Zillow Group drops iBuying. Douglas Elliman prepares to spin off as a standalone public company. @properties acquires Christie’s International Realty. CoStar Group acquires Homes.com. Stone Point Capital and Insight Partners acquire CoreLogic. Inventory remains at near record lows. Capital is abundantly available. The pandemic is hopefully almost over. And more companies are going public.

These are big industry developments, some of which will have an impact on the coming years. And while specific events are unpredictable, the underlying trends they represent – increasing presence of finance, industry consolidation, the rise of major new players, private equity’s growing industry influence, the powerful alternative finance transaction model – are sometimes harder to discern and understand without careful analysis.

That is the operating thesis for the Swanepoel Trends Report (STR), which officially published its 17th annual edition on December 6. In over 200 pages, it gives real estate leaders the information and analysis to better understand the forces shaping the brokerage industry, and empowers them to make the foundational decisions that will help their companies adapt and thrive.

The 2022 STR presents in-depth analysis on the impact of industry tech consolidation, the emergence of CoStar Group a significant marketing and technology player, how private equity works in real estate and its increasing impact of multiple facets of the industry and the alternative real estate financing revolution catalyzed by iBuying.

The full slate of trends covered in 2022 STR include:

- Trend 9 – The Impact of New Construction: Homebuilding’s influence on the nation’s persistent low inventory of housing

- Trend 8 – The Residential Real Estate Media Landscape: An analysis of the industry’s leading news sources

- Trend 7 – Branch Manager Magic and How to Find It: How to hire and retain for this critical brokerage role

- Trend 6 – The Technology Consolidation Wave: How the accelerating cadence of brokerage technology acquisitions impact brokerages

- Trend 5 – CoStar Group: Inside Residential Real Estate’s New Heavyweight: The operator of the nation’s dominant commercial real estate portal dives into residential

- Trend 4 – Real Estate and the Great Reshuffling: How the pandemic impacted real estate consumer migration and habits

- Trend 3 – The Real Estate Financing Revolution: Approaching an end-to-end digital transaction through innovations in financing

- Trend 2 – Private Equity’s Real Estate Rising: The increasing industry influence of private investors

- Trend 1 – The Accelerating Transformation: The industry embarks on a new era

Physical copies of the report can be purchased at t3trends.com and while digital access can be obtained at t3intel.com.

To provide some deeper insight into the report, below some details from the chapters are presented.

Alternative Financing

While iBuying represents a new real estate brokerage business model it also stands as just one part of the real estate financing revolution. This trend of alternative financing, or AltFin for short, has progressed beyond the capital- and risk-intensive practice of companies simply purchasing homes directly.

The benefits iBuying provides to sellers – certainty, convenience, simplicity – can be achieved in a variety of other ways, which many companies have introduced, including cash-backed offers on their next home via a home trade-in (if the sellers are buying another home) as Opendoor and Knock have introduced, guaranteed cash offers on their home (if the home does not sell on the open market) and discount, streamlined listing brokerage services.

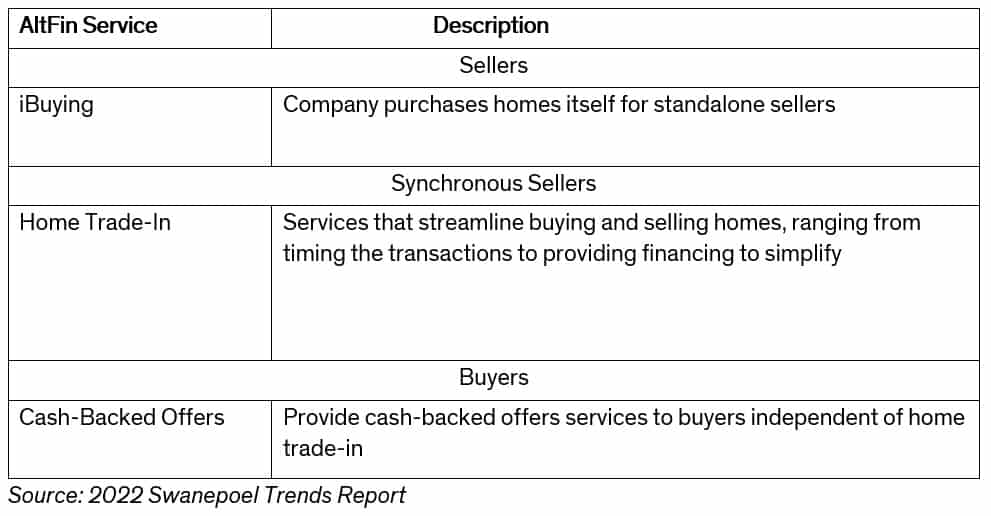

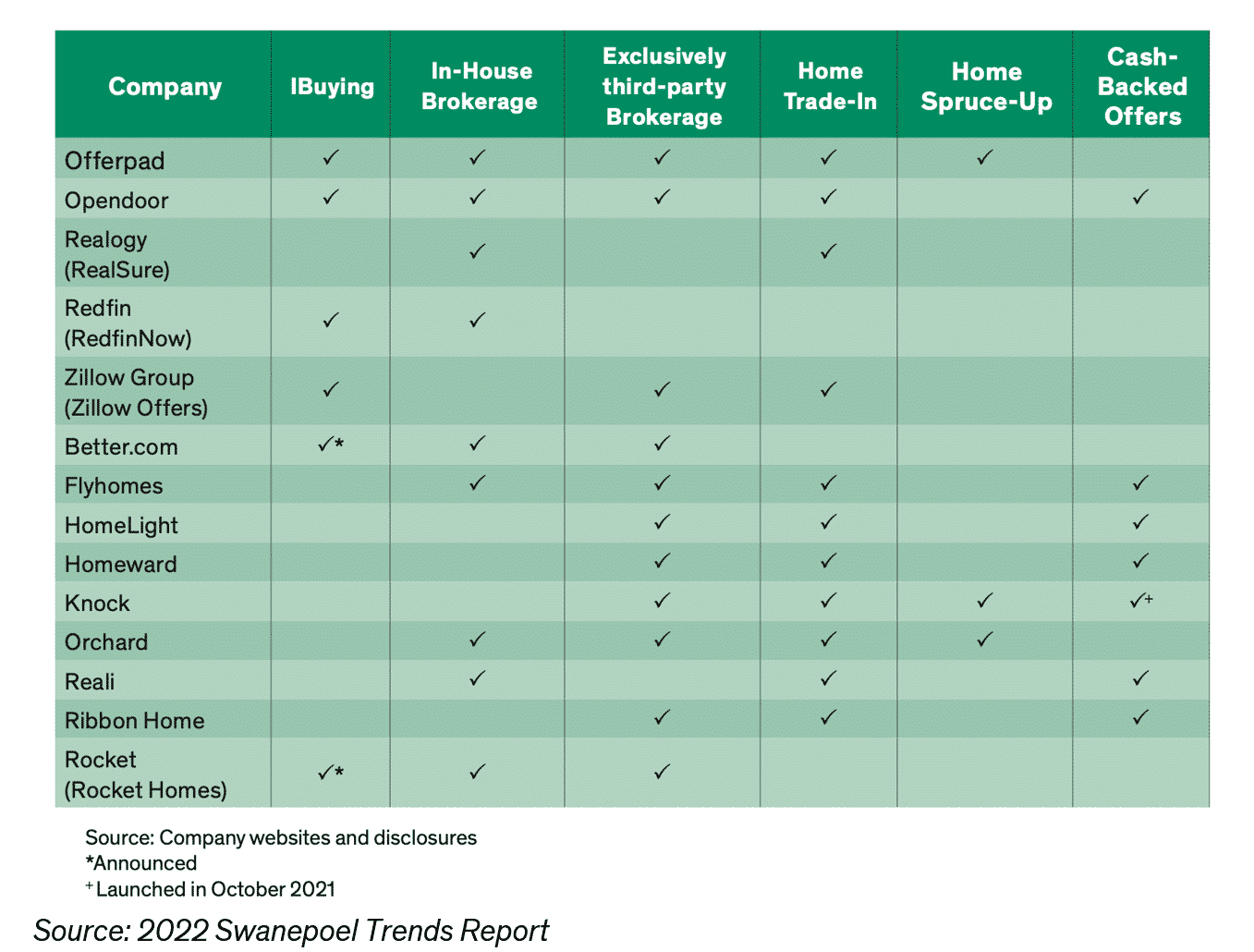

Companies have introduced a variety of AltFin services – some just serve sellers (such as the traditional iBuying service), some serve sellers who are also buyers (known as synchronous sellers) and some just buyers. In addition, several AltFin companies offer brokerage services that supplement or serve as a backup to their AltFin options.

Some companies serve more than one type of consumer, while others just focus on one.

For example, Opendoor serves all three consumer types. It provides traditional iBuying to sellers, a home trade-in option for synchronous sellers and cash-backed offers for just for buyers. It also serves as a discount brokerage for consumers who want to transact without using one of its AltFin offerings. In addition, it partners with third-party agents in some cases in markets where it does not have in-house agents.

Some companies, such as Opendoor, Offerpad and Orchard, aim to win and serve customers directly. Others such as HomeLight, Knock, Ribbon Home and HomeWard only provide AltFin services in partnership with a third-party brokerage or a third-party agent.

For example, HomeLight provides a cash-backed offer service to buyers, a home trade-in service to synchronous sellers and an iBuying service to sellers exclusively through third-party agents in its network. It makes money by charging consumers for these products and also from capturing business related to the transaction through its HomeLight Home Loans and HomeLight Closing Services subsidiaries.

Inside CoStar Group

In the last 12 months, the operator of the nation’s leading commercial real estate marketplace, CoStar Group, jumped into the residential brokerage side in a substantial way with acquisitions of Homesnap and Homes.com.

It had already established a big presence on the multifamily rentals side with its 2014 $585 million acquisition of Apartments.com, along with hundreds of millions of dollars spent each year marketing it, along with several more recent acquisitions to build out the rental network.

Instantly, the real estate industry has a major new portal operator, one with the resources, operational experience and skill to compete with Zillow Group and realtor.com for dominance in the battle for real estate consumer eyeballs and data.

The company has shared part of its strategy – it will lean heavily into a Your Listing, Your Lead portal strategy and will leverage Homesnap as an agent marketing and productivity tool and Homes.com as the public-facing portal.

The company has not, of course, outlined its entire strategy, but by analyzing how it operates its commercial and rental business, the 2022 STR chapter “CoStar Group: Inside Residential Real Estate’s New Heavyweight” provides some insight into how the company generally operates. Its model will likely include:

- Subscriptions from real estate brokers and agents for marketing their listings

- Tiered marketing packages, with done-for-you marketing at the highest tiers

- Analytics and tools for real estate brokerages and agents

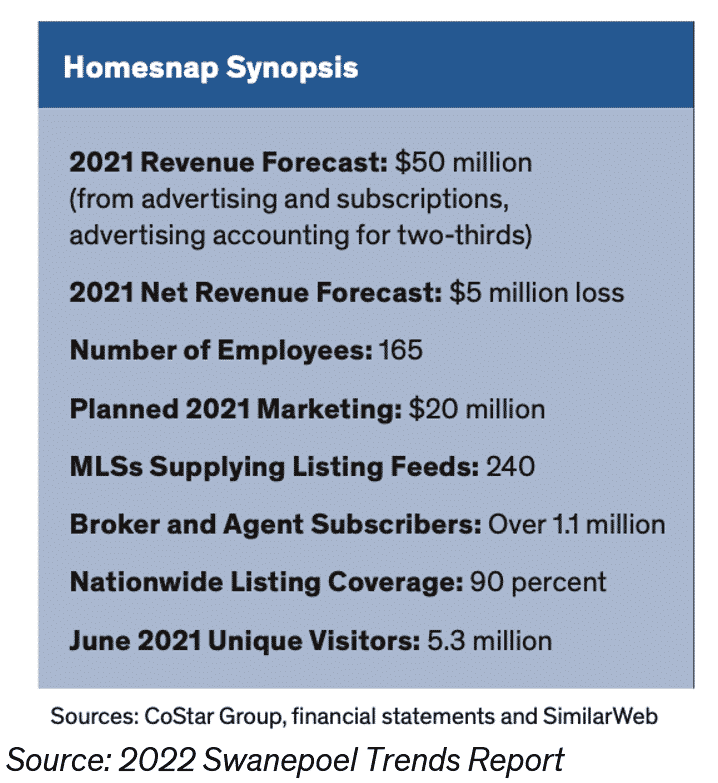

Homesnap, which has approximately 240 MLSs supplying listing feeds, which cover 90 percent of the nation, gives the company broad coverage.

CoStar Group also operates with a go-for-it approach. It has made eight acquisitions in the multifamily and residential real estate space since its 2014 Apartments.com acquisition.

Part of the company’s approach includes cross-selling and integrating with some of the other real estate-related marketplaces it operates in commercial, land and rental. The full breadth of the company gives an idea of its potential.

Its most significant brands in each industry include:

- Commercial: A commercial real estate data, analytics and information service at CoStar (costar.com); a commercial real estate advertising network with LoopNet (loopnet. com), CityFeet (cityfeet.com) and Showcase.com; and a commercial real estate auction marketplace with Ten-X (ten-x.com).

- Business and Franchise Sales: A marketplace for busi- ness and franchise sales, which includes BizBuySell (bizbuysell.com), BizQuest (bizquest.com) and FindaFranchise (findafranchise.com).

- Land Sales: A marketplace for rural land sales led by Land. com and includes LandsofAmerica (landsofamerica.com), LandAndFarm (landandfarm.com), and LandWatch (landwatch.com).

- Multifamily Rentals: A rental listing marketplace network led by Apartments.com and includes ForRent.com, Apart- mentFinder.com, ApartmentHomeLiving.com, Apartamentos.com and a handful of smaller sites.

- Residential Sales: A real estate search, productivity and marketing platform led by Homesnap and Homes.com.

- Hospitality: STR, formerly known as Smith Travel Re- search, a company that collects, analyzes and reports hotel industry data.

The real estate media landscape

Like brokerages, technology and organized real estate, real estate media has undergone significant change in recent years, too. The industry’s leading news source for years, Inman News, sold to private equity group Beringer Capital in 2021 while HW Media, operator of HousingWire, acquired the publishing arm of RealTrends. It, too, is owned by a private equity company. Industry stalwart RISMedia underwent changes in ownership and introduced a revamped website in 2021.

Keeping track of industry news is important, and, with the significant recent shifts on the media landscape, T3 Sixty did an analysis of the leading real estate news organizations that included identifying the types and frequency of content they produce.

The news organizations analyzed include: Inman News, HousingWire, RealTrends, RISMedia, Realtor Magazine and The Real Deal. Details are included in Chapter 8 of the STR report.

Takeaway Change is occurring faster than usual. The Swanepoel Trends Report is designed to be your tool in making smart decisions to navigate successfully through the maze of change. T3 Sixty spends hundreds of hours researching, analyzing and debating to create the report to serve industry leaders. Purchase a physical copy of the report here or sign up for T3 Intel to access a digital version of the report here.