Home prices and sales have risen by double-digit rates since 2020 driven by elevated demand and, until very recently, ultra-low mortgage rates.

The recently released Mega 1000, which ranks the nation’s largest brokerages by sales volume, transaction sides and agent count, shows how the robust housing market has translated into significantly higher sales volume and a steep rise in the number of transaction sides with the largest brokerages capturing an increasing share of market activity.

Real estate’s largest holding companies are outpacing smaller counterparts, too.

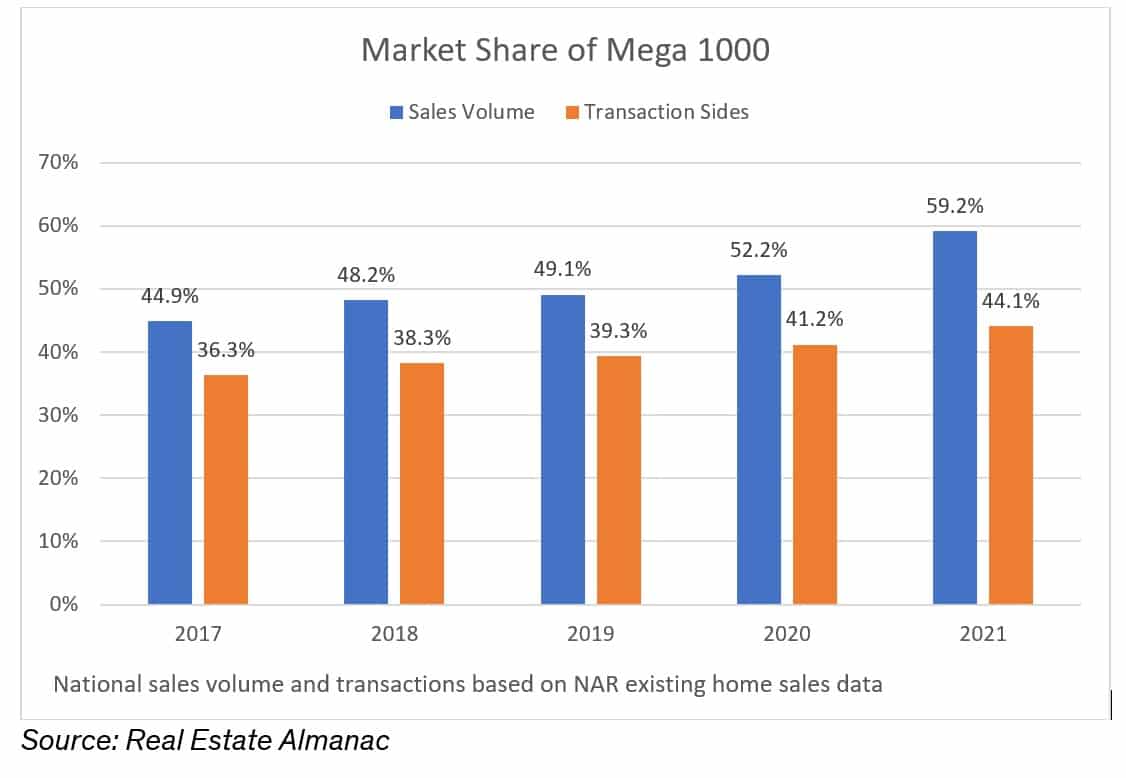

The national sales volume market share of the Mega 1000, based on NAR existing home sales data, rose from 44.9 percent in 2017 to 59.2 percent in 2021. The market share of transaction sides rose as well with the largest U.S. brokerages involved in just over 44 percent of either buyer or seller transaction sides in 2021.

The increase in market share occurred while the number of home sales transactions rose — the top segment of the brokerage industry to capture a larger portion of a growing pie.

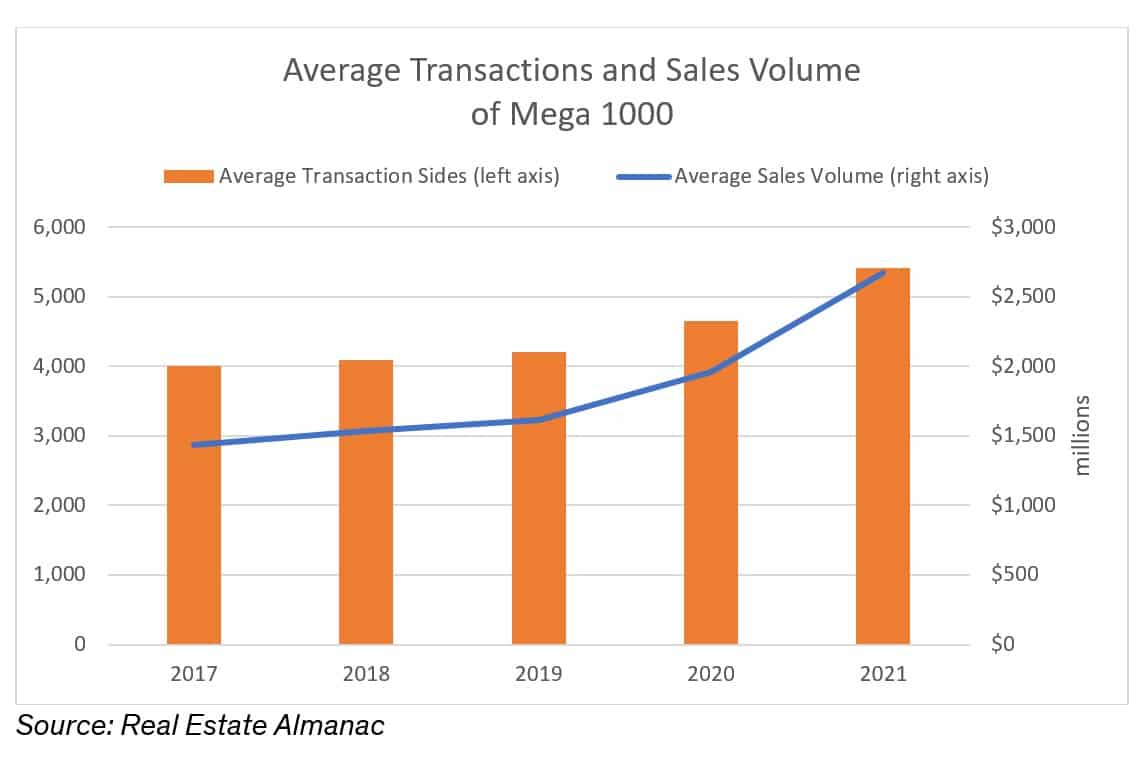

Among the 1,000 largest brokerages in the U.S., the average sales volume rose to nearly $2.7 billion in 2021, a 36.6 percent increase over the previous year and an 86 percent gain compared with 2017. The average number of transaction sides rose to 5,415, a gain of 16.4 percent from 2020 and an increase of more than 35 percent from 2017.

Concentration at the top

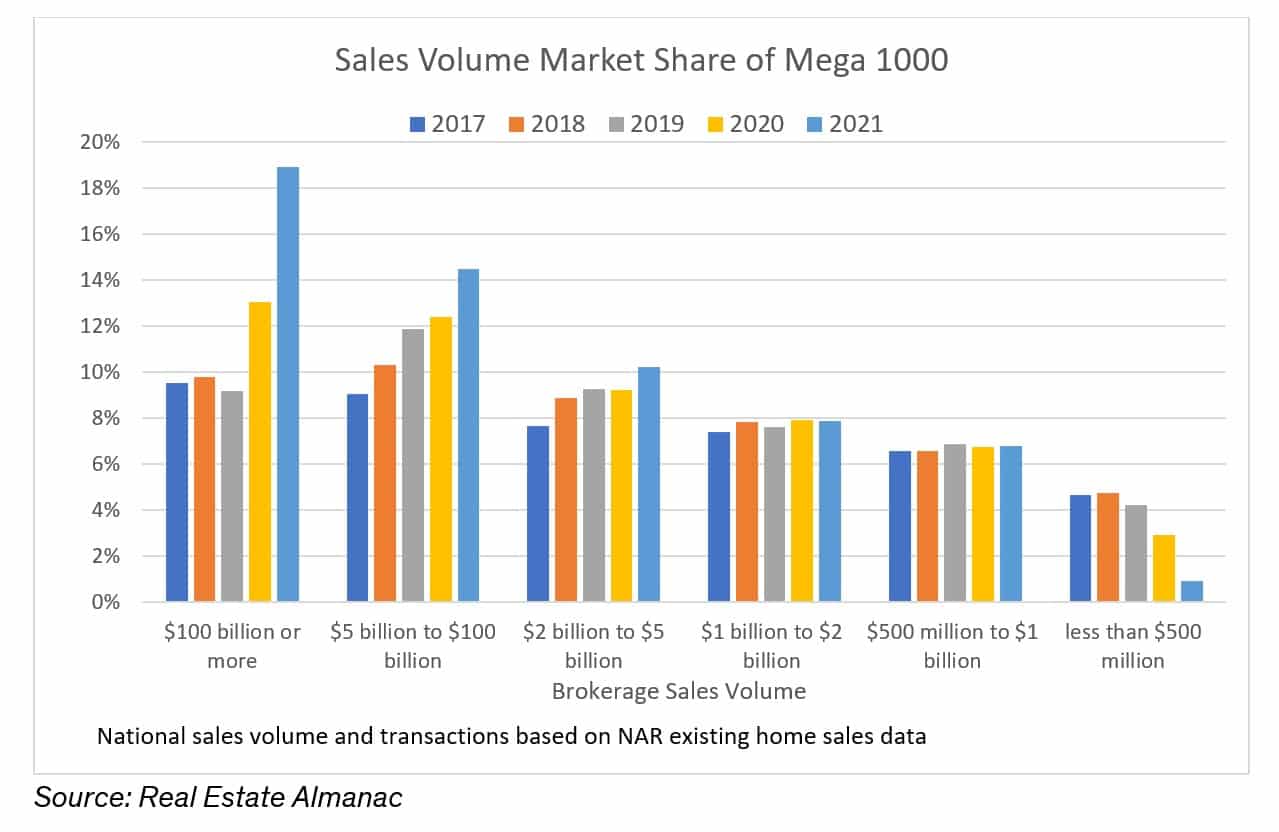

While the nation’s largest firms as a group have gained market share, the increases among firms in the Mega 1000 have varied as well with the largest firms capturing a greater share of the gain in national market activity.

Among the four firms with at least $100 billion in 2021 sales volume (Compass, Realogy Brokerage Group, HomeServices of America and eXp Realty), market share was relatively steady between 2017 and 2019 at about 10 percent.

With the rapid growth in Compass and eXp, both among the newer entities to recently join the $100 billion club, the market share of the top firms jumped to 19 percent, nearly double what it was just a few years earlier!

Even within the next tier, brokerages with $5 billion to $100 billion in sales volume, market share has risen from 9 percent to 14 percent in just the past five years. The market share for the group of firms with $500 million to $2 billion in sales volume has remained relatively steady.

On the other side, market share has declined for the smallest firms in the Mega 1000. While still among the largest brokerages in the U.S., the benefits of access to capital and scale efficiencies from investment in technology diminish for firms with less than $500 million in sales volume compared with the largest brokerages.

Takeaway

Scale matters for many businesses and its no different for the residential brokerage industry as the recently released Mega 1000 illustrates. Mega 1000 firms as a group have gained market share during the past several years, but the gains have been greatest among the very largest in this elite group.