T3 Sixty released the 2022 Organized Real Estate, which ranks the nation’s largest MLSs and Realtor associations by subscriber and member count, this week. We began publishing this data annually in 2020, and, this year, the data reveals a clear yearslong trend of local Realtor associations and MLSs consolidation is continuing.

The data also presents a developing trend T3 Sixty has not identified before: the growing presence of real estate professionals in the South and Northeast. This article touches on both trends, starting with a brief outline of MLS and Realtor association consolidation and then a discussion of the shifting real estate professional concentration.

Access the full 2022 ORE online here. It includes both the MLS 200, a ranking of the nation’s largest MLSs, the ORE 200, a ranking of the nation’s largest local Realtor associations, and a ranking of the nation’s largest state Realtor associations. The ORE ranking is the second section of the Real Estate Almanac, a comprehensive compendium of real estate data and analysis produced by T3 Sixty every year.

Consolidation

As professionalism requirements and technology standards go up, the needs of MLS subscribers and local Realtor association members increases. This has led to a steady consolidation of both organizations, which, in turn, has increased the average member/subscriber size of the organizations.

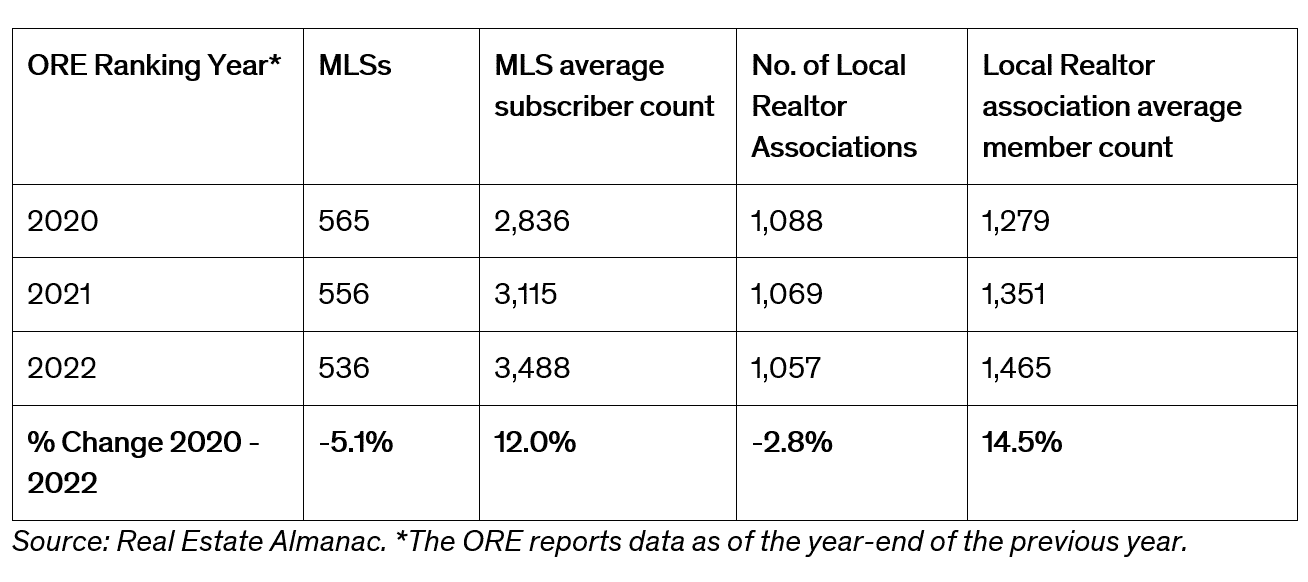

The 2022 ORE data, which presents MLS subscriber and Realtor association member information as of year-end 2021, shows just how it is progressing. The number of MLSs, according to the MLS 200, has dropped 5.1 percent from 2020 to 2022 to 536 while the average number of subscribers per MLS rose 12.0 percent to 3,488 subscribers.

On the Realtor association side, 2022 ORE 200 data show that the number of associations dropped by 21, or 2.8 percent, to 1,057 between 2020 and 2022. Over that same period, the average member count rose 14.5 percent to 1,465 members.

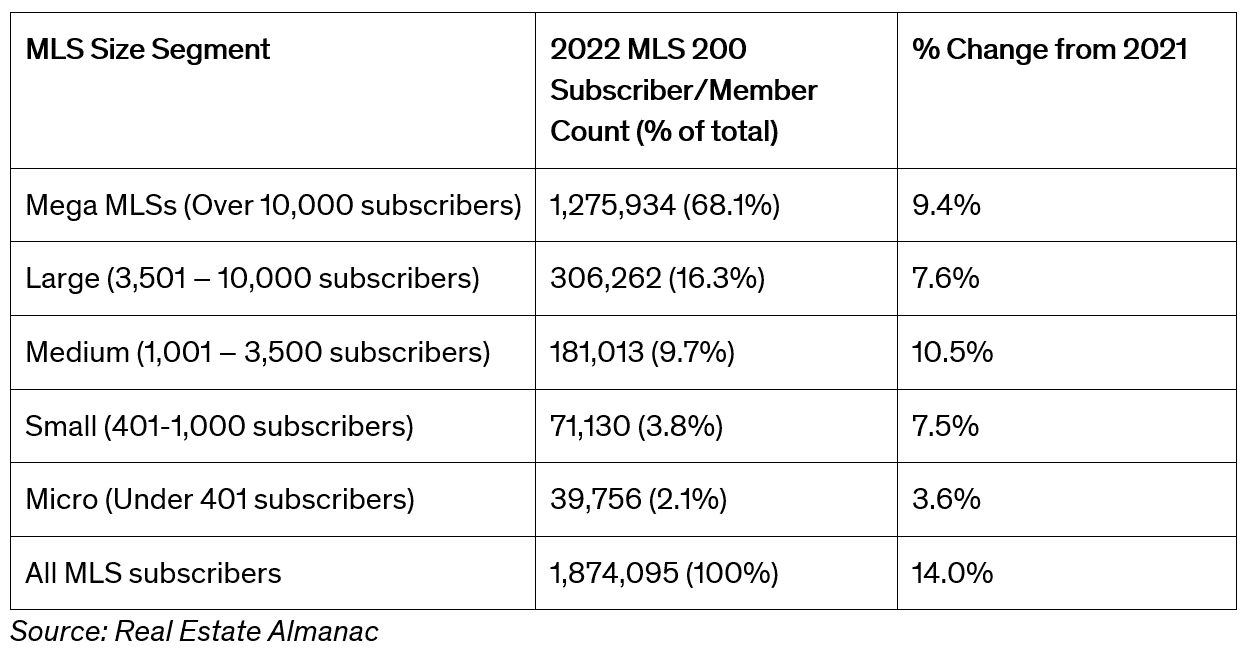

Diving down into the size segments of these organizations reveals that the biggest are getting bigger, and the smallest are getting smaller.

For example, when looking at T3 Sixty’s size segmentation of the nation’s MLSs, the data show that the largest size tiers are outpacing the smaller tiers in subscriber growth. From 2021 to 2022, medium MLSs (those with 1,001 – 3,500 subscribers) and mega MLSs (those with over 10,000 subscribers) saw the largest percentage of subscriber growth, with 10.5 percent and 9.4 percent, respectively. Micro MLSs (MLSs with under 401 subscribers) saw the smallest year-over-year subscriber growth at 3.6 percent.

This tracks with the experience on the ground in markets throughout the country where residents of metros expand their search out of the city and, often, the metro MLS serving it. The associations and MLSs are then expanding their territory, as agents follow their clients further from the urban core.

Real Estate Professional Regional Concentration

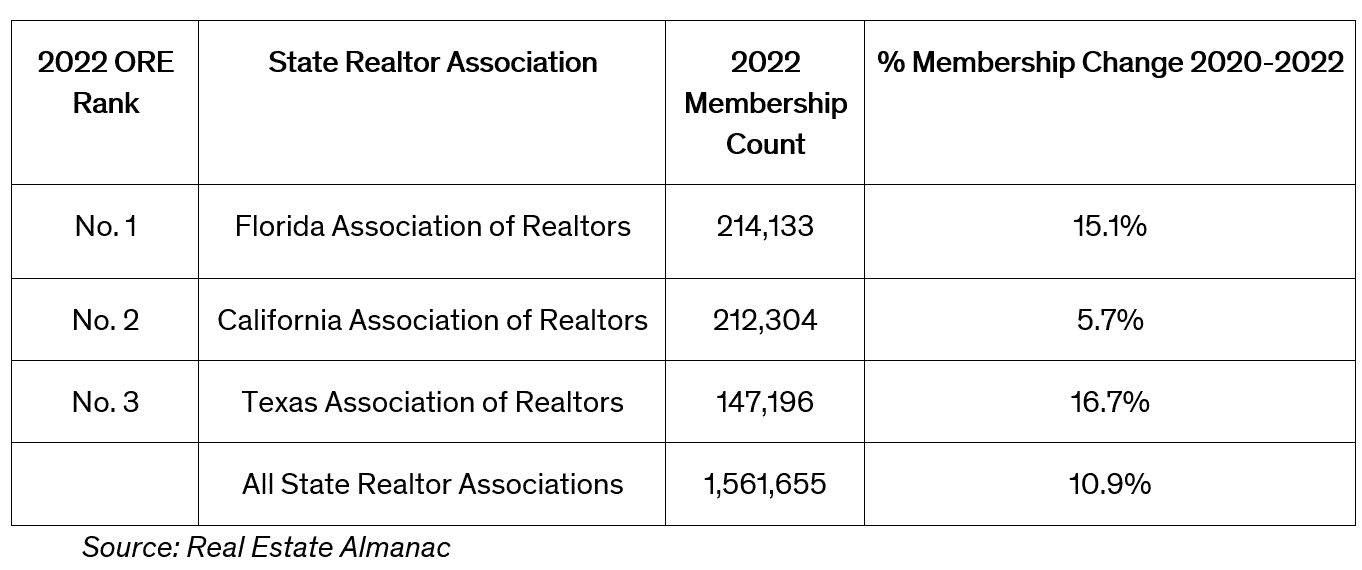

In the 2022 ORE, the Florida Association of Realtors with 214,133 members took the crown as the state Realtor association with the most members from the California Association of Realtors.

Both Texas and Florida greatly outpaced membership growth of the California organization from 2020 to 2022. In that period, all state Realtor associations grew by 10.9 percent, while Texas and Florida grew 16.7 percent and 15.1 percent, respectively, and California just 5.7 percent.

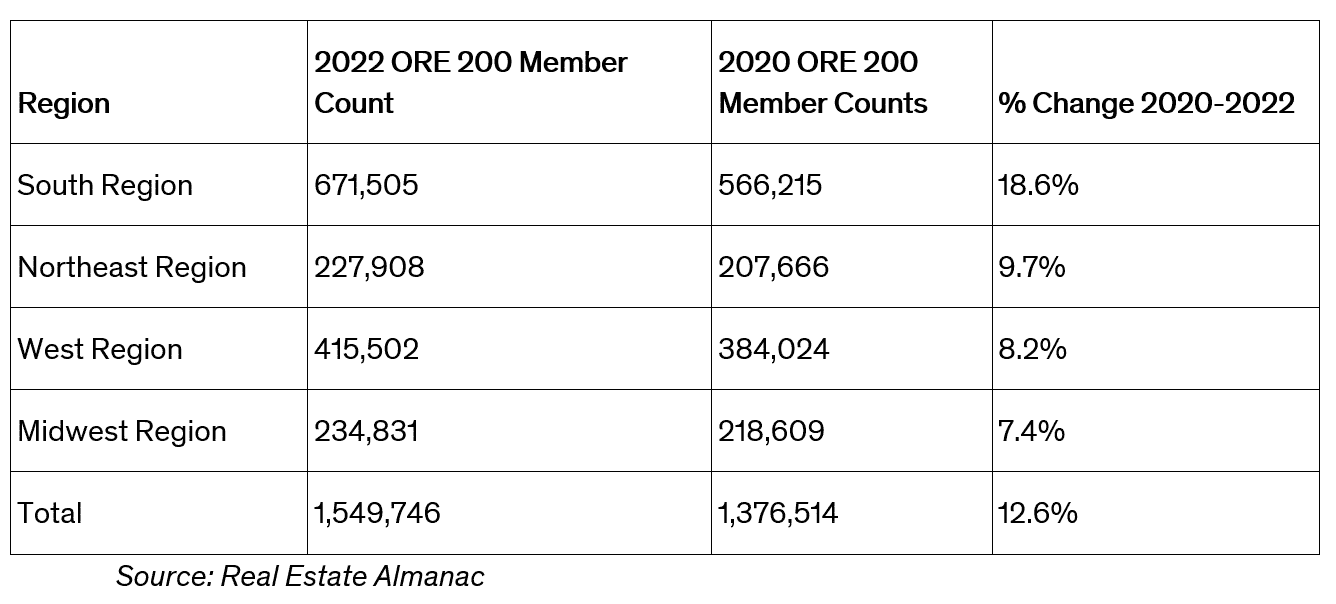

The same trend holds when analyzing local Realtor association membership by census region: West, Midwest, South and Northeast. Local Realtor association membership grew by 12.6 percent from 2020 to 2022. Local associations in the South region grew membership by the highest percentage over that period at 18.6 percent, followed by the Northeast region at 9.7 percent.

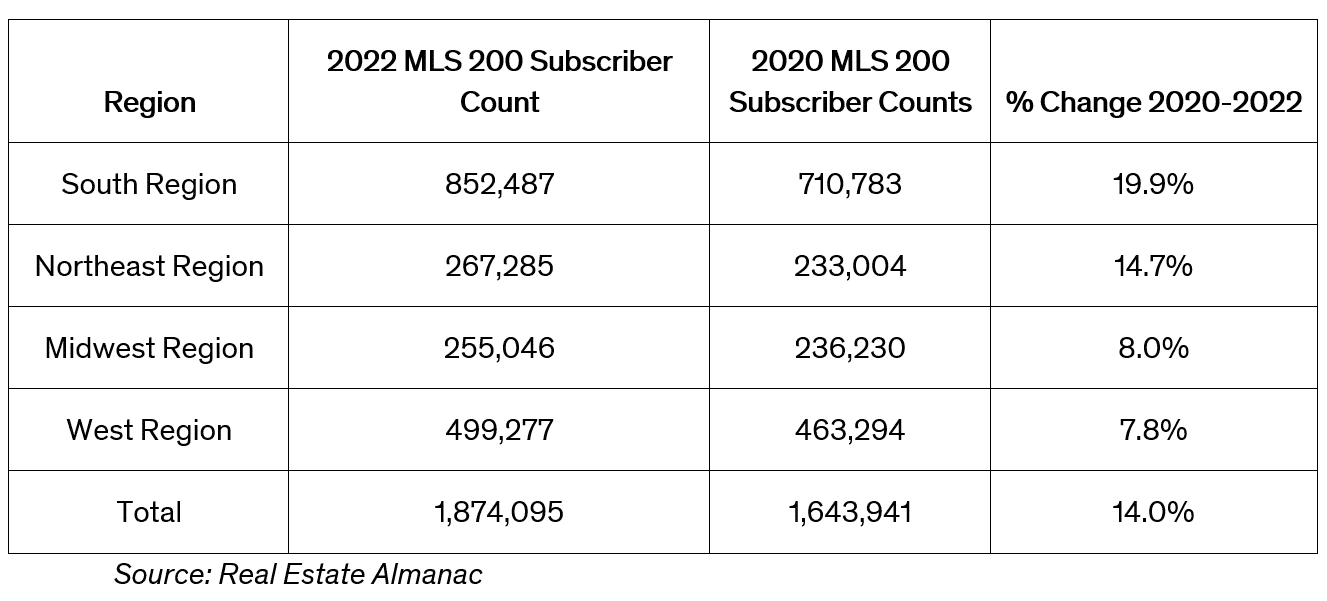

The same trend, as would be expected, holds for MLS subscribers.

This regionality, which the ORE rankings began tracking for the first time this year, reveals how the concentration of real estate professionals is changing in different areas, and that the South and Northeast have added more members and subscribers than the West and Midwest from 2020 to 2022.

Takeaway

Like every year, the 2022 ORE offers the data that allows the industry to track exactly how Realtor associations and MLSs are changing. The needs and requirements for Realtor associations and MLSs are changing, and the data here reflects that. If you’re looking at how to adapt into the future as an organized real estate professional, reach out to me, Clint Skutchan, vice president of organized real estate at T3 Sixty, for a consultation, clint@t360.com.