A wave of acquisitions has concentrated the real estate tech ecosystem into the arms of fewer and larger players. This has taken some third-party tech off the board for brokerages and agents, while other tech companies, either public or backed by private equity, have gotten bigger and closer to providing a full suite of services to their brokerage and agent clients.

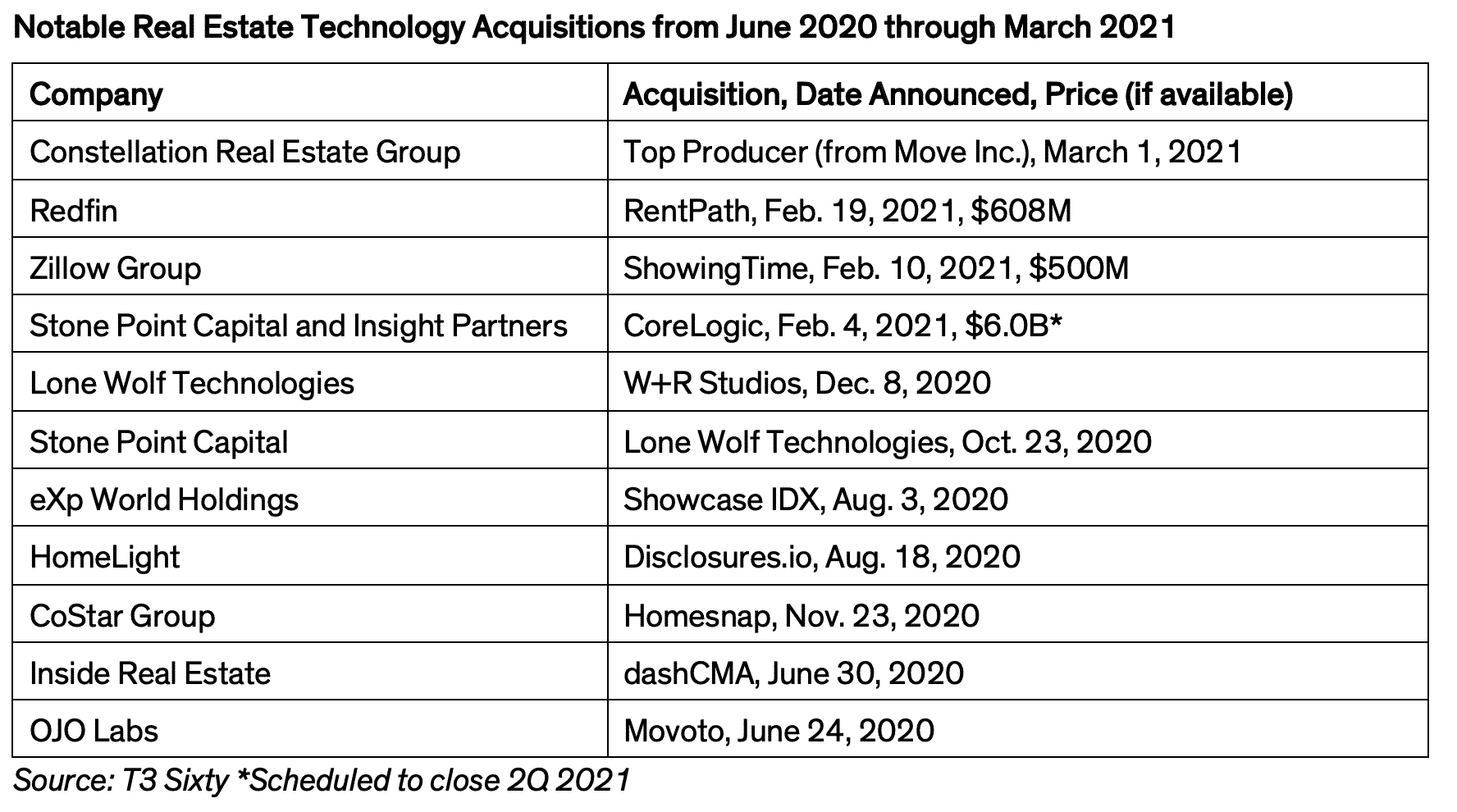

Just since November, Zillow Group entered into an agreement to acquire popular real estate showing software ShowingTime, Constellation Real Estate Group acquired CRM Top Producer, Redfin acquired rentals marketing platform RentPath, private equity firms Stone Point Capital and Insight Partners won an acquisition bid for MLS software giant and data analytics provider CoreLogic (scheduled to close second quarter 2021), CoStar Group acquired Homesnap, and Lone Wolf Technologies acquired makers of Cloud CMA W+R Studios.

These are just a few of the acquisitions that have taken place in the last 12 months, and reveal an increased cadence of real estate tech consolidation, fueled by the great amounts of financing that is rapidly catalyzing an industry dominated by fewer, larger players. This has a few ramifications, including fewer technology choices for brokerages and agents, as some get taken off the board as third-party providers when acquired by brokerage companies, such as Compass’s February 2019 acquisition of popular CRM Contactually, HomeLight’s August 2020 acquisition of budding disclosure software provider Disclosures.io, and RE/MAX’s December 2019 acquisition of marketing intelligence software First.

Some brokerage companies, like Keller Williams Realty, have responded by focusing on building their own technology. Others have turned their technology strategy to third-party providers.

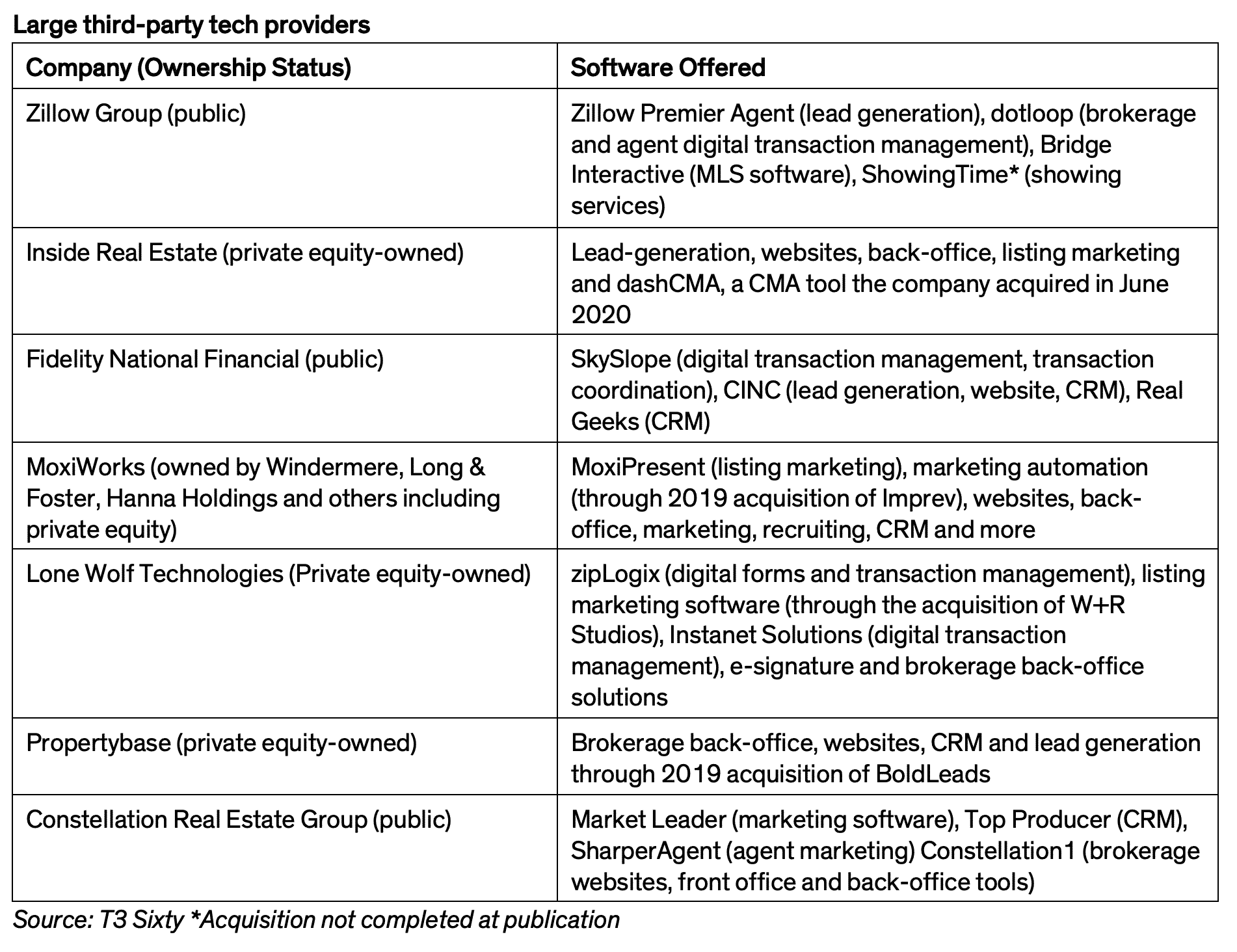

Consolidating third-party players

The spate of real estate technology acquisitions has created some larger third-party players who offer a broad set of tools to brokers and agents. The largest of these are either traded on public exchanges or owned by private equity companies. These large third-party tech providers include Zillow Group, Inside Real Estate, MoxiWorks, Lone Wolf Technologies, Propertybase and Constellation Real Estate Group.

Zillow Group, while a third-party technology provider, is also a national licensed brokerage (for the properties it acquires and sells through its iBuyer wing, Zillow Offers).

Takeaway

There are still plenty of smaller, point solutions for brokers and agents to choose from, but, increasingly, they are either scooped up by bigger third-party tech providers or by a brokerage company itself, becoming an exclusive product. As the real estate technology landscape matures, brokerages and agents are getting access to more sophisticated, more integrated technologies from larger players. Review T3 Sixty’s annual analysis of real estate’s leading technology in the 2021 Tech 500, which is released on March 23.