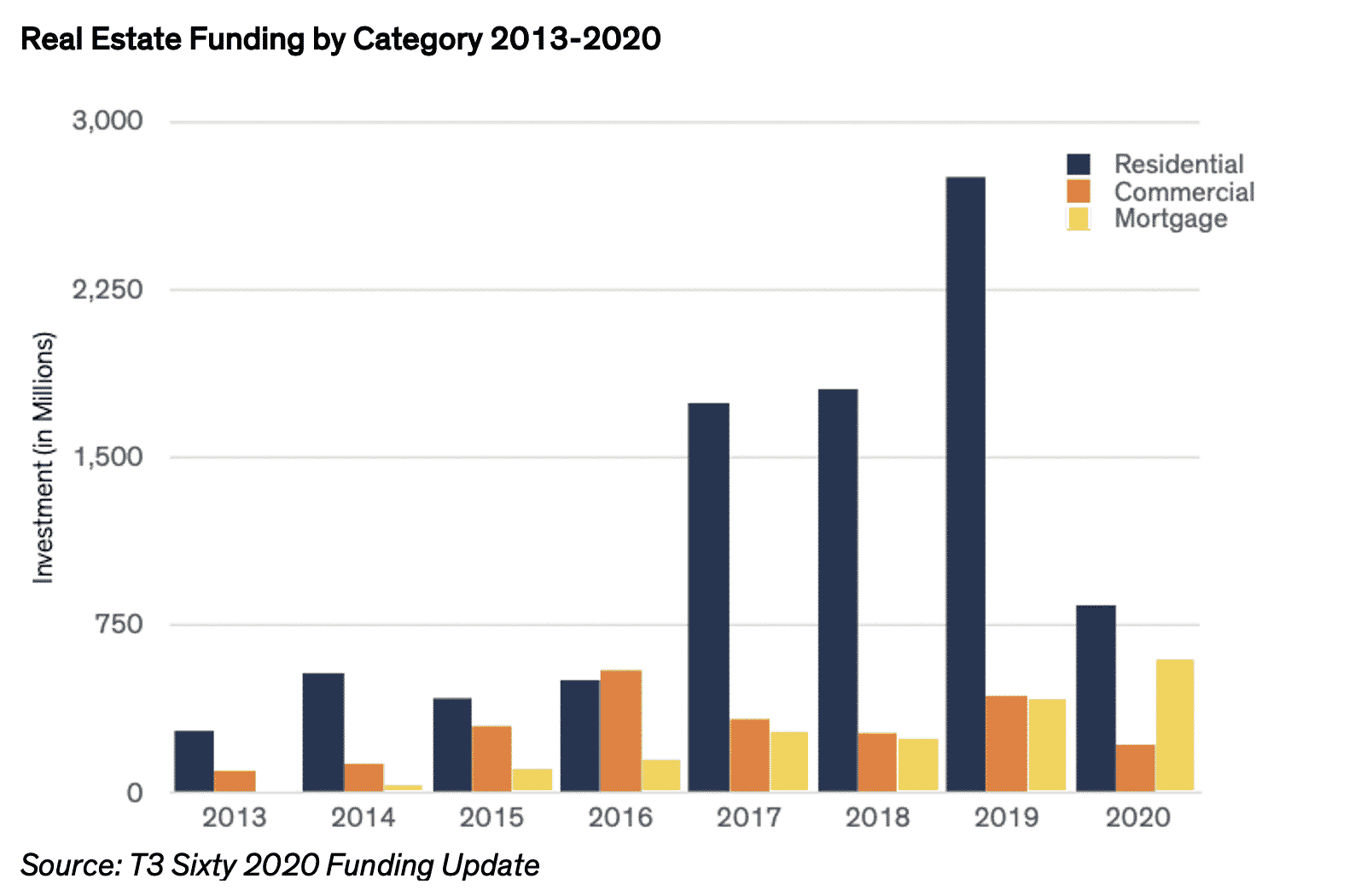

Real estate has seen outsized investment activity exploded from 2017 to 2019, but the pandemic significantly depressed funding activity in 2020, as it did in many industries. 2020 real estate funding across residential, commercial and mortgage decreased notably to just 46 percent of 2019 levels, but the pandemic is just one part of the story.

The large year-over-year drop in real estate funding in 2020 had to do with several significant, mostly late-stage 2019 funding rounds related to iBuyers and alternative financers. Offerpad, Knock, Opendoor, Orchard and Flyhomes raised a total of $1.6 billion in 2019 alone. If these rounds are excluded, 2020 investment dropped, with only 17 percent from 2019, to 83 percent of 2019 levels.

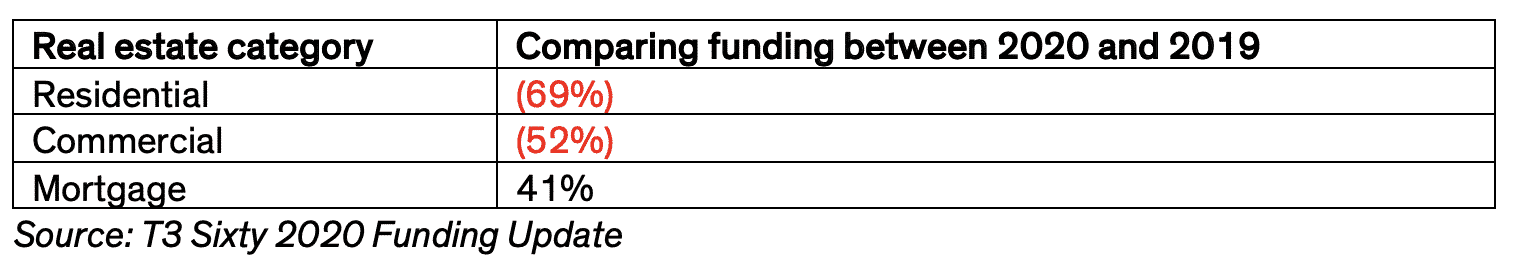

Looking at investments by category, residential saw the largest drop in year-over-year funding in 2020 at 69 percent, followed by commercial at a 52 percent drop. Mortgage, however, saw a 41 percent jump, likely buoyed by record-low interest rates and a pandemic-inspired trend to push financing further into the digital realm.

As industries begin to ramp up in preparing to a life after the pandemic, early 2021 funding activity has again picked up. Early activity may seem to indicate that the pandemic’s effects on funding have mainly to do with timing, not necessarily with demand.

2020 saw about the same number of late-stage funding rounds as 2019, but early-stage funding in 2020 stood at approximately half of 2019’s amount, both in quantity and dollar amount.

The Pandemic Funding Pause

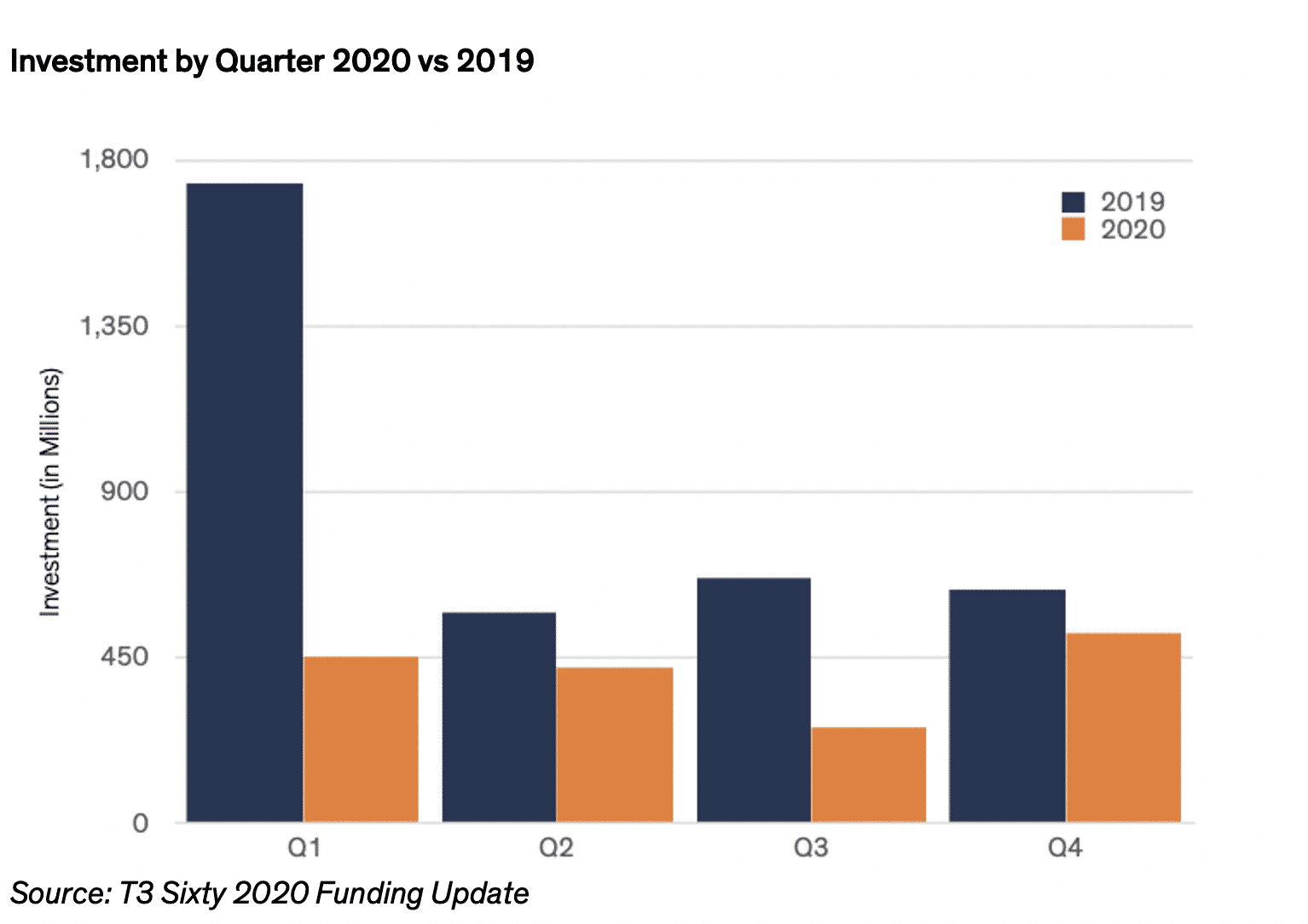

Investment rounds typically take several months from start to finish. The pandemic paused many investment decisions in the second and third quarters of 2020, which pushed those funding events later into 2020 and into 2021.

As 2020 pulled to a close, funding activity had already started to increase; fourth quarter 2020 funding was twice that of the third quarter, and accounted for 31 percent of the full year. Signs suggest that 2021 will see an uptick in investment as well.

Funding Through Mergers and Acquisitions

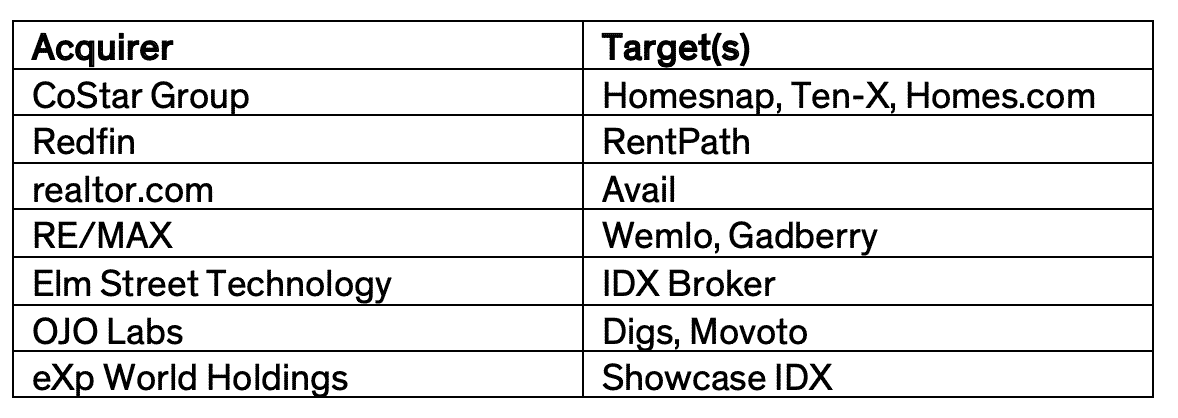

One trend that shows through in the analysis of 2020 funding is the role that mergers and acquisitions played in the funding universe. As funding paused, strategic buyers in the residential real estate and rental categories continued.

Rather than pursue public or private funding as an independent company, firms may also seek growth capital by becoming part of a larger entity through mergers and acquisitions (M&A). There was strong M&A activity in 2020, particularly among strategic buyers in residential real estate (including rental); all signs indicate this trend will continue in 2021. CoStar Group continued to be very active, acquiring Homes.com in April, Homesnap in December and Ten-X in May (2020).

Notable recent strategic acquisitions include the following:

Takeaway

Download the T3 Sixty 2020 Funding Update here for additional details on the year’s funding. T3 Sixty updates this report every quarter, so keep an eye out for the updates throughout the year. For any specific questions related to funding and real estate’s M&A landscape, email me, Michele Conn, T3 Sixty senior vice president of Mergers and Acquisitions, at michele@t360.com.