Many in the industry see evidence that production, in particular sales volume, is increasingly concentrated among the largest firms. T3 Sixty’s latest Real Estate Almanac data released last week shows to what degree this is happening.

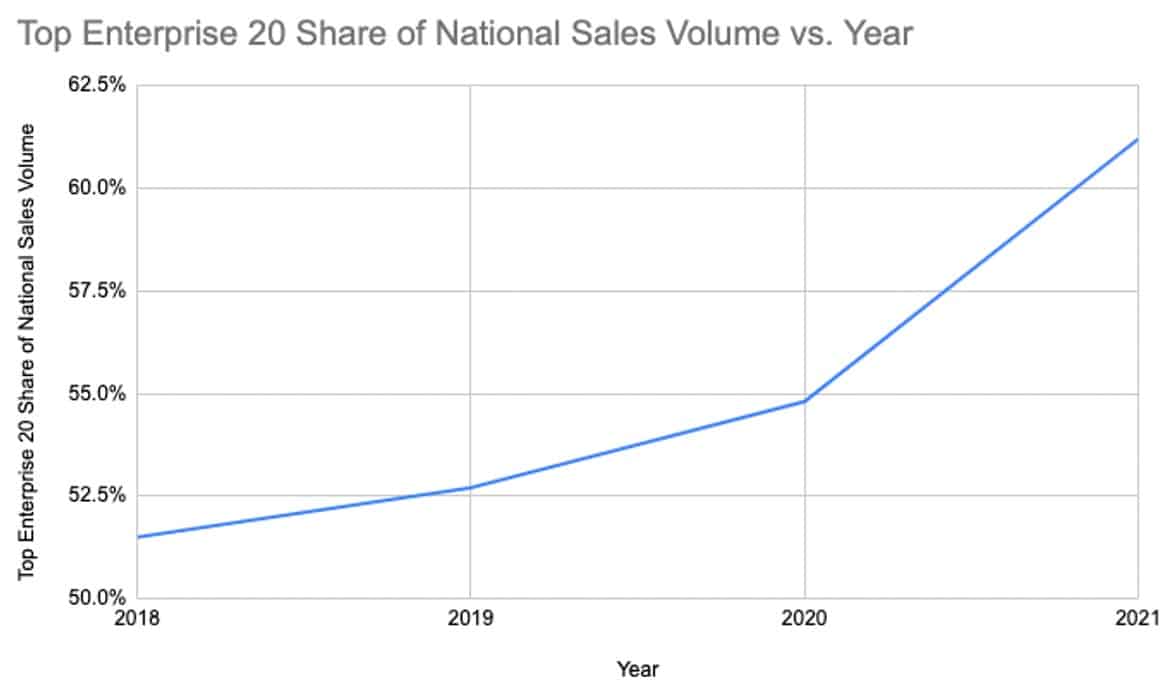

The 2022 Corporations report, which analyzes the nation’s largest enterprises (also known as holding companies), franchise brands and franchisees by 2021 sales volume, transaction sides, agent count and year-over-year growth, shows that the nation’s 20 largest enterprises (which includes production of both a brokerage’s franchise and brokerage wings), accounted for 61.2 percent of total sales volume in 2021, up from a share of 54.8 percent in 2020, representing the largest year-over-year jump since T3 Sixty became the first company to annually analyze enterprises in 2018.

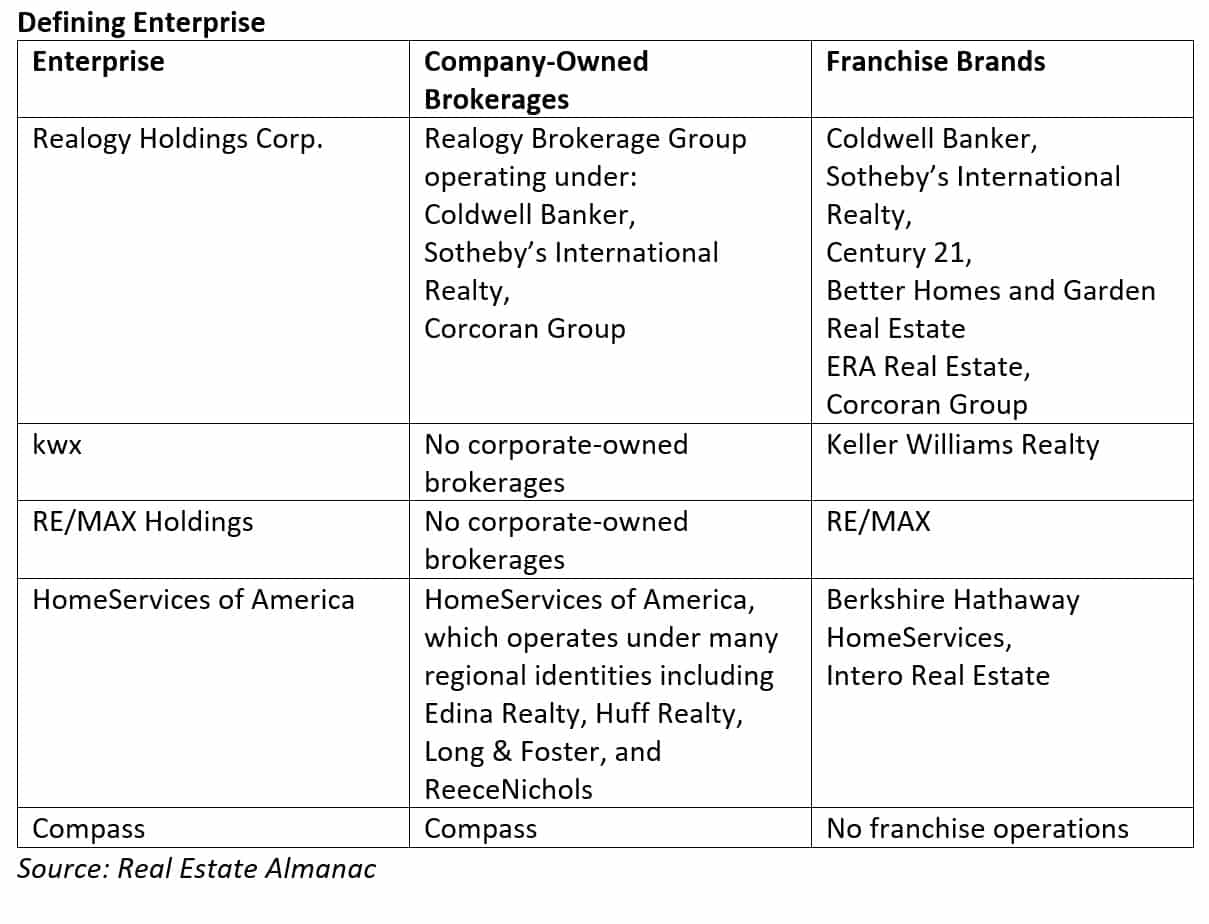

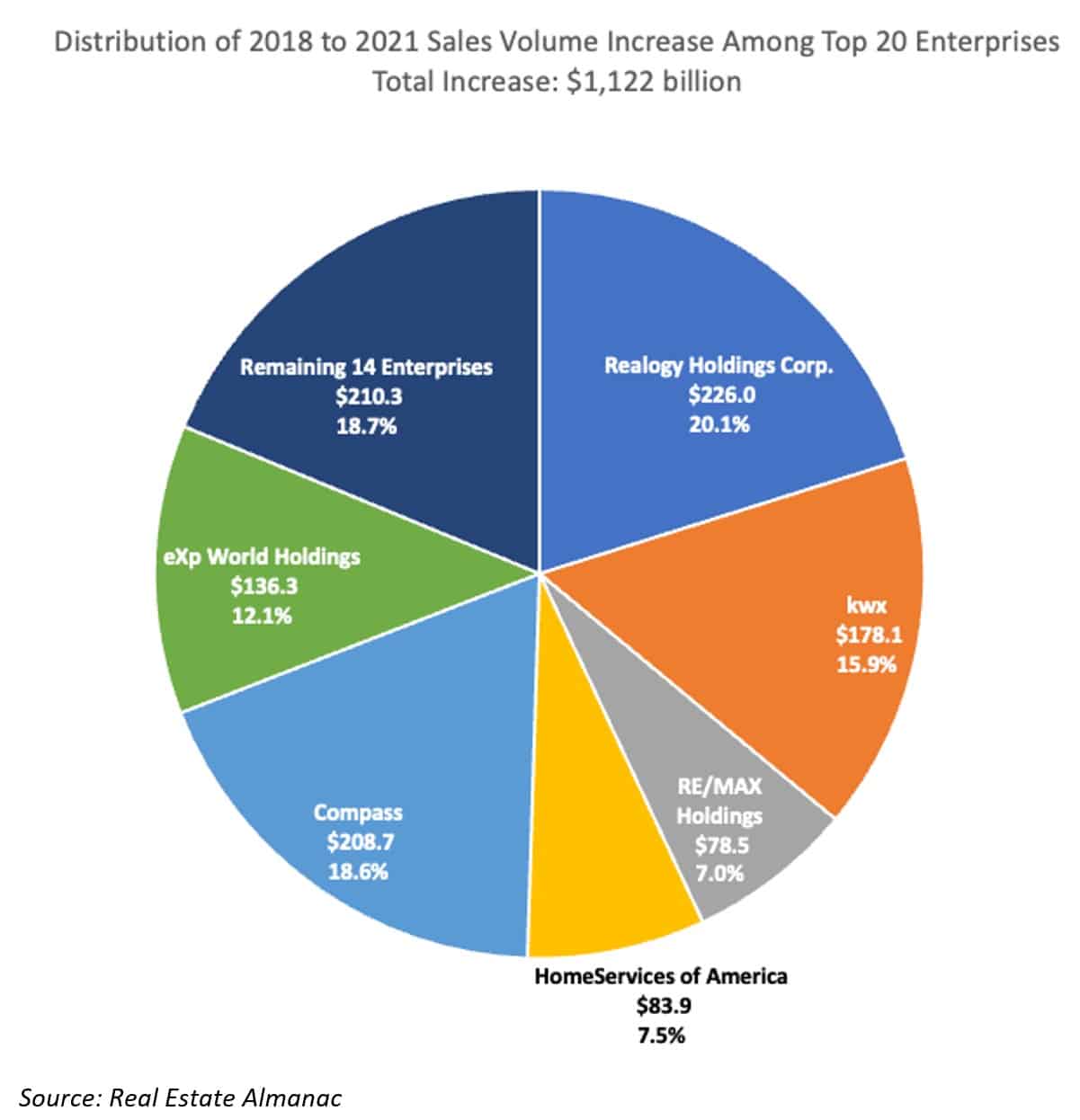

Diving deeper into the numbers reveals that the gains over that period among the nation’s 20 largest enterprises have been concentrated at the top. The nation’s four largest enterprises, as measured by 2021 sales volume – Realogy, kwx (which owns and operates the Keller Williams Realty franchise brand), RE/MAX and HomeServices of America – accounted for over half of the total sales volume increase in the 2022 Enterprise 20 from 2018 to 2021.

Realogy Holdings Corp., the nation’s largest enterprise in 2022, accounted for 20.1 percent of the top-20 enterprise sales volume gains over that period, a greater share than the combined increase of the 14 Enterprises ranked Nos. 7-20.

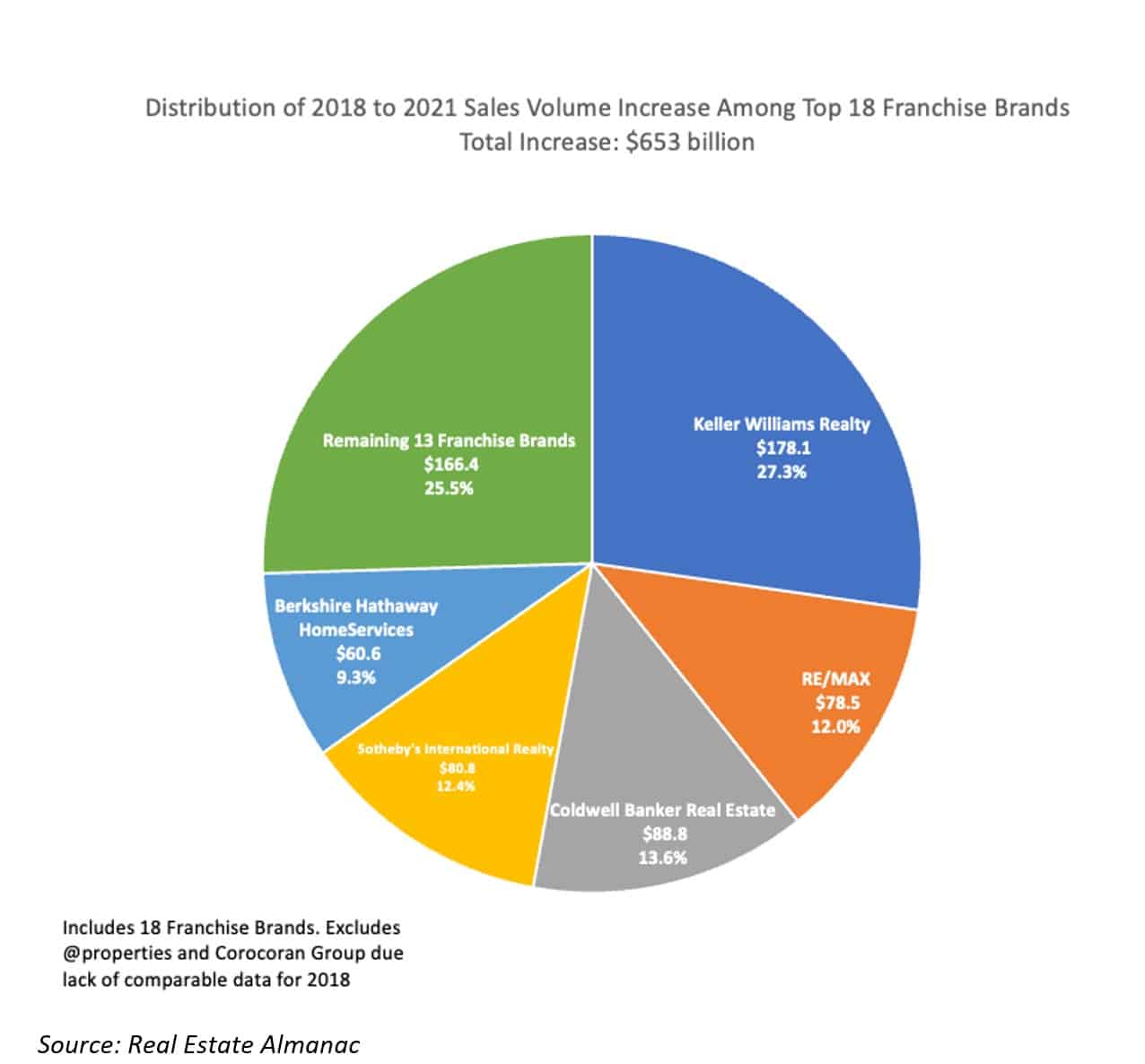

When looking at franchise brands – the individual brands that brokerages operate as franchisees under – the same trend appears.

The Keller Williams Realty brand accounted for 27.3 percent of the $651 billion in sales the nation’s 18 largest franchise brands added from 2018 to 2021, more than the brands Nos. 6-18 combined. (This franchise brand calculation excluded relative newcomer brands Corcoran Group (No. 11 on the Franchise Brand 20) and @properties (No. 20 on the Franchise Brand 20) as they did not have franchise operations in 2018).

Takeaway

As scale becomes more of an asset with the maturing of industry technology and the increasing advantage access to vast amounts of capital provides, the nation’s largest companies are getting larger. The 2022 Corporations report shows the degree to which the big companies are outpacing even their large peers.