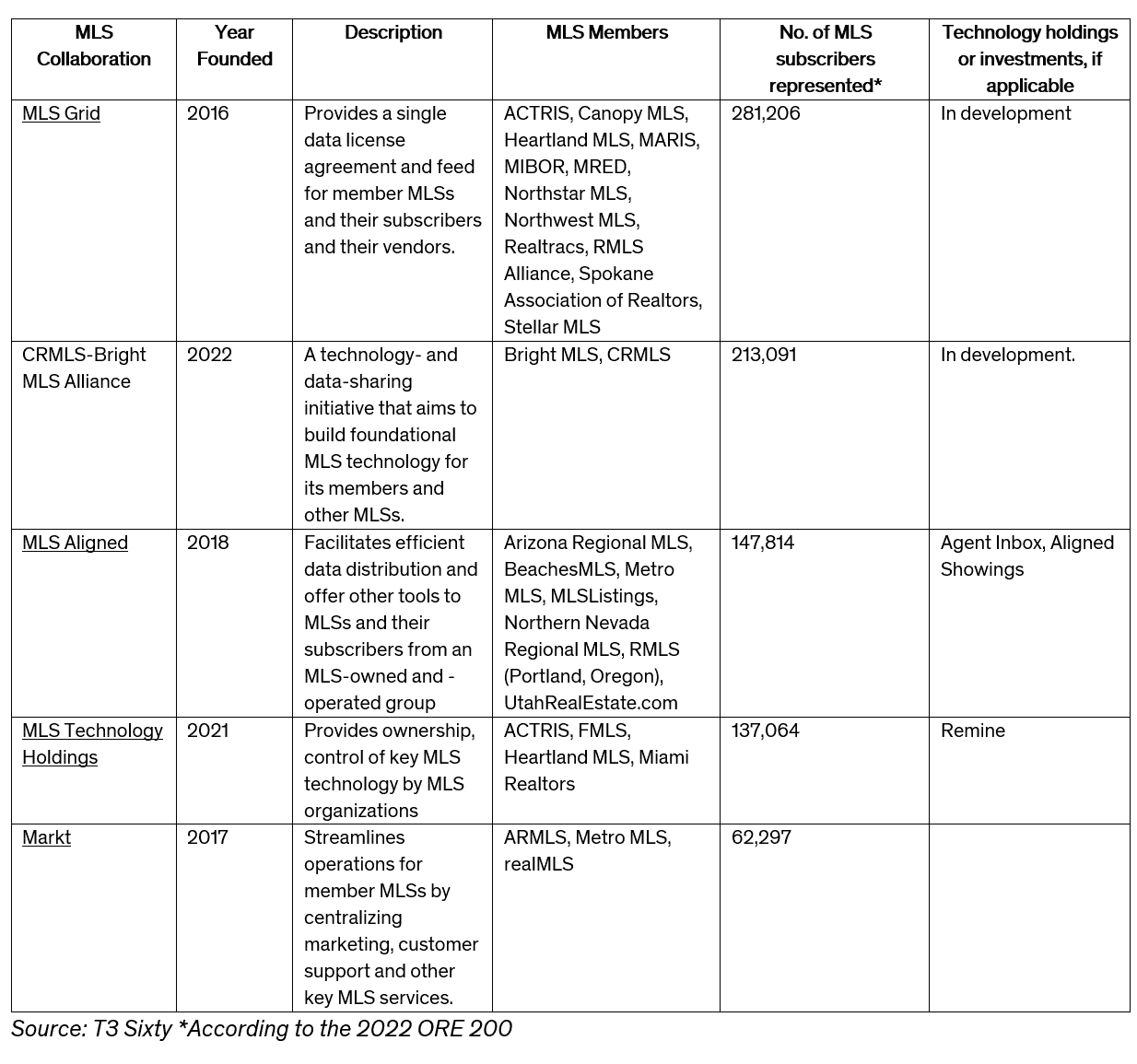

This article examines some of the nation’s largest MLS collaborations looking to own MLS technology and make it available to MLS partners and members throughout the country: MLS Grid, CRMLS-Bright MLS Alliance, MLS Aligned and MLS Technology Holdings.

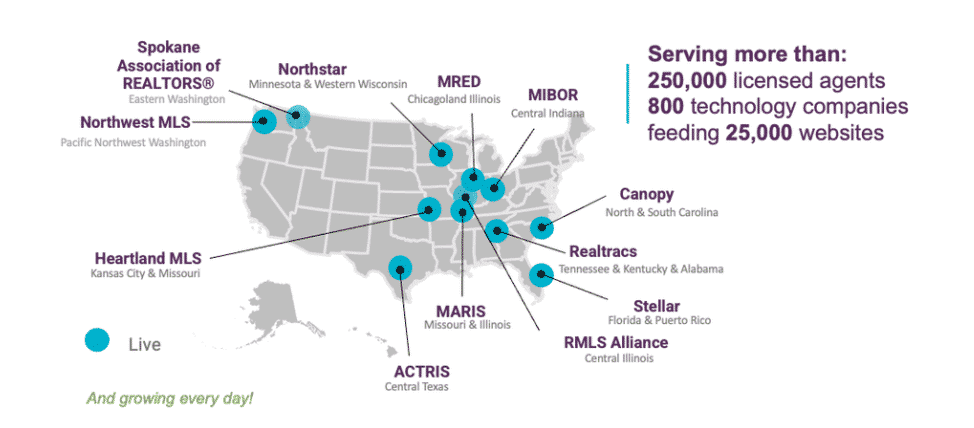

Founded in 2016, MLS Grid represents over 281,000 subscribers in 12 MLSs. It has developed a single data standard agreement and a single data feed for all its members and their subscribers. Not all MLS participants in MLS Grid are owners of the entity (RMLS, for example, exists just as a member).

The standardization that MLS Grid provides its members gets brokerages and their vendors much closer to a final data feed they need, which reduces startup and operating costs. For example, brokers who operate in multiple markets where more than one MLS Grid MLS member operates have just one data license agreement and payment for that data.

MLS Grid has not made any outside strategic technology investments, but it is currently evaluating opportunities, says Rebecca Jensen, chair of MLS Grid and CEO of MRED, one of the founding MLS members of the group.

MLS Grid has not made any outside strategic technology investments, but it is currently evaluating opportunities, says Rebecca Jensen, chair of MLS Grid and CEO of MRED, one of the founding MLS members of the group.

In addition, the group is looking to develop and offer showing service hub software, spearheaded by an informal collaboration between CRMLS, MRED and Bright MLS, that will facilitate the ability of multiple showing services to synch up their scheduling, making it easier for MLSs to offer more than one showing service.

Current MLS Grid membership map. Source: MLS Grid.

CRMLS-Bright MLS Alliance

The CRMLS-Bright MLS Alliance grew out of the informal collaboration on showing hub technology the MLSs, with MRED, had last year. That set the stage for a deeper alliance, says CRMLS CEO Art Carter.

The Alliance has not spawned a new company and the two MLSs are not merging, but they are sharing technology resources and aligning their tech visions in an effort build a strong MLS backend system that MLSs across the nation can also use. The two are hoping to lead the way and then present ways for others to participate down the road.

For example, the showing hub software the two worked on – that will facilitate the ability for MLSs to easily incorporate more than one showing service – should release to the industry in the summer, according to Carter.

The ability to control its tech future for CRMLS extends beyond this Alliance. In December, the MLS launched venture fund and announced participation in a funding round for Perchwell, a front-end MLS tech vendor. Carter envisions other MLSs joining this fund in the future as general partners.

Part of Perchwell’s pitch. Source: Perchwell

This tech-equity strategy by CRMLS — owning core MLS backend technology and then taking smaller stakes in tech vendors via a venture fund – gives the MLS multifaceted control of the tech it and its members will rely on for the future.

MLS Aligned

The vision for MLS Aligned, which debuted in 2018 with founding members Arizona Regional MLS (ARMLS), Metro MLS, MLSListings, RMLS and UtahRealEstate.com, began with a recognition of the new data possibilities for MLSs in the digital era, and, like MLS Grid and MLS Technology Holdings members, an increasing concern over consolidation in the MLS technology space, says Matthew Consalvo, a board member of the group and CEO of ARMLS.

The vision for MLS Aligned, which debuted in 2018 with founding members Arizona Regional MLS (ARMLS), Metro MLS, MLSListings, RMLS and UtahRealEstate.com, began with a recognition of the new data possibilities for MLSs in the digital era, and, like MLS Grid and MLS Technology Holdings members, an increasing concern over consolidation in the MLS technology space, says Matthew Consalvo, a board member of the group and CEO of ARMLS.

MLS Aligned, which now has seven MLS members representing over 147,000 subscribers, acquired Agent Inbox in May 2021 with the intention of using the technology to build its own showing system. The group launched Aligned Showings in beta within MLS Aligned in December. The group intends to make it available to MLSs outside the group soon.

Consalvo says the group intends to introduce other technologies — either via strategic investments or by building them itself – in the future with the same Aligned nomenclature.

In addition to MLS Aligned, ARMLS is a member of Markt, an MLS collaboration group founded in 2017 that provides centralized MLS operational support to members including marketing, customer support and technical resources. The group has three MLSs – ARMLS, Metro MLS and realMLS, representing over 62,000 subscribers.

MLS Technology Holdings

ACTRIS, FMLS, Heartland MLS and Miami Realtors, representing over 137,000 subscribers collectively, formed joint venture MLS Technology Holdings to acquire MLS technology provider Remine in October for an undisclosed sum. MLSs in approximately 60 markets, representing approximately 1.2 million subscribers, currently use Remine.

The group formed organically, says Chenevert, as the member MLSs discovered they were evaluating strategic investments in Remine independently.

Remine provides a much more accessible MLS system for brokerages and their vendors than legacy MLS systems, Chenevert says. And while not many MLSs currently use the provider as a full-service MLS system, MLS Technology Holdings plans to develop and market it as such.

Still a group with four members, MLS Technology Holdings is aggressively looking to add partners, adds Chenevert.

Takeaway

The deepening collaborations among MLSs suggest a future in which several large MLS groups will attract membership from the majority of the nation’s MLSs and spur increased consolidation. Regardless, MLS leaders recognized a need to act to maintain MLS relevancy, and have done so.