Every year, T3 Sixty dives deep into the residential real estate brokerage industry and identifies and analyzes the top trends that will shape it for the next 18 to 24 months. The result: the Swanepoel Trends Report (STR). The report provides over 200 pages of information, strategy and research to help industry leaders design the most sturdy course for their companies.

The report’s 17th edition, the 2022 STR, will be published in early December and is available for preorder here.

This year’s report covers the major trends catapulting the industry into uncharted territory, one dominated by large, well-financed mega-companies, private equity and a formidable wave of newer players and models.

T3 Sixty identifies this new innovation era as Stage 10, dubbed the “Great Acceleration,” in which the massive amounts of financing, rapid technology development and new business models that emerged over the last decade have catalyzed the industry into hyperdrive. This trend, which includes a description of past industry stages and how this year’s trends dovetail together, tops the report.

As a preview of the report, this article provides some additional information on several chapters.

Real Estate and the Great Reshuffling

The big life and business adjustments associated with the Covid-19 pandemic truly marks a sustained change in where Americans live and work. This trend in the 2022 STR, The Great Reshuffling, analyzes these changes, how they influence today’s housing market, and what industry players should take away from this significant shift.

One of the big insights when analyzing the moving data associated with the pandemic is that Covid-19 did not necessarily create new moving trends, but accelerated some already long-developing ones, such as the migration away from higher-priced larger cities to lower-cost, more rural areas.

In fact, the number of realtor.com users searching for single-family homes in rural areas jumped 18.7 percent in June 2021 compared to June 2019. That was the highest increase of any area type over that period.

Of course, rural areas – which offer larger spaces at typically lower costs — not only gained attention as a result of the pandemic. Second-tier cities also gained remarkable attention. From June 2020 to June 2021, for example, home prices increased the most in the following cities: Boise, Idaho; Austin, Texas; Provo, Utah; Colorado Springs, Colorado; and Youngstown, Ohio (the top 15 listed in the chapter).

In addition to chronicling how people moved, this chapter presents how real estate was impacted. Industry leaders may know some of the impacts in their local areas – this chapter provides insight into how the pandemic affected the industry across states and regions.

Private Equity’s Real Estate Rising

Private equity is having a significant impact in the brokerage industry, behind some of the large industry developments such as the sale of CoreLogic, Lone Wolf Technologies’ acquisition spree and the increasing cadence of industry consolidation. Private equity acquisitions have picked not only in the technology space, but also with brokerages, franchisors and media.

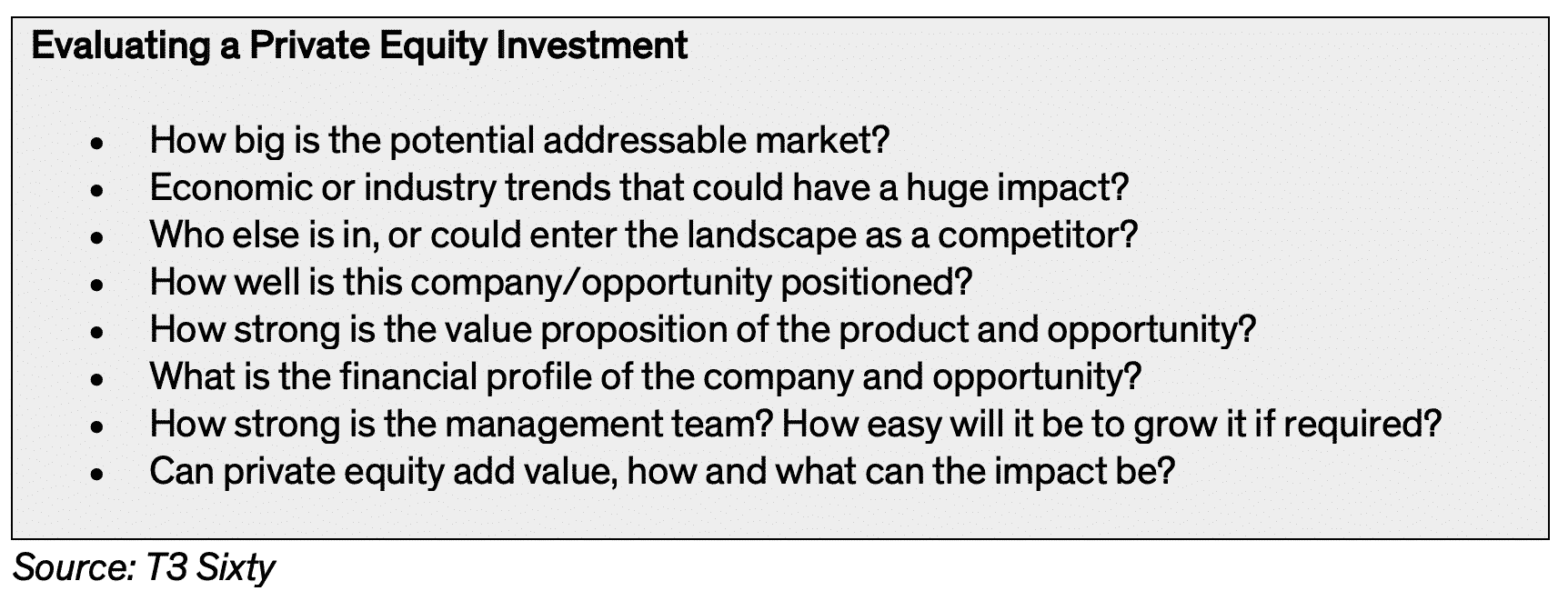

While venture capital and public markets have gained prominence in the industry, private equity flies a bit more under the radar. This chapter in the report presents an overview of how private equity works, what these companies look for in investments, how they look to grow them and how they have worked in real estate recently.

For example, private equity companies typically acquire a controlling equity stake in the companies they invest in. This means they have an extremely hands-on management and strategy influence over companies in their portfolio. They look for opportunities to grow the company before selling it again, typically three to five years after their initial purchase, to realize a return.

The Tech Consolidation Wave

Between January and September 2021, the industry saw 34 real estate technology acquisitions. That’s a blur of purchases in just 21 months and represents the great time of change and acceleration the industry faces as it heads into 2022.

This trend in the report tracks all 34 transactions, identifies the strategies they represented for the acquirer and provides readers with a sense of how these acquisitions affect their long-term tech strategies and what they should do about it.

For example, some consolidations make technologies exclusive to an acquirer’s network, such as RE/MAX’s 2019 acquisition of predictive marketing software provider First. Some consolidations, such as those by Constellation Real Estate Group, which acquired five companies from January 2019 through September 2021, create more full-featured platforms for brokers and agents to choose from.

This chapter gives brokers and agents a fuller picture of the significant real estate technology consolidation occurring and what to do about it.

Takeaway

Industry change has never occurred as fast as it is happening now. This is, of course, not something to fear, but it is something to understand and respond to with swift, knowledgeable action. The 2022 Swanepoel Trends Report gives brokerage industry leaders the insight, analysis and information to do that.