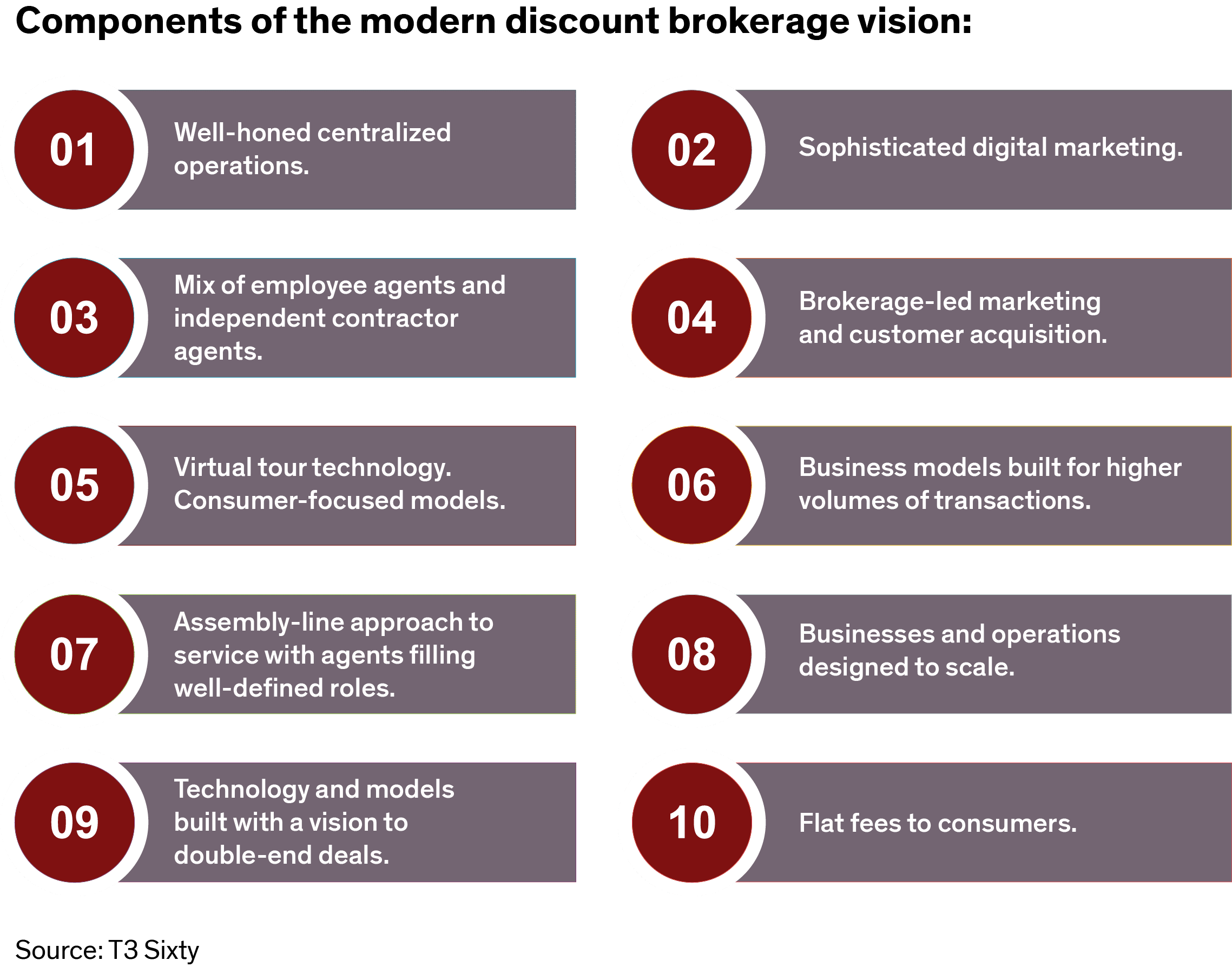

The concept of a discount brokerage — in which brokerages offer services to real estate buyers and sellers for less than the predominant commission-based model — has existed for decades in the real estate space.

Companies have employed variations of the model, which often involves offering services to sellers for a flat fee or lower-priced commission and pre-set rebates to buyers with salaried agents. Some profess full service for that lower fee, including in-person meetings and guidance, professional photography and marketing, assistance with negotiation and all the key services brokerages and agents provide. Others offer streamlined services for the discounted compensation.

In the 2000s, Your Home Direct, which became Foxtons, went big with a 2 percent commission fee (and none offered to cooperating buyer brokers), but lagging customer service as it scaled and the housing crash killed it off in 2007.

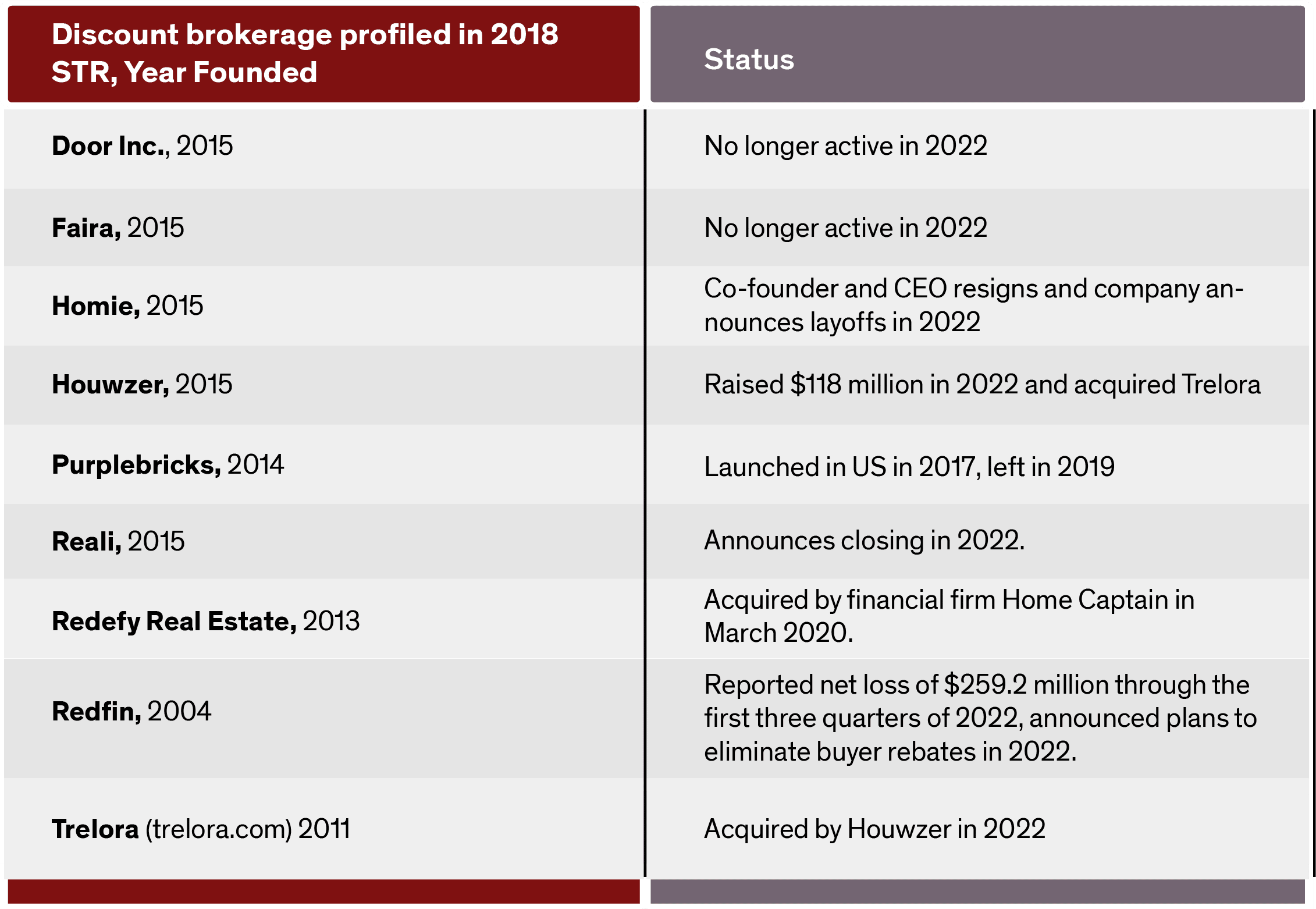

As technology proliferated, the model’s promise brought new players and investment, hoping to capitalize on the economies of scale technology unlocks. Purplebricks, the high-flying UK-based startup, came to the US in 2017 grabbed a lot of attention with a model that charged sellers a flat fee of $3,600 to list and sell their home while professing full service. After struggling to gain traction, it left the U.S. market in 2019

As recently as five years ago, this modern discount brokerage model was seemingly flying high. Redfin, the industry’s most successful and longest-running discount brokerage, was among the most prominent. A group of well-funded startups emerged to join the space and Purplebricks made a splashy debut in the U.S.

The 2018 Swanepoel Trends Report chapter, “Rise of the Modern Discount Brokerage,” covered the trend. Of the nine companies profiled in the chapter, only two are still going strong: Redfin and Houwzer.

Redfin, which launched in 2004, went public in 2017 and now operates in all 50 states and Canada and has a market cap of over $600 million. The company, which uses a core cadre of salaried agents supplemented with independent contractor agents in some markets, charges sellers 1.5 percent (and the traditional co-brokerage fee) and had offered buyers rebates since launch, but announced plans to eliminate that in July 2022.

Houwzer

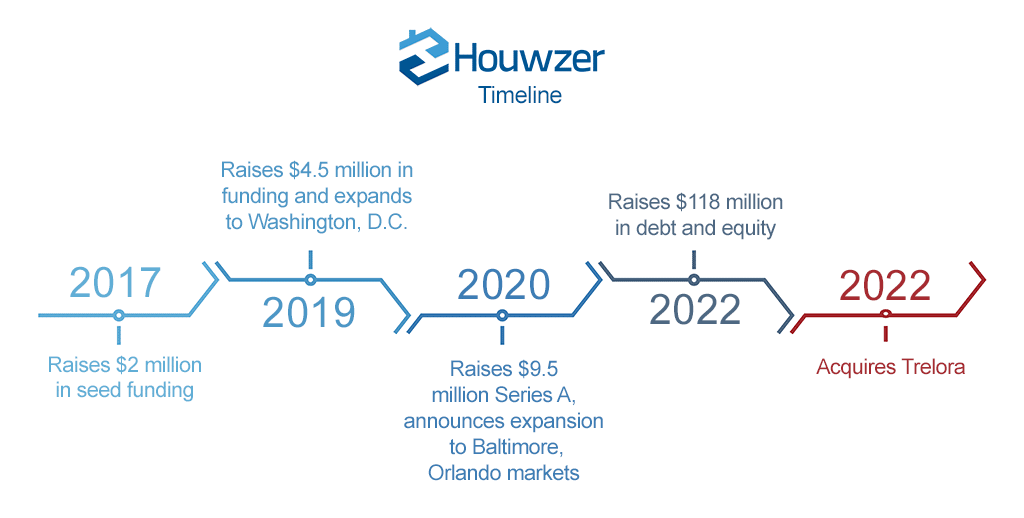

Arguably the discount brokerage with the most momentum as 2023 kicks off is Houwzer, a Philadelphia-based company that launched in 2015, raised $118 million in debt and equity in early 2022 and acquired competitor Trelora in December. The acquisition expanded the company’s operations from 10 markets and seven states to 24 markets and 14 states.

The firm charges sellers a flat fee of $5,000 for full brokerage service, including in-house meetings with a salaried agent. Sellers who also buy with Houwzer receive a $2,500 rebate. The company has approximately 140 full-time employees, with approximately half serving as agents, co-founder and CEO Mike Maher tells T3 Sixty.

When asked why he still believes in the model and that Houwzer has shown staying power while other discounters have struggled, Maher credited the firm’s slow and steady approach, which allowed it to refine operations and better stitch together its ancillary services, which is a key part of its model and the prospects for outsized success.

Like many real estate companies now, Houwzer has jumped all in on the ancillary side of the brokerage business, and Maher sees it as a key to the firm’s future. It has in-house mortgage and title operations with Houwzer Mortgage and Houwzer Title.

Maher says the company achieves attach rates above 60 percent for mortgage and title for consumers of its real estate brokerage services. An end-to-end real estate transaction platform Houwzer is building and salaried agents are keys to achieving this high rate, he adds. The platform provides efficiency and simplicity for consumers, and agents, who are salaried, are carefully trained to communicate the benefits of using the firm’s in-house services (while following CFPB rules related to marketing ancillary services).

The end-to-end transaction platform supported by employee agents are keys to the big success Maher sees for the company at scale. There are many hurdles remaining, not least of which how to maintain high customer service and respond efficiently to market shifts with a cadre of employee agents, a challenge Redfin grapples mightily with.

Also, as Maher points out in the interview below, the model, like others, will receive a vigorous stress test in the shifting market in 2023.

Takeaway

The promise of technology has fueled the hopes of many newer brokerage models. The discount model persists and the promise of new technology and alternative finance innovations may spell a future for it.