Back-office accounting systems are critical to brokerage operations. They are the literal engine that runs the company. T3 Sixty often refers to these systems not as “back-office” systems, but as “business operating systems,” as they play such a fundamental role in the management and operations of a brokerage.

Many real estate brokerages have implemented off-the-shelf programs such as QuickBooks, Xero or Microsoft Dynamics, as they are widely available. These programs make tracking and filing taxes easy, but they are less desirable as brokerage accounting systems. They simply were not designed with the intricate nuances of the residential real estate transaction and the associated brokerage operations.

As a result, brokerages (and, of course, teams) end up creating a plethora of spreadsheets to administer the various aspects of their operations such as commission split plans, agent billing, contract and license renewals.

As the impact of technology increases, many brokerages are reevaluating their existing accounting solutions and whether they should select a tailored program. The primary reasons for doing so are:

- To manage a better system to effectively manage their commission plans, including the auto adjustment of commission levels and renewal dates.

- To be more scalable and efficient in growing the company with the increased volume of business they hope to conduct.

- To have access to an advanced reporting on agent production, transaction tracking and financial analysis.

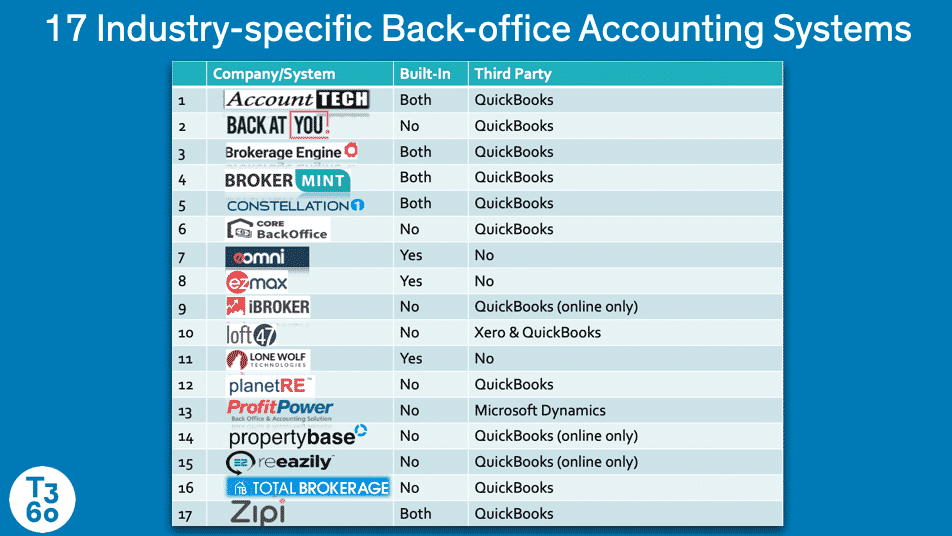

With over 17 industry-specific back-office accounting systems on the market, choosing the right one can be complicated for brokerage leaders. Of course, not all of these systems are created equal, and as brokerage and team leaders proceed down the road of selecting the best solution for them, here are some important questions they should ask and steps they should take to determine the best fit.

To simplify this process, T3 Sixty has distilled some of the most important questions to ask prospective vendors and some evaluation best practices below.

1. Does the system fit current accounting needs?

There are two types of back-office accounting systems. One can serve as a supplement to another accounting system such as QuickBooks, NetSuite, Microsoft Dynamics or Xero. The other is a complete system, which is designed to work as a standalone accounting platform.

Both types of systems have their merits, depending on a brokerage’s specific accounting needs.

2. Can the system accommodate company commission models?

Some systems have more extensive commission-tracking systems. The importance of this feature will vary depending on the number and complexity of the commission options in the brokerage or team evaluating the product.

For example, if a brokerage has many commission plans and tiers, and separate team-focused structures, then this feature is very important; if a brokerage operates a flat-fee model, this feature will be less important.

3. Does the system offer in-depth reporting?

It’s not enough to have a report writer that allows brokerages to pick fields and design reports. While that’s a nice feature to have, it’s more important to have standard reports with business intelligence and analysis valuable to brokerage operation, like projected income, “at-risk,” agent accounts receivable reports, or year-over-year production comparison reporting.

Do agents have access to reporting? This is only important if it’s something brokerages want, but if it is, what level of access do agents have to reports and production? These are important questions to consider and answer.

4. How is training and support managed in the system?

Training and support are critical components to any system. Undoubtedly, there are learning curves to adapting the system, and updates can change operation and complicate workflows.

Determine upfront who is responsible for answering questions about the system and making sure that users know how to navigate it on an ongoing basis. If the system offers support, what are their response times, turnaround and method of training and support?

These are very important questions to answer as brokerages plan contingencies if support is slow or not robust enough.

5. What sort of innovations or future enhancements are they planning?

Brokerages want to partner with a company that will innovate and adapt to their needs. Business never remains static, and a partner that grows and adapts as business needs change is invaluable. Brokerage leaders should also find out how amenable the tech is to suggestions, feedback and product requests.

6. Conduct demos with all the key stakeholders.

As staff will ultimately use the system chosen, have them demo the finalists and prepare a list of questions and concerns about each system.

This will help brokerages proactively discover which system has the most buy-in, how easy it will be to implement a system and how responsive the tech company’s team is to questions and training.

7. Interview References

This cannot be overstated and is perhaps the most useful and important step when evaluating potential technology partners, especially back-office accounting systems.

Ask for the company to share contact information for brokerage clients of a similar size and with a similar business model, even, if possible, by brand and demographic. These conversations will uncover invaluable insights.

8. Understand the process

The implementation of an enterprise back-office accounting system will be challenging and time-consuming, so build in a cushion to do so. It will take more time to train staff and to tweak the system to fit specific needs than what leaders often expect. To properly implement a back-office accounting system takes at least three months.

Takeaway

If you have any questions about any of the back-office systems or would like assistance in evaluating the appropriate solution for your brokerage, please feel free to reach out to me, Jonathan Peterson, T3 Sixty senior vice president of brokerage solutions, at jonathan@t3sixty.com.