In May, Rick Davidson, a three-decade industry veteran who led Century 21 Real Estate as president and CEO from 2010 to 2017, acquired the fast-growing brokerage and franchise brand JP and Associates Realtors (JPAR) with his new holding company, Cairn Real Estate Holdings, backed by private equity firm, Aperion Management.

With over $4.4 billion in 2020 sales volume and over 15,000 sides, JPAR, founded in 2011, was the nation’s 53rd largest brokerage in 2020, according to the Real Estate Almanac. Its new franchise operation, operating under the same brand name, was the nation’s 25th largest franchise brand in 2020, with a 2020 sales volume of $5.6 billion on nearly 19,800 transaction sides.

The acquisition of JPAR, which operates an agent flat-fee model in which agents at the brokerage and its franchisees pay set fees and keep 100 percent of the commission, is part of Davidson’s vision to build a new national holding enterprise of multiple brands, models and brokerages powered by a single backend tech platform and suite of ancillary services.

Davidson’s move fits a long-developing industry consolidation strategy fueled by outsized capital from public markets, venture capital, private equity and massive corporations as they look to compete for dominance in real estate’s next era with a centralized tech platform, a streamlined ancillary services program and the size that supports great economies of scale.

Established real estate enterprises like Realogy, HomeServices of America, Keller Williams Realty and RE/MAX are aggressively pursuing this national scaled strategy as an increasing number of newer companies (formed since 2000) such as Redfin, Compass, eXp Realty, Opendoor, Realty One Group, HomeSmart and United Real Estate are growing faster than the more established brokerage companies.

T3 Sixty spoke with Davidson to clarify his vision and the opportunity he sees, and, in doing so, sheds light on the macro forces pushing real estate rapidly into the future.

The rise of giant real estate

The industry’s future will undoubtedly be dominated by fewer, larger companies who have the economies of scale and resources to serve modern consumers and workflows and withstand commission compression and other industry trends, and Davidson and others are acting on this.

Data from T3 Sixty’s Real Estate Almanac – which reports brokerage, franchise brand and enterprise production each year – clearly shows how the industry is consolidating. (Visit realestatealmanac.com for official stats on all the largest brokerages nationwide).

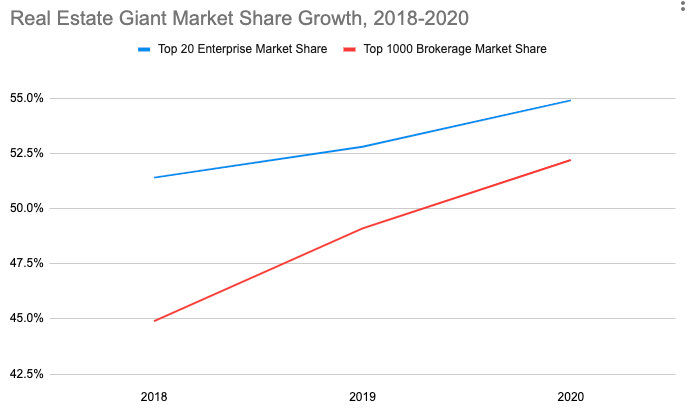

From 2018 to 2020, the nation’s 20 largest real estate enterprises – which encompass both the brokerage and franchise arms – grew their existing home sales volume market share from 51.4 percent to 54.9 percent, according to the research. Market share is determined by comparing company sales volume obtained from T3 surveys and analysis against the total number of existing home sales volume as reported by NAR.

In that same time period, the nation’s 1,000 largest brokerages grew market share to 52.2 percent, capturing over half of the nation’s existing home sales volume for the first time in 2020.

The increase in real estate brokerage and tech companies going public and consolidating suggests that this graph will increasingly shift up and to the right as the years progress. Davidson and many of these investors and leaders are betting on this.

The rollup vision

If the total number of brokerages is 86,000 (best estimate), that means that 85,000 brokerages do 47.8 percent of the production, while 1,000 brokerages do 52.2 percent. This illustrates how much of the market smaller companies still command.

This is the fragmented market, investors and entrepreneurs like Davidson are now looking to roll up. Davidson (and others pursuing this strategy) see an opportunity to help aging broker-owners who don’t have workable succession plans in place with an option to exit gracefully. (Reach out to Michele Conn, head of T3’s M&A division, at michele@t360.com to explore your options if you find yourself in this position).

A multiplicity of approaches

The overall vision involves enabling brokerages with technological sophistication and connecting them on one platform with ancillary services and other brokerages in an increasingly national operation. Companies have different approaches here. Compass, Redfin and Keller Williams Realty are building and acquiring their own technology platforms while Realogy, HomeServices of America and eXp Realty are pursuing open systems.

Davidson’s tech vision for Cairn lies squarely with the latter companies. Cairn plans to build a platform that integrates with other industry technologies via application programming interface connections.

One element of his approach, however, stands out. Instead of operating a single brokerage model, he wants to acquire multiple companies with multiple brands and models from discount to traditional to employee to 100 percent commission like JPAR. “If you choose a lane, you’re limited,” Davidson said.

Takeaway

The game plan is becoming increasingly clear for companies looking to top the industry’s future leaderboard – build a large national footprint, have a companywide tech platform, integrate ancillary services into the core business plan and have access to lots of cash, either through public markets, company reserves, private equity or venture capital.

Source: 2021 Real Estate Almanac. Market share determined by comparing company sales volume to the total existing home sales volume.