The real estate market has undoubtedly slowed. As the end of 2022 approaches, this article explores the market features to expect in 2023.

Before looking ahead, however, it is worthwhile to take a look at the state of the market now in mid-December, and how the market got here.

Existing home sales started out strong in 2022, at an annual rate of more than 6 million in January and fell each month through October (the latest available data) to just 4.4 million. That translates to a 32 percent decrease over the first 10 months of the year. Undoubtedly, home sales are down from the year previous and are trending that way into 2023.

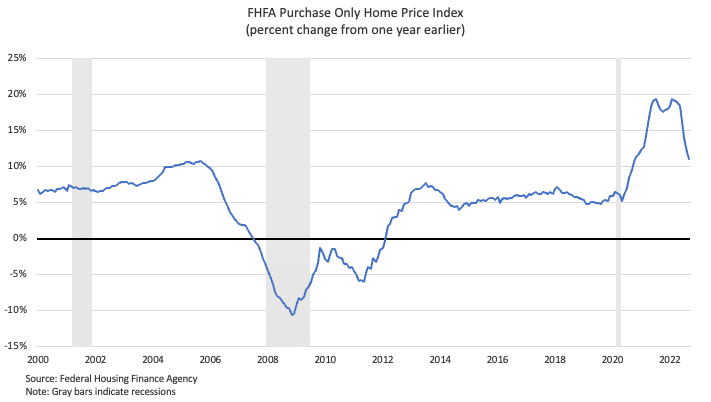

Since peaking in June, home price increases have slowed dramatically, according to the FHFA Purchase-Only Home Price Index. At the start of the year, home prices were rising by nearly 20 percent on a year-over-year basis but by September the rate of price growth had dropped to just over 11 percent.

Inventory has slowly risen through 2022. In January, there were 850,000 existing homes for sale, equivalent to a 1.6-months supply, according to NAR. By October, the inventory had risen to 1.22 million for a 3.3-months supply.

Mortgage rates have doubled since the start of the year, rising from 3 percent to approximately 6 percent in December. Although the pace of home price gains has slowed, the rise in mortgage rates has made all homes more expensive for borrowers. The monthly payment on a $300,000 mortgage in January, for example, would have been $1,300, but by December the payment on that same mortgage amount grew to $1,860.

What to Watch for in 2023: Inflation + Interest Rates

All eyes have been on the Federal Reserve as it works to tamp down inflation by raising rates. After peaking in June at 9 percent, inflation came in below expectations in November at 7.1 percent.

On December 14, the Fed announced it was raising the Fed Funds rate by 0.5 percent, after raising the rate by 0.75 percent four times since June and by a total of 4.25 percent since the start of 2022.

Despite a bit of breathing room, the overall trajectory for interest rates is up, at least until the Fed is certain that inflation is no longer a problem. Even if, under the best of circumstances, mortgage rates drift down a bit in 2023, 3 percent rates on 30-year mortgages are not on the horizon.

Moreover, the standout price appreciation witnessed throughout much of 2021 and early 2022 will likely not happen in 2023. Many metro areas benefited from an influx of new residents who left big cities and took advantage of remote work. That trend seems to be winding down. And the jump in interest rates across the country also pushed up prices beyond the reach of many homebuyers and has overall dampened demand.

In Austin, for example, annual home price gains topped 30 percent from mid-2021 to mid-2022, according to the FHFA. The pace of price growth has downshifted to 17 percent according to the latest data – still strong, but only half of the pace of just a few months ago. 2023 looks to be on the same trajectory.

Even if homes sales pull back a few percentage points from the current pace, which seems likely, millions of transactions will take place next year. As homebuyers and sellers adjust their expectations about the market, agents and brokers should make sure their clients understand local market dynamics and realize that this is a different environment than a year ago when homes were flying off the market and prices were increasing by double-digit rates in many areas.

A slowdown in home sales will work to the advantage of buyers who do not have to compete in multiple bid situations and risk spending more than they can afford on a home. For sellers, many of whom are also buyers, reducing the uncertainties of a chaotic market (Am I going to find my next home?) should come as a relief.

Takeaway

The housing market has been transitioning from the breakneck pace of a year ago largely due to the impact of higher mortgages rates and the cumulative effects of rising home prices and deteriorating affordability. In 2023, slower price growth and lower sales are likely. How much the market will slow will be determined by whether the Fed is successful in taming inflation without tipping the economy into a recession and ultimately achieving a soft landing. soft landing.