On April 25, T3 Sixty released the sixth annual Mega 1000, a ranking of the nation’s 1,000 largest brokerages by sales volume, and its 100 largest brokerages by transaction sides and agent count.

The 2023 report reveals a years-long trend of concentration of brokerage production among the nation’s largest brokerages. Leaders in all areas of the country feel this trend, but analyzing the Mega 1000 numbers shows just how big it is and some of the ways brokerages are finding ways to grow.

This article spotlights the trend and presents some of the numbers and data behind it.

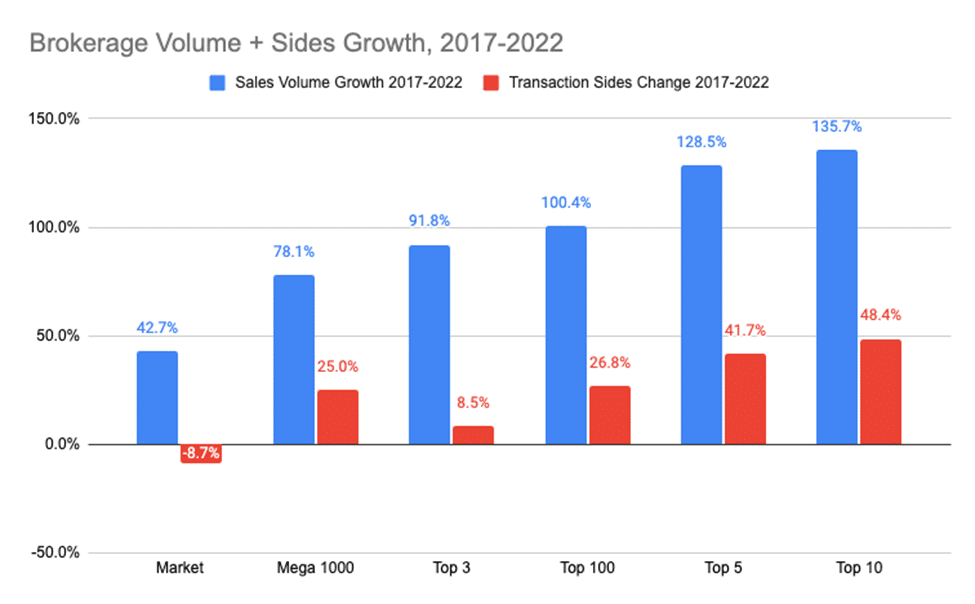

Mega 1000 Production Growth

Between 2017 and 2022, the overall real estate brokerage market saw sales volume grow 42.7% and transaction sides actually drop 8.7%.

Mega 1000 brokerages, however, saw sales volume grow nearly twice that amount at 78.1% growth and transaction sides grow 25.0%.

Just looking at the nation’s 10 largest brokerages, that segment of the Mega 1000 saw the biggest gains in that six-year span: 135.7% growth in sales volume and 48.4% in transaction sides.

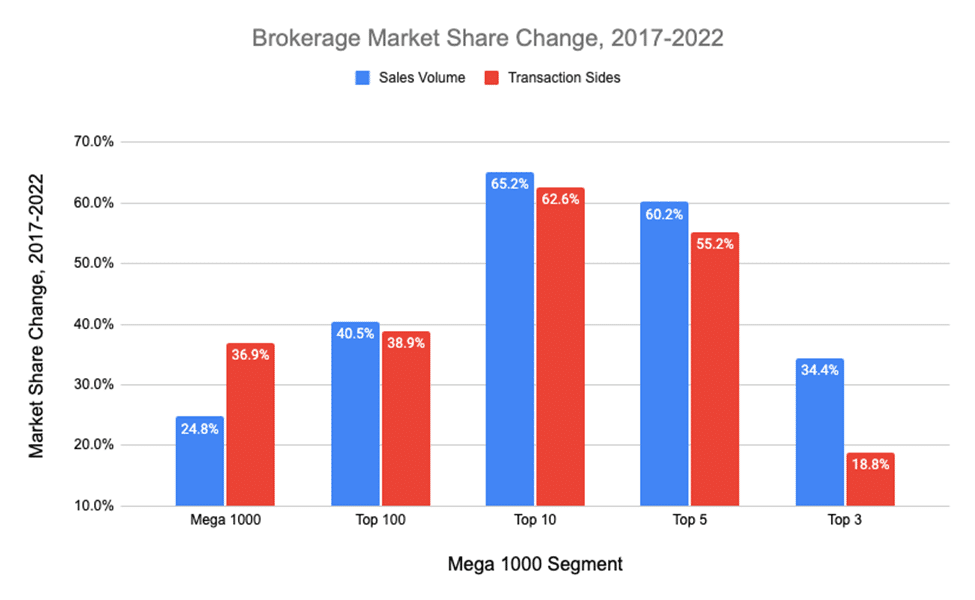

Mega 1000 Market Share, Sales Volume

When looking at market share, using NAR’s existing home sales data as a proxy for the overall market, all segments of the Mega 1000 saw market share increases from 2017 to 2022. For example, the Mega 1000 accounted for 65.6% of all US sales volume in 2022, up from a share of 52.6% in 2017.

Market Share Growth, 2017-2022

When analyzing which segment of the Mega 1000 saw the largest growth in market share between 2017 and 2022, the top 10 came out as clear winner. In that period, the nation’s 10 largest brokerages increased their sales volume market share by 65.2% and their transaction sides market share by 62.6%.

Takeaway

Brokerages are leveraging capital partners and going public to scale and realize the efficiencies and opportunities that come from operating as larger organizations. This trend will likely continue as firms race to compete for the advantages scale have to offer.