For the last decade, finance has served as the primary driver of real estate’s rapid evolution into a mature, consolidating industry. It started with a great uptick in venture capital and Wall Street turning its eyes toward technology and then brokerage after the Great Recession.

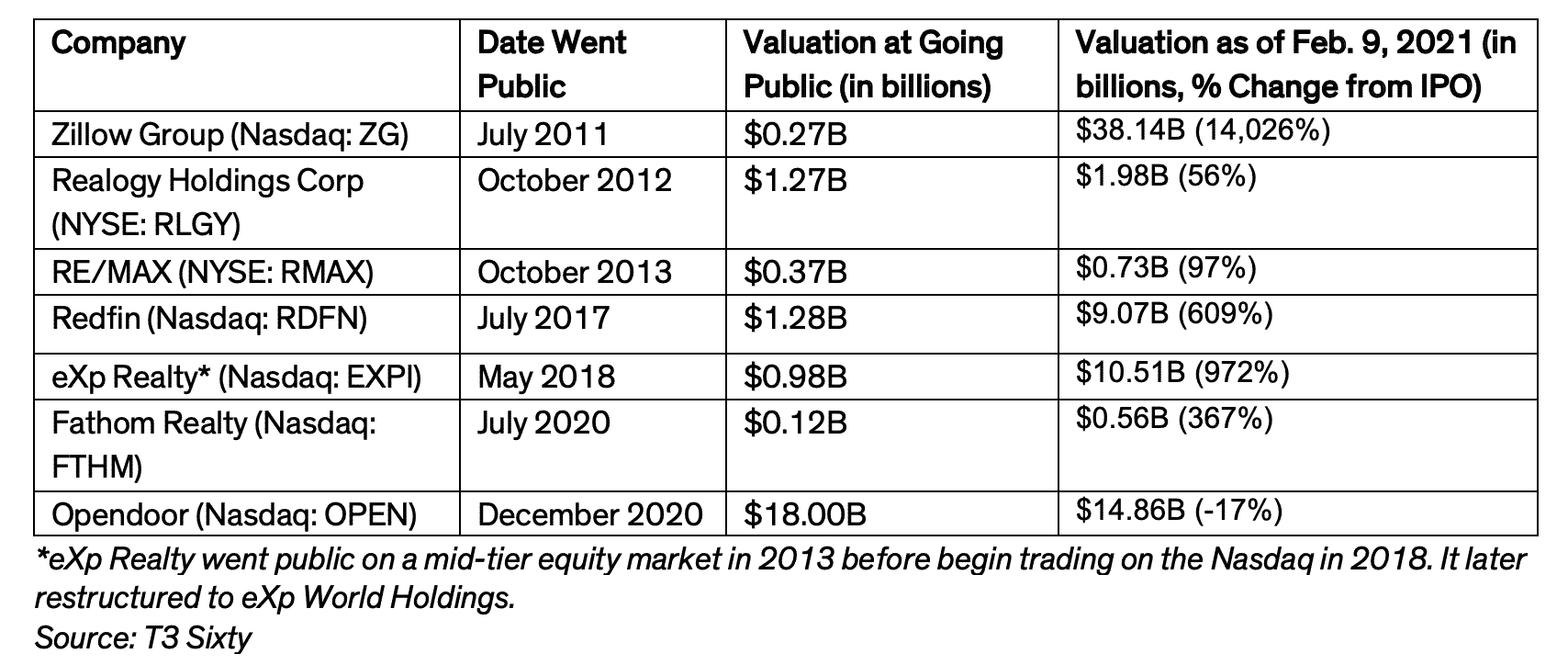

Zillow ushered in the recent public market wave when it went public in 2011. Trulia, RE/MAX and Redfin followed. These moves have accelerated the growth and valuations of the companies who have taken the public leap, and helped speed up real estate’s march to maturity. For example, Zillow’s valuation has jumped over 14,000 percent since it debuted on the Nasdaq stock exchange in July 2011, while it revolutionized home search and has embarked on a new initiative to evolve the transaction.

Real estate’s public market wave

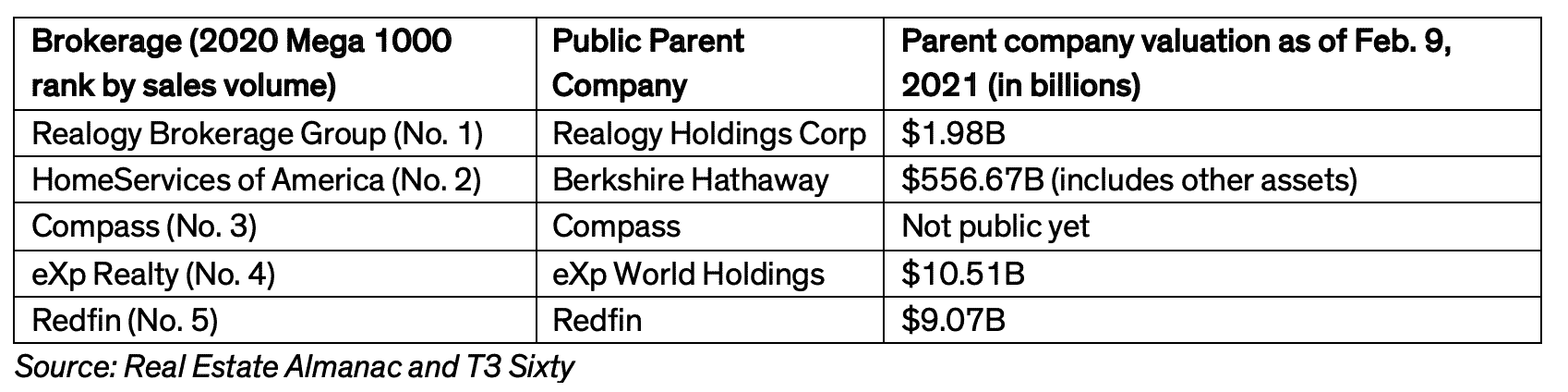

Companies throughout the real estate brokerage industry ecosystem are going public – brokerage companies, franchise brands, technology companies and mortgage companies. All five of the nation’s largest brokerages are now public (directly or through their parent company) or will be soon (given Compass’s announced IPO). This trend has made the nation’s brokerage leaderboard top-heavy with public companies.

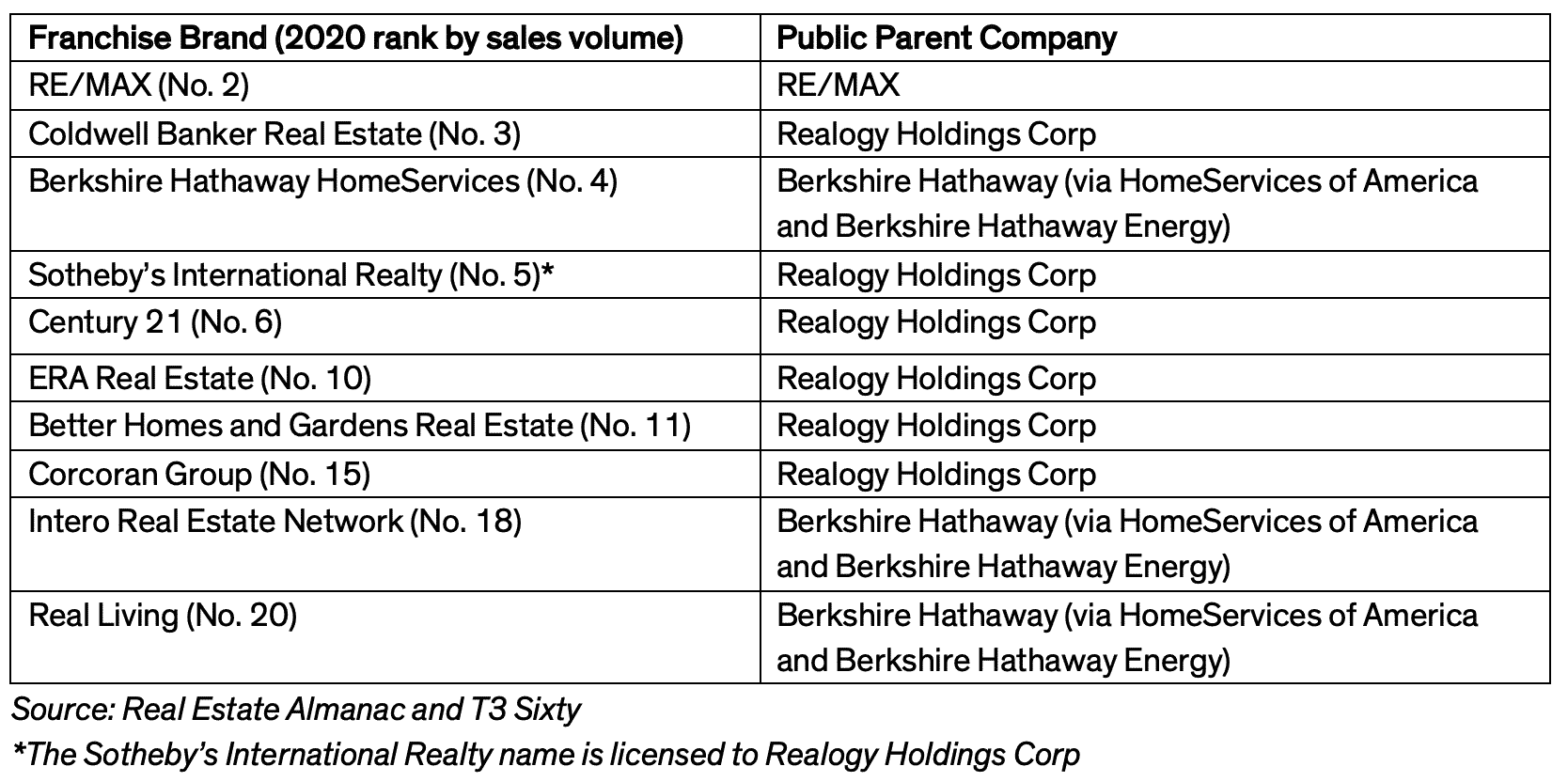

Real estate brands fit the same story. Of the 20 largest brands by annual sales volume, according to the 2020 Real Estate Almanac, half are public or part of public companies. That count does not include the nation’s largest brand, Keller Williams Realty, which has taken steps – such as creating a new holding company KWx and hiring a CEO with public markets expertise – that suggest it’s possibly heading toward a public structure.

What Public Markets Provide

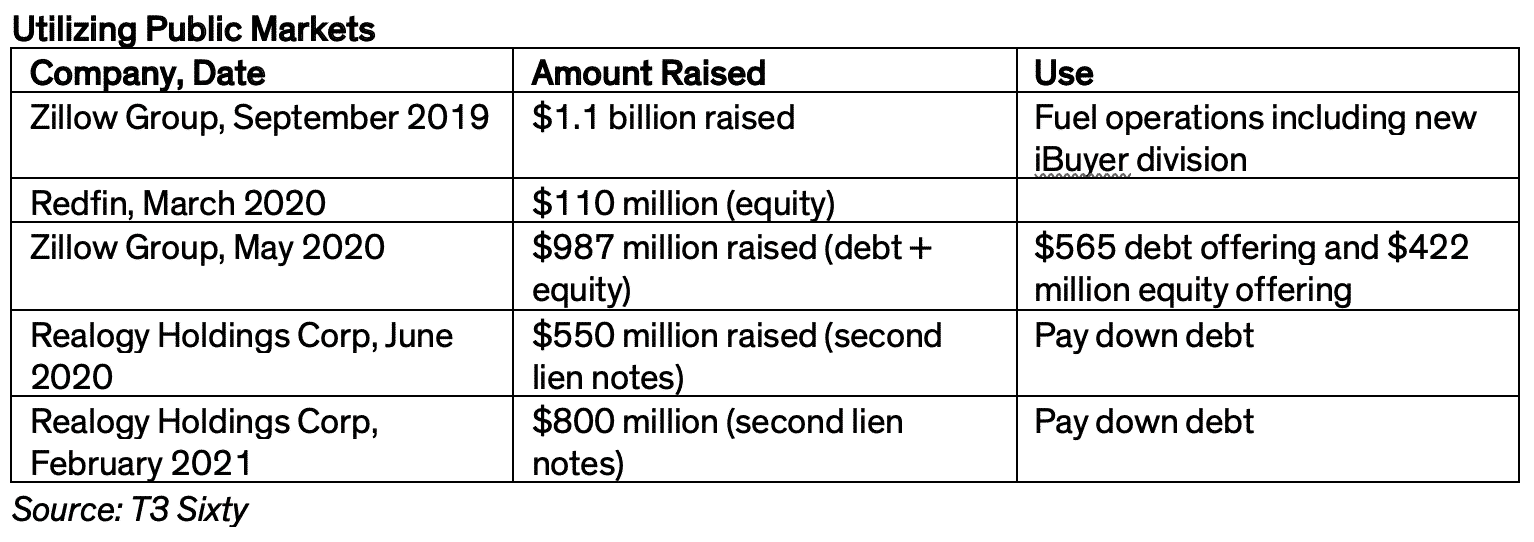

Going public gives companies an influx of cash, giving them the resources to develop new products, expand their market, make acquisitions and more. Companies traded on public markets also gain the ability to compensate staff and recruits with stock options, to pitch ownership of the company their talent work for or affiliate with; they can raise debt capital as both Realogy and Redfin have recently done, do additional equity financing, and more.

EXp Realty implemented its equity program in 2014 and it has helped fuel its explosive growth. The company actively recruits agents with messaging centered on becoming an owner in the company and in the added value it carries to hanging a license with the brokerage. T3 Sixty profiled this part of the fast-growing brokerage’s model and much more in eXp Realty profile in the 2021 Swanepoel Trends Report chapter “Real Estate’s Cloud-Based Brokerage Takes Flight” (read it now on T3 Intel). In the run-up to its announced IPO, Compass has similarly used equity and the messaging around it to attract and retain agents.

Public companies can also use the equity and debt financing as a public company to fund new business models, such as Zillow Group and Redfin have done to fund their iBuying efforts.

Companies must balance these benefits with the increased scrutiny and transparency that comes with life as a public firm. They have quarterly financials and disclosures they must make under the U.S. Securities and Exchange Commission rules. They also cannot use forward-looking statements in marketing. And they must balance pressure from investors to deliver short-term results as they build a longer-term business.

Beyond Brokerage

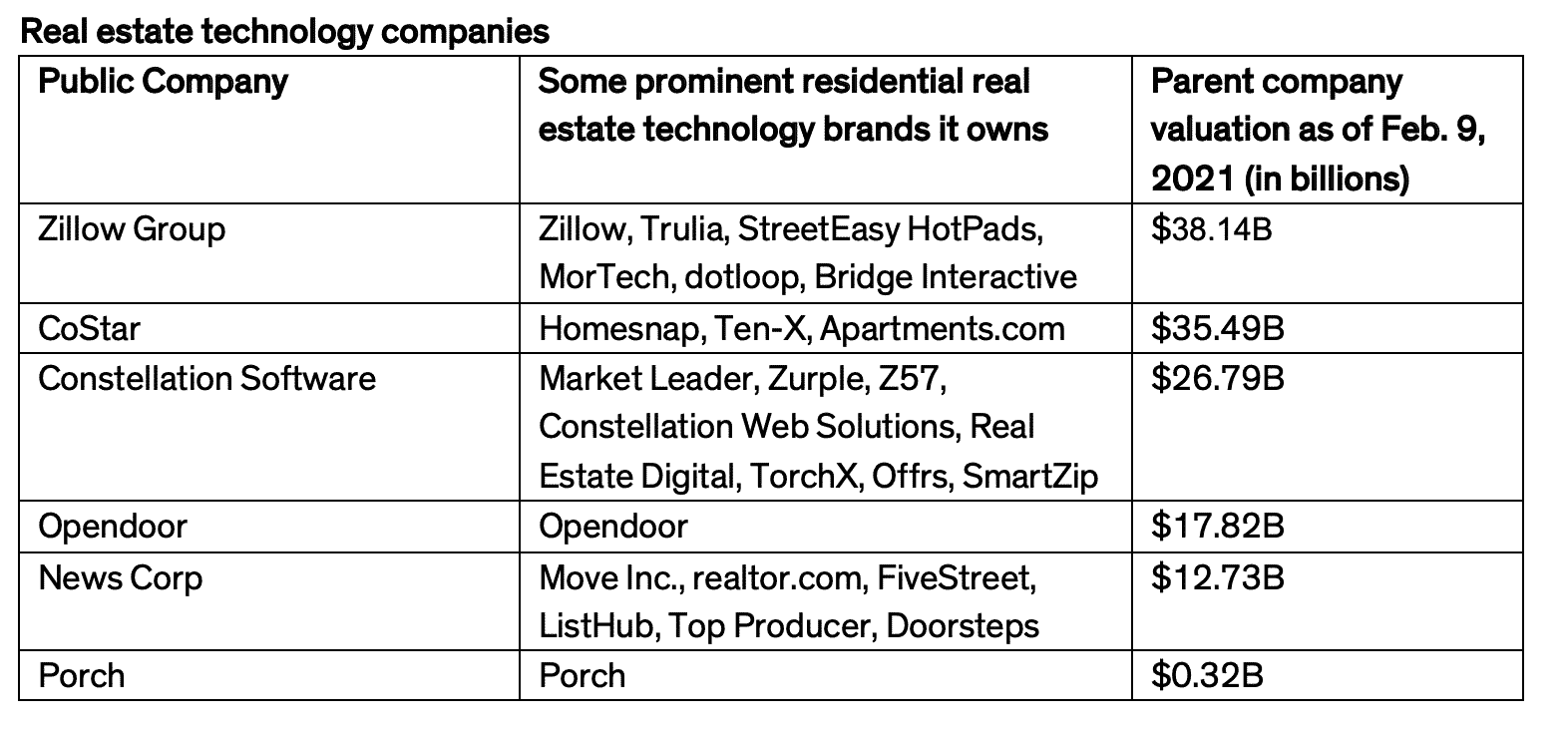

It’s not just brokerage companies, the industry’s largest technology companies have long had the public bug. Zillow Group, of course, is public, and so is realtor.com owner News Corp, the new owner of Homesnap CoStar and Constellation Software, which runs multiple real estate technologies including Market Leader, Zurple, Z57, Real Estate Digital, TorchX, Offrs and SmartZip. In addition, one of the pioneers in 3D, immersive real estate showing technology, Matterport, announced its plans to go public via a special purpose acquisition company (SPAC) this month (February 2021).

Two real estate technology companies went public just in the fourth quarter 2020 via the special purpose acquisition company (SPAC) route (read the T3 Insight on SPACs here) – Opendoor and Porch.

Rocket Companies, the parent company of Rocket Mortgage went public in August 2020, while the nation’s largest lender, United Wholesale Mortgage, went public in January 2021 with a $16.1 billion valuation via a SPAC.

Takeaway

This access to large amounts of additional money, resources and the overall growth that going public supports, further fuels the consolidation and maturation that the industry has undergone in recent years. Leverage and scale redefine the rules and this trend, itself, changes the industry. The big get bigger until a few very large entities dominate the industry. Residential real estate brokerage is speeding down that path.