The number of public real estate companies has exploded in recent years. This, along with the record investment pouring into the industry, has accelerated the introduction of new business models to the industry, such as iBuying, cloud-based, flat-fee and more, with each bringing different ways of compensating agents beyond the longstanding traditional commission split.

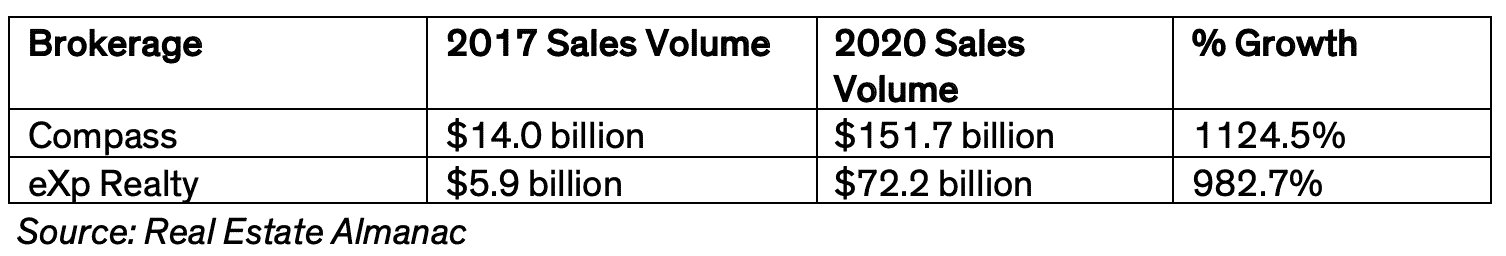

The “commission-plus” agent compensation model – in which agents receive equity or other financial perks in addition to commission splits they receive from each transaction – has already redefined and reshaped the residential real estate brokerage landscape. Compass and eXp Realty owe part of their explosive growth in recent years to attracting agents with stock options and other monetary perks such as marketing spends and revenue-sharing. Among the nation’s 1,000 largest brokerages, these two brokerages saw the largest growth from 2017 to 2020, by far, with an annual sales volume increase of 982.7 percent and 1124.5 percent, respectively, over that time period.

Other elements played a factor in these companies’ growth, especially on Compass’s side as it made huge brokerage acquisitions such as Pacific Union International and Alain Pinel Realtors. But both companies have grown significantly by attracting individual agents with their competitive compensation plans.

Commission-plus agent compensation is not new, of course. Keller Williams Realty has shared over $1.5 billion of profits with its agents since launching its profit-sharing program in 1986.

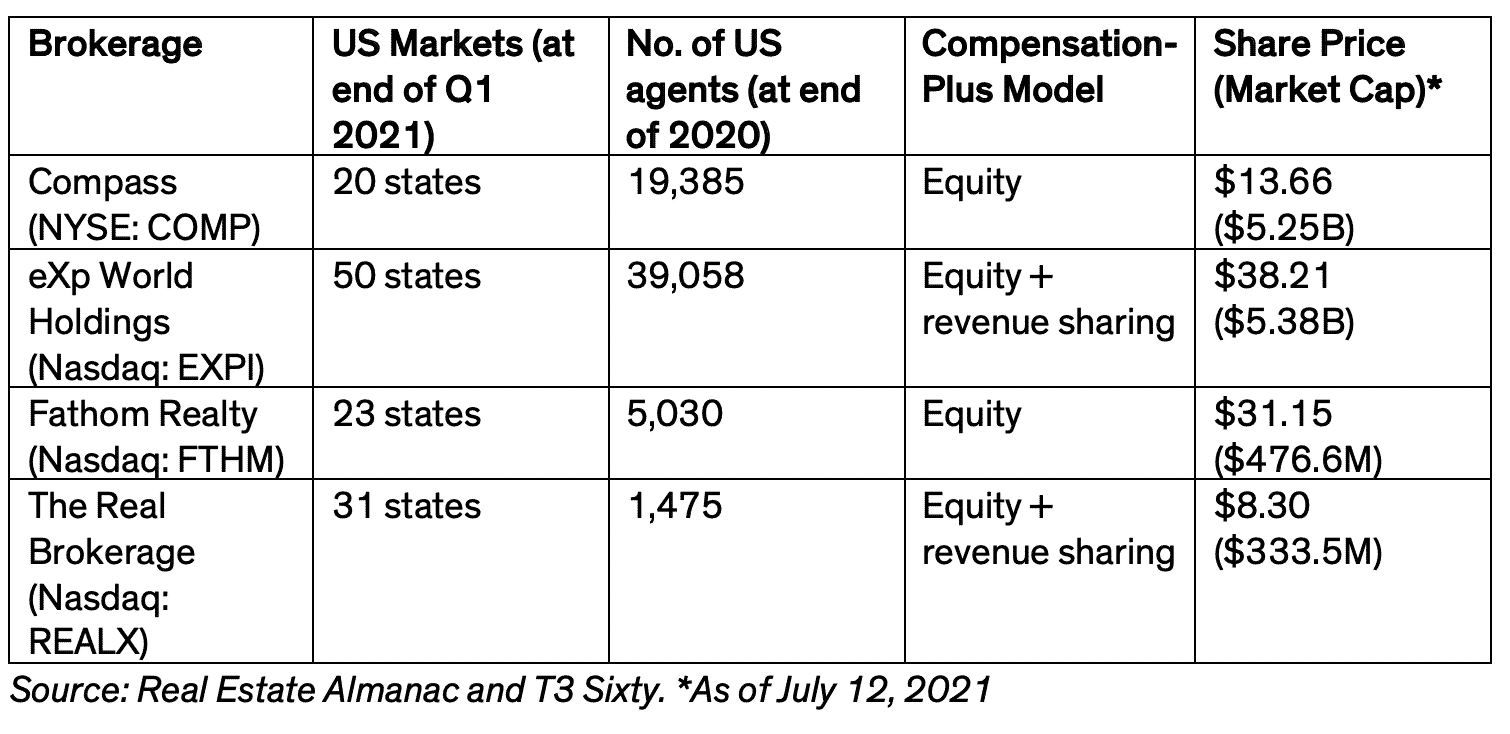

But as Compass and eXp Realty broaden and deepen their national presence, and others such as Fathom Realty and The Real Brokerage grow and bring their own compensation-plus plans to more of the market, brokerages will increasingly have to account for the model when recruiting and retaining their agents.

This article provides an overview of the three predominant commission-plus plans: equity, profit-sharing and revenue-sharing.

Equity

Equity can be a powerful tool to attract and keep agents, as agents who own shares – or rights to shares – in a company can develop a sense of ownership and collaboration in a brokerage that they might not have otherwise, especially as independent contractors. Brokerages don’t have to be public to offer equity, but being public, or on a trajectory to being public, provides a convenient way to turn shares into cash for equity.

Compass, eXp Realty, Fathom Realty and Real – all public brokerage companies — are among the most notable brokerages who make equity available to their agents in addition to commission splits. These come in the form of stock options – the option to buy company shares in the future at a set price – restricted stock units, which vest under certain conditions, or stock purchase plans.

Depending on the program, agents can receive the stock as part of a recruiting package, purchase stock with part of their pre-tax commission earnings or receive stock when they meet certain performance goals.

Compass, for example, rolled out its Agent Equity Program in 2018 in which agents can use part of their commission to purchase stock, with Compass supplementing the purchase with additional dollars. In late 2019, this program transitioned from stock options to restricted stock units and continues today.

EXp Realty launched its equity program in 2014. The company offers agents company stock when they complete their first transaction, reach their annual commission cap and when an agent they directly recruit closes their first sale, according to a recent investor presentation.

In addition, eXp Realty agents can use up to 5 percent of their commission to purchase company stock at a 10 percent discount. They have additional opportunity to earn $16,000 in stock each year for meeting production thresholds, participating in trainings and events and attending company events.

Fathom Realty, the nation’s 24th largest brokerage by 2020 sales volume, introduced its agent equity program in 2016. In that program, the company gives shares to agents when they join, for every year they remain, homes they sell and agents they bring to the brokerage. The brokerage went public on the Nasdaq in June 2020.

Ontario, Canada-based, virtual brokerage The Real Brokerage, which went public on the TSX Venture Exchange in August 2020, and began trading on the Nasdaq in June, also offers an equity program. The company, which operates in 31 U.S. States, allows agents to choose to receive a portion of their commissions as stock, can earn stock by reaching their annual cap and recruiting fellow agents and by meeting certain benchmarks.

Profit-share

Keller Williams Realty, the nation’s largest franchise brand, has popularized the profit-sharing model in the residential industry and remains the most prominent practitioner of it today.

The company operates a profit-share plan throughout its vast network of market centers and 160,717 U.S. agents (as of the end of 2020). Each market center – KW’s term for a brokerage – shares nearly 50 percent of the profit the market center produces with agents based on their own production and that of the agents they recruited to the office.

When agents join Keller Williams Realty, they assign a sponsor – the person they feel most responsible for them joining the brand. The sponsor agent then gets 50 percent of the market center’s monthly profit attributable to that agent, paid out each month. The sponsor agent also receives a portion of the profit attributed to the agents that agent recruits, and so on, down seven levels.

As noted above, Keller Williams Realty has distributed over $1.5 billion in its profit-sharing program since launching it in 1986.

Revenue-share

Revenue-sharing programs have the same logic as profit-sharing, except companies share their revenue with agents as opposed to just the profit. Both eXp Realty and The Real Brokerage operate revenue-sharing programs.

The company reserves approximately 50 percent of the commissions agents pay to the company (minus transaction fees) for sharing with agents. Agents receive a percentage of this pool of funds based on the number of agents they sponsor into the company, seven levels down. The percentage they earn diminishes as the levels move down.

Both profit-sharing and revenue-sharing programs incentivize agents to recruit productive agents.

Takeaway

The real estate agent compensation landscape is changing as more companies go public and compete for agents based on financial perks beyond the commission split. Companies are aggressively leveraging these models as they expand and grow across the U.S., forcing many brokerages to compete for agents with new options available to them.