The MLS system vendor landscape is undergoing shifts while collaboration and competition among MLSs is increasing, both of which will impact the MLS technology offerings and subscribers’ day to day experience.

One of four leading MLS system vendors, CoreLogic, was acquired this past year in a public bidding war, an emerging vendor, Remine, was bought by an MLS investment consortium and appears poised to become a full MLS system with backend capabilities, and a new entrant, Perchwell, arrived on the scene in with a modern search and reporting user-interface, and received an investment from the largest MLS in the country.

Meanwhile, the largest and most sophisticated MLSs, to advance collaboration and expansion efforts, are fully embracing the concept of giving members choices in their systems. This, in turn, is adding pressure to all MLS decision-makers to learn the MLS system market so they can act strategically to better serve their members and prepare for the future.

This is why, in part, T3 Sixty conducts a thorough MLS system analysis every year, which includes surveying MLS executives and subscribers to assess usage and viewpoints about the nation’s leading MLS systems. In 2021, the survey received 208 responses from MLS executives on its MLS system survey, and over 29,000 responses from MLS subscribers.

This information, along with a variety of in-depth client work throughout the year, provides insight into where the MLS vendor technology landscape is headed. This article outlines some of those insights.

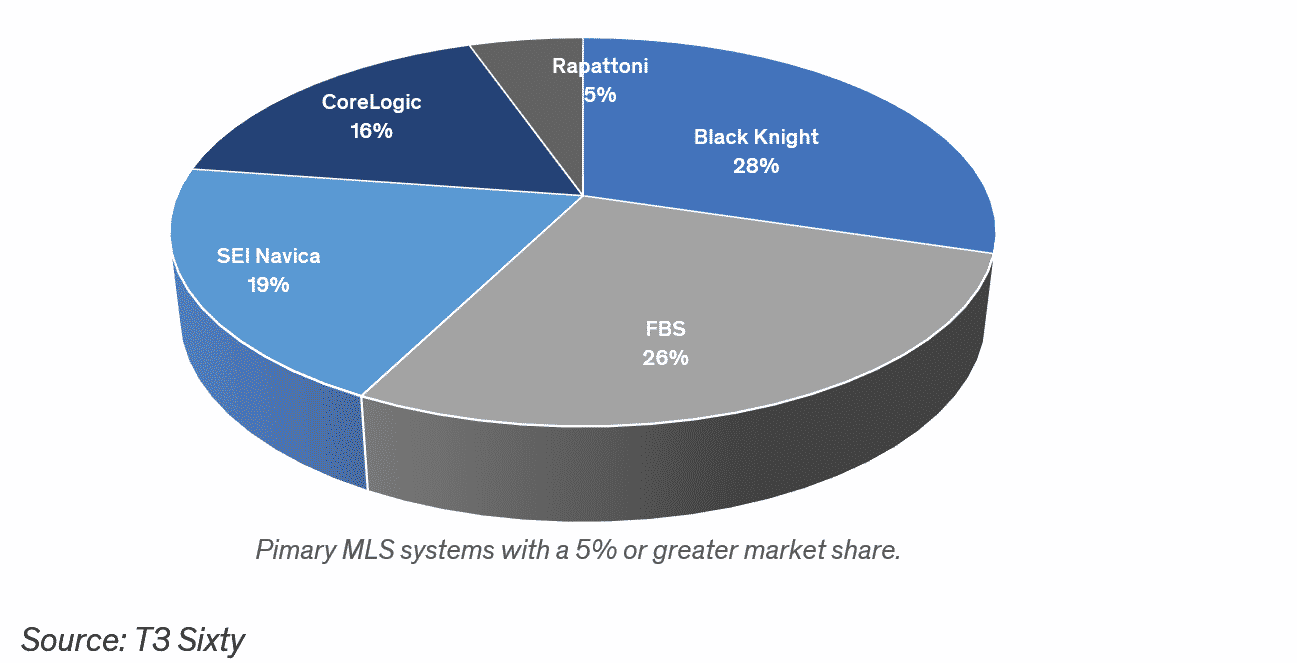

The MLS system marketplace (market share represents use by percentage of total MLS organizations)

Four leading vendors dominate the MLS systems marketplace. These serve approximately 90 percent of all MLS organizations. They include Paragon from Black Knight, Flexmls from FBS Solutions, Navica MLS SEI Navica and CoreLogic Listing Management Platform (formerly Matrix) from CoreLogic. (A select group of 10 MLSs have developed their own systems, the majority of whom are among the largest MLSs, such as MLS Pin in Massachusetts, Realtracs in Tennessee, and UtahRealEsate.com.)

Based on subscriber surveys and MLS executive questionnaires, overall satisfaction levels for each of the leading MLS Systems are strong.

However, subscriber respondents identified key system elements such as client collaboration portals and mobile app functionality as common pain points across all systems, while MLS executives identified that current market reports and mobile application functions are not meeting their needs.

Interestingly, subscriber satisfaction rates tend to track with how well MLSs support and implement the systems. What MLSs do to train and support users along with the third-party integrations they support have a significant impact on user satisfaction.

According to T3 Sixty research, 87 percent of MLSs only have one MLS system. Yet, among MLSs with over 10,000 subscribers, nearly 50 percent currently offer more than one MLS systems, with some offering as many as five.

Offering multiple systems is a costly endeavor from a financial, technical and human resources standpoint. But it is a valuable differentiator and gives subscribers choice in the systems and features they prefer to use. Offering subscribers systems of choice or multiple systems will serve as a differentiator among MLSs as real estate market areas expand with increased consumer migration and remote work options, and aggressive MLS expansion strategies exacerbate overlapping services areas, fueling direct competition among MLS organizations.

Two-thirds of MLS contracts are up for renewal in the next three years. Yet, 92 percent of MLS executives survey respondents said they are likely or extremely likely to renew with their current vendor. Given current system parity and aversions to system conversions by all impacted there has been almost no motivation to change vendors.

However, given the strategic MLS service area expansion by large MLSs and MLS consortiums, and competitive vendor landscape shifts with newer players such as Remine and Perchwell looking to modernize MLS systems with new features, leaders may be compelled to make a change.

With that, T3 Sixty outlines the characteristics and some of the pros and cons of the five most-used MLS systems below. This analysis comes from MLS systems research and from facilitation of client MLS systems selection processes.

Black Knight (Paragon)

- Has maintained market share over the past two years.

- Serves the largest number of MLS organizations by a slim margin. Typical MLS served has less than 10,000 subscribers.

- Maintains a focus on core listing and search functionalities with a mix of built-in products and integration capabilities.

- Strengths include search and regularly scheduled upgrades and new features.

- Improvement opportunities include mobile performance, reporting, and overall user interface.

FBS (Flexmls)

- Has grown market share over the past two years.

- Serves over 150 MLS organizations of all sizes, and is a leading provider for MLSs with between 1,000 and 9,999 subscribers.

- Focuses on core listing and search functionality with third-party integration capabilities.

- Strengths include add/edit and search along with strong customer relationships.

- Improvement opportunities include mobile performance and reporting capabilities.

SEI Navica (Navica MLS)

- Saw a slight dip in market share over the past two years.

- Almost exclusively provides services for MLSs under 1,000 members.

- Focuses on core listing and search functionality with some integration capabilities.

- Strengths include strong customer relationships and affordability.

- Improvement opportunities include mobile performance and ability to meet advanced integration needs.

CoreLogic (CoreLogic Listing Management Platform, formerly Matrix)

- Has maintained market share over the past two years.

- Serves nearly half of the MLS organizations with more than 10,000 subscribers.

- Focused not only on core listing and search functionality but also offers end-to-end solutions and a third-party alliance network with integration capabilities.

- Strengths include MLS executives’ perceived overall value offered by the system along with the services and support delivered to the MLS organization by the vendor.

- Improvement opportunities included mobile performance, reporting and innovation.

Rapattoni (Rapattoni MLS)

- Slight decrease in market share over the past two years.

- Primarily serves MLS organizations with between 500 and 9,999 subscribers.

- Focused on core listing and search functionality, is adding tax and public records services, and integration capabilities.

- Strengths include MLS executives’ perceived overall value offered by the system and the customizable services and support delivered by the vendor.

- Improvement opportunities include mobile performance, client portal design, and reporting.

Takeaway

If you would like a copy of our 2021 MLS Systems Performance Synopsis Report or if you need assistance with and upcoming MLS system decision please contact Clint Skutchan, SVP of Organized Real Estate at clint@t360.com.