New construction – or the lack of it – has been a key factor in the nation’s nearly decade-long housing inventory shortage. With too few homes being built each year, demand for single-family homes has consistently outstripped supply – builders are just not constructing enough housing for the nation’s growing population.

This update to the 2022 Swanepoel Trends Report chapter “The Impact of New Construction” analyzes the current state of the new construction industry and what has transpired since that chapter came out in December 2021.

The key takeaway from the previous analysis was that growing demand for homes, and builders’ hesitancy to build at scale has contributed to the inventory shortage and escalating prices for both new and existing homes.

What, if anything, has changed?

Single-family construction

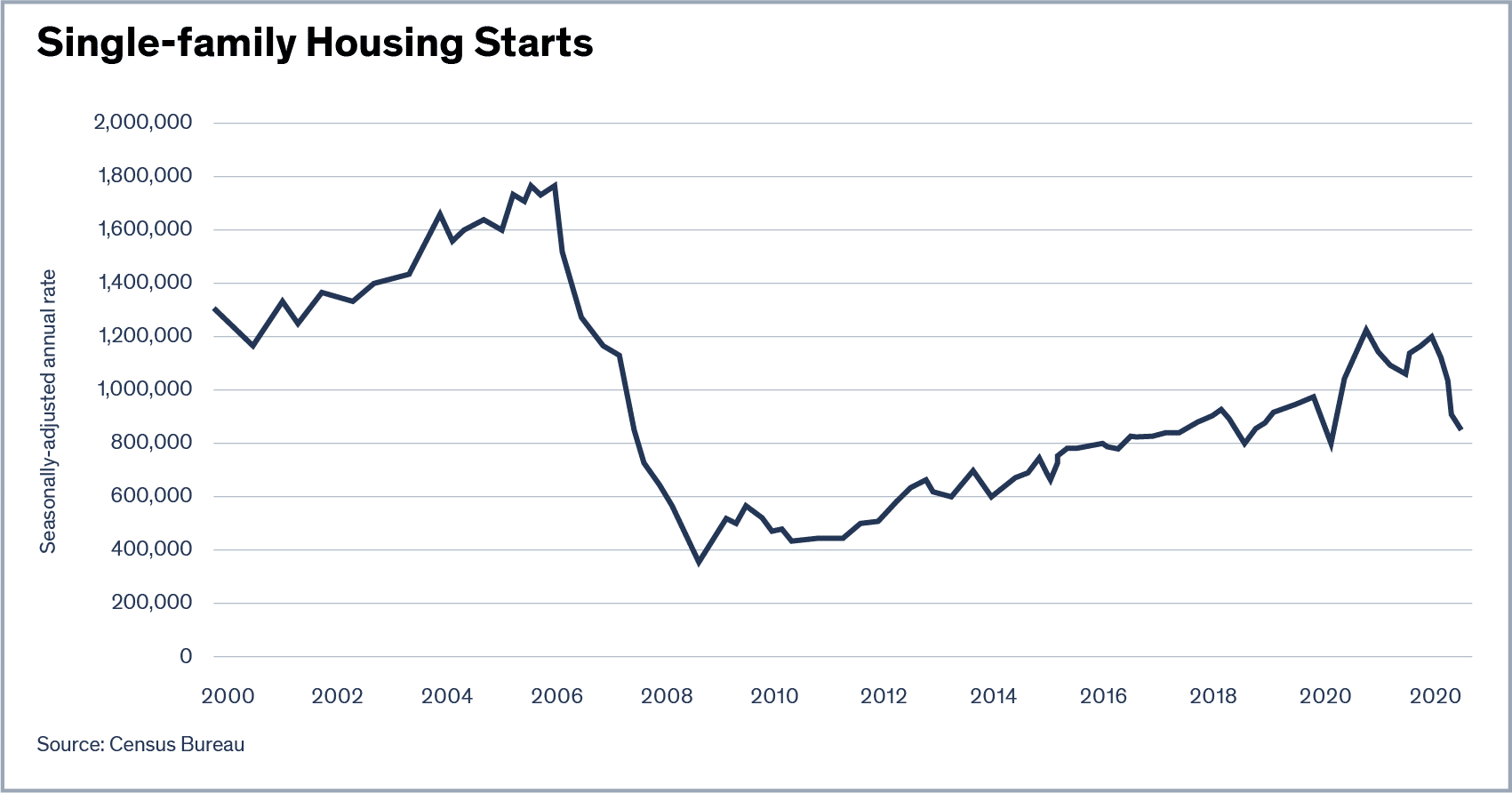

The construction of single-family homes was on a decade-long upward trend after the end of the Great Recession in 2008. Beginning in 2021, the pace of construction jumped, a sign that even more homes would be coming on the market. But by the beginning of 2022, the pace of new construction fell back to pre-pandemic levels.

In the 10 years before the Great Recession, the average number of single-family starts measured 1.4 million per year. The latest data show a pace of less than 900,000, the lowest level since the fourth quarter of 2018. That shortfall means that the well-documented housing shortage will not be solved for the foreseeable future unless there is a sustained rise in home construction.

New-home sales

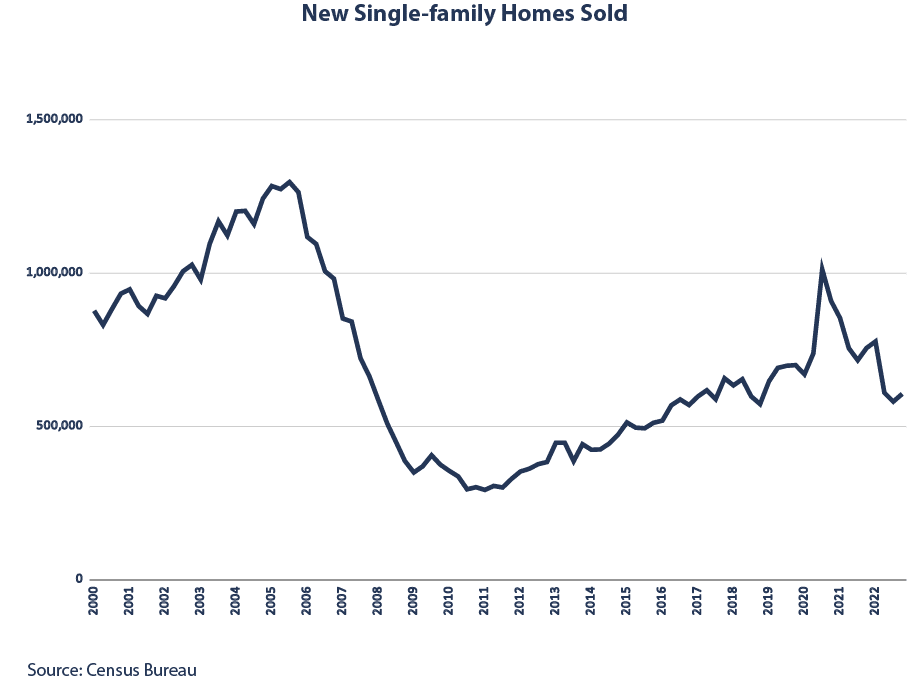

Single-family new-home sales rose in 2021 with heightened buying activity supported by the emergence of remote work and buyers’ need and desire for larger spaces. Low mortgage interest rates of 3% or less also supported these gains as the lower rates helped offset some of the increase in prices, making larger, more expensive homes accessible to a wider swath of potential home buyers.

The surge in new home sales did not last, however. By late 2021, the pace of sales had eased; this mirrored the slowdown in single-family construction. With the combination of rising prices and higher mortgage rates, the monthly mortgage payment for buyers of median-priced new homes more than doubled between 2020 and 2022, to $2,340.

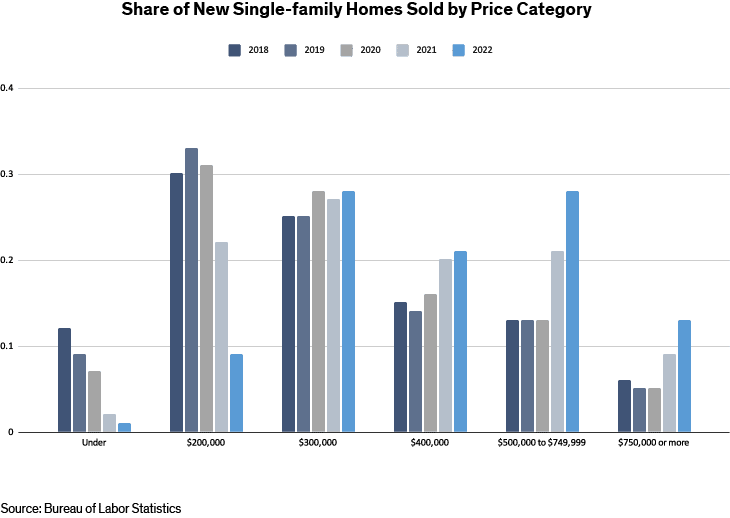

As the costs to purchase new homes has gone up – and the costs to build them – homebuilders have been building a greater proportion of homes at the higher end. For example, in 2020, the proportion of new homes priced at $750,000 or more rose by over 2X from 5% to 13%. At the next-highest price band – new homes priced between $500,000 and $749,999 – the share rose from 13% in 2020 to 28% in 2022. Overall, the share of homes priced above $500,000 has risen from about 18% in 2020 to 41% by 2022 – a doubling of the share in just two years.

Fewer new homes built at the lower-price end and more at the higher-price end largely explains why new home prices overall have increased by 30.8% between 2020 and 2022. For comparison, median existing home prices rose 30.2% over the same period. The lack of new construction is not just a concern for the new home market. The spillover from unmet demand in the new home market has contributed to the increased demand for existing homes and rapidly rising prices in this segment as well.

Builder challenges

Higher prices for suitable building lots, costly regulation and elevated labor and material costs all have added to the cost of new construction and driven up new-home prices.

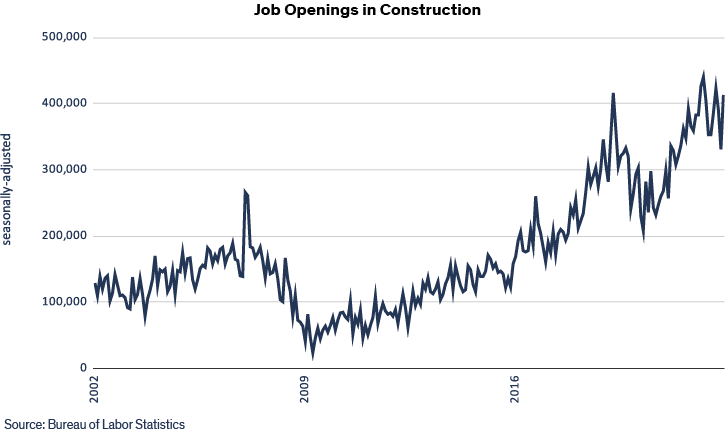

The shortage of construction labor remains a consistent hurdle. The number of job openings in the construction industry rose sharply since 2020 from less than 300,000 to more than 400,000 – a record level since the data has been collected back to December 2000. With low overall unemployment, filling the existing open construction jobs is difficult, especially for skilled trades that require training and experience.

Rising building material prices has also dampened the overall pace of construction as some of the price increases stemmed from pandemic-related supply bottlenecks. Softwood dimensional lumber has risen in price by 38% since the start of 2020. Many other building materials have followed a similar trajectory.

Over the period from January 2020 to January 2023, the prices of inputs to construction for goods rose 35.5% and 22.7% for services. The consumer price index – the leading barometer for inflation – over this period rose 16%.

Takeaway

After a promising uptick in new construction in 2020 and into 2021, the pace of homebuilding has tapered-off. Along with the slowdown in new construction, the sales of new homes has eased. The combination of rising home prices and higher mortgage rates has contributed to a slowdown with builders shifting to higher-priced homes in the face of elevated costs and a continuing labor shortage. Overall, the housing shortage remains a challenge for the real estate industry with new homes not likely to be a relief valve in the foreseeable future.