The discount brokerage model has always had a precarious position in the U.S. real estate market. The promise appears clear – offer real estate consumers a discount for selling and buying services at a discount to the traditional commission rates and win a sizeable portion of the business.

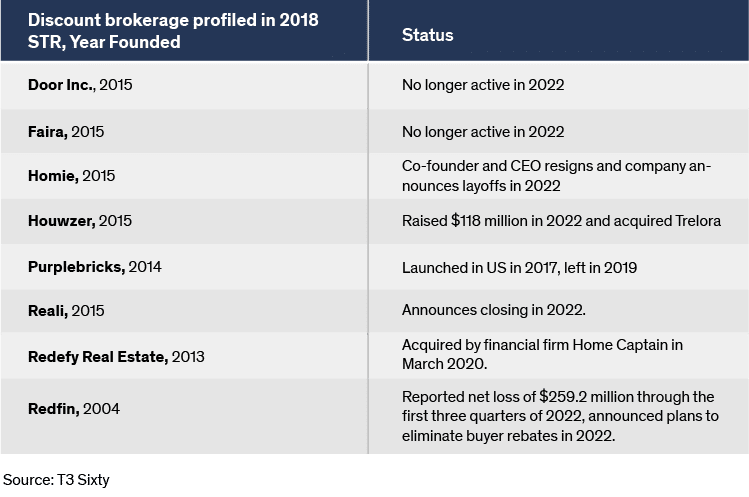

Technology made this promise even more alluring, with the ability to efficiently market properties, track and organize documents, centralize communications and more. However, it has not caught on. Of the nine discount brokerage companies T3 Sixty analyzed in the 2018 Swanepoel Trends Report chapter “The Rise of the Modern Discount Brokerage,” only three are still in operation: Redfin, Homie and Houwzer, which we profiled in last month’s Insight

The company made a bet that its platform, which facilitated owners’ engagement and encouraged them to take a more active role in showings and negotiating a home sale, would allow its independent contractor agents to close more transactions. This, along with a centralized agent-support staff from the company would, in theory, allow them to make more money overall with more transactions while making less on each one.

Eric Eckardt, who served as the U.S. CEO for Purplebricks from 2016 until 2019, reached out in response to last month’s Houwzer profile to say he felt the main reason for Purplebricks’ failure in America came down to its brand awareness strategy in which it spent millions on TV and radio campaigns that hampered profitability. Eckardt did note, however, that the company had very high capture rates on ancillary services.

If he was able to run the company as he felt it should have been operated, he would have had agents focus more on generating their own business and more efficient modes of generating brand awareness such as digital marketing. In the video below, we discuss this and also why the discount brokerage model has not really caught on in the U.S.

Purplebricks still operates in the U.K, but its model has continued to struggle. In the six months through October 31, 2022, it reported a loss of $17.6 million.

Takeaway

Many brokerages have tried to gain traction with a discount model in the U.S., but most have floundered. Redfin has shown the most staying power and traction, but it eliminated its buyer rebate in 2022 and still struggles to achieve profitability nearly two decades in. The allure remains for a lower-cost consumer fee business model for entrepreneurs, but it is not clear cost moves the needle for real estate consumers. We will continue to track this.

Enabling Intelligent Change.