IBuyers – the companies that purchase homes directly from sellers – is rapidly developing into a broader category of iFunding in which companies, often as licensed brokerages, use a variety of financing methods to streamline transactions on behalf of homebuyers and homesellers.

These companies, including Zillow and Opendoor, but also a growing number of others including HomeLight, Orchard, Knock, Offerpad and FlyHomes, engage directly with buyers and sellers with a message of a certain, fast and simple transaction, and then work to get them into ancillary services they own. Many have in-house mortgage, title and escrow firms that will help them with the thin (or currently in many cases still negative margins) inherent in this model.

IFunders are learning what traditional brokerages have over many years learned the hard way: the modern real estate transaction, including iBuying, has relatively low margins, and, to build a sustainable modern business, they must either complete an enormous amount of transactions, win consumers directly and distribute those as leads to their agents under favorable splits, or grow additional (ancillary) revenue to survive. Read Trend No. 6 in the 2020 Swanepoel Trend Report, “The Diminishing Financial Viability of Traditional Brokerages.”

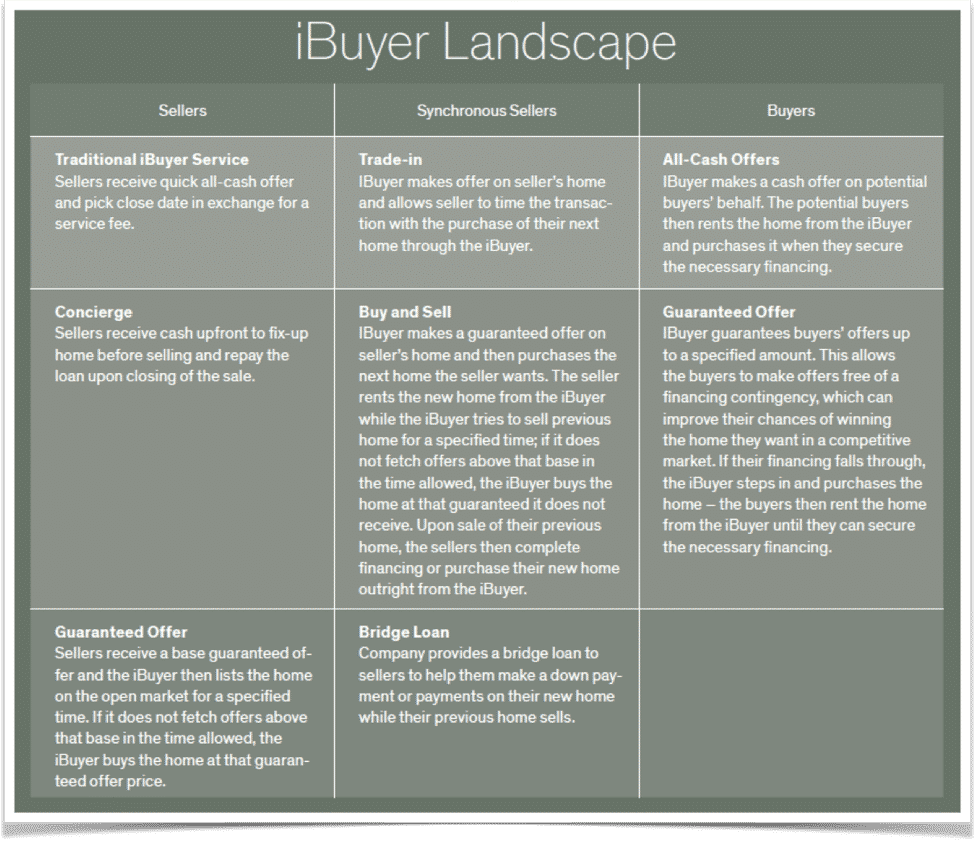

IFunding has spread well beyond just iBuying. IFunders have a variety of products for buyers, sellers and synchronous sellers, those sellers also looking to buy a new home.

Source: 2020 Swanepoel Trends Report.

To help elucidate this new model, we dive into one iFunder, HomeLight, to explore its value proposition and offerings.

HomeLight overview

HomeLight launched as an agent-matching service in 2012 with $1.5 million in backing from Google Ventures and other investors; it has raised a total of over $165 million since launch. Its site, geared directly to consumers, uses MLS data, sales histories, agent performance and other factors to match consumers with what it deems is the best agent for them. A registered brokerage, HomeLight charges agents a referral fee on leads it sends its network of over 80,000 agents when they close.

The company uses digital marketing, TV advertising and sponsored content as well as partnerships such as the one it has through U.S. News and World Report to attract consumers for its agent-matching and iFunding programs.

Like other brokerages with a referral model, including Zillow’s new Flex program, HomeLight calls each consumer lead and then, once qualified, hands them off to an agent. It also launched a new program this year, HomeLight Elite, which, like Zillow’s Best of Zillow program, identifies top-performing agents in its network and features them more prominently on its platform.

Eighteen months ago, HomeLight co-founder and CEO Drew Uher, like many in the industry, saw the growing interest in iBuyers and decided to guide the company toward iFunding.

HomeLight took steps to start building out its iFunding business by:

- In January 2019, it launched title and escrow divisions (currently active in just a few states).

- In February 2019, it launched Simple Sale, in which it presents all-cash offers to consumers from a network of buyers that include established iBuyers, investors and others (the national network has over 200 buyers). Under this program, it does not purchase homes directly. The cash buyers pay HomeLight a fee when they buy a home through the program. Approved agents, can market this service to their clients.

- In July 2019, HomeLight bought mortgage startup Eave, which has become HomeLight Home Loans.

- In November 2019, the startup raised $109 million to build out its mortgage and closing services business, with $46 million of that as debt financing.

- Finally, this January, it rolled out Cash Close, which includes two components: HomeLight Cash Offer and HomeLight Trade-In.

How it Works

HomeLight’s network of 80,000 third-party agents working for other brokerage companies are key to its iFunding model. It has chosen to not funnel business to in-house agents, but to rather charge its network a 25 percent referral fee when it brings an iFunding consumer.

Cash Close, only operational in California as of press time, represents an agent twist on the iFunding model. It requires consumers to work with an agent in its network that it has certified in the Cash Close program. It charges agents a referral fee of 25 percent, the same fee it charges agents on its matching service.

With Cash Offer, consumers apply for a loan through HomeLight Home Loans. If approved, HomeLight then allows buyers to make a cash offer (with its funds) up to the amount approved. If consumers choose to use HomeLight Home Loans for the purchase, HomeLight charges them a fee of 1.0 percent of the purchase price for the Cash Offer service. If they choose another lender for their loan, it charges them a fee of 3.0 percent of the purchase price for the service. In both cases, HomeLight charges an additional fee of 0.5 percent of the purchase price for every period of 30 additional days it owns the home.

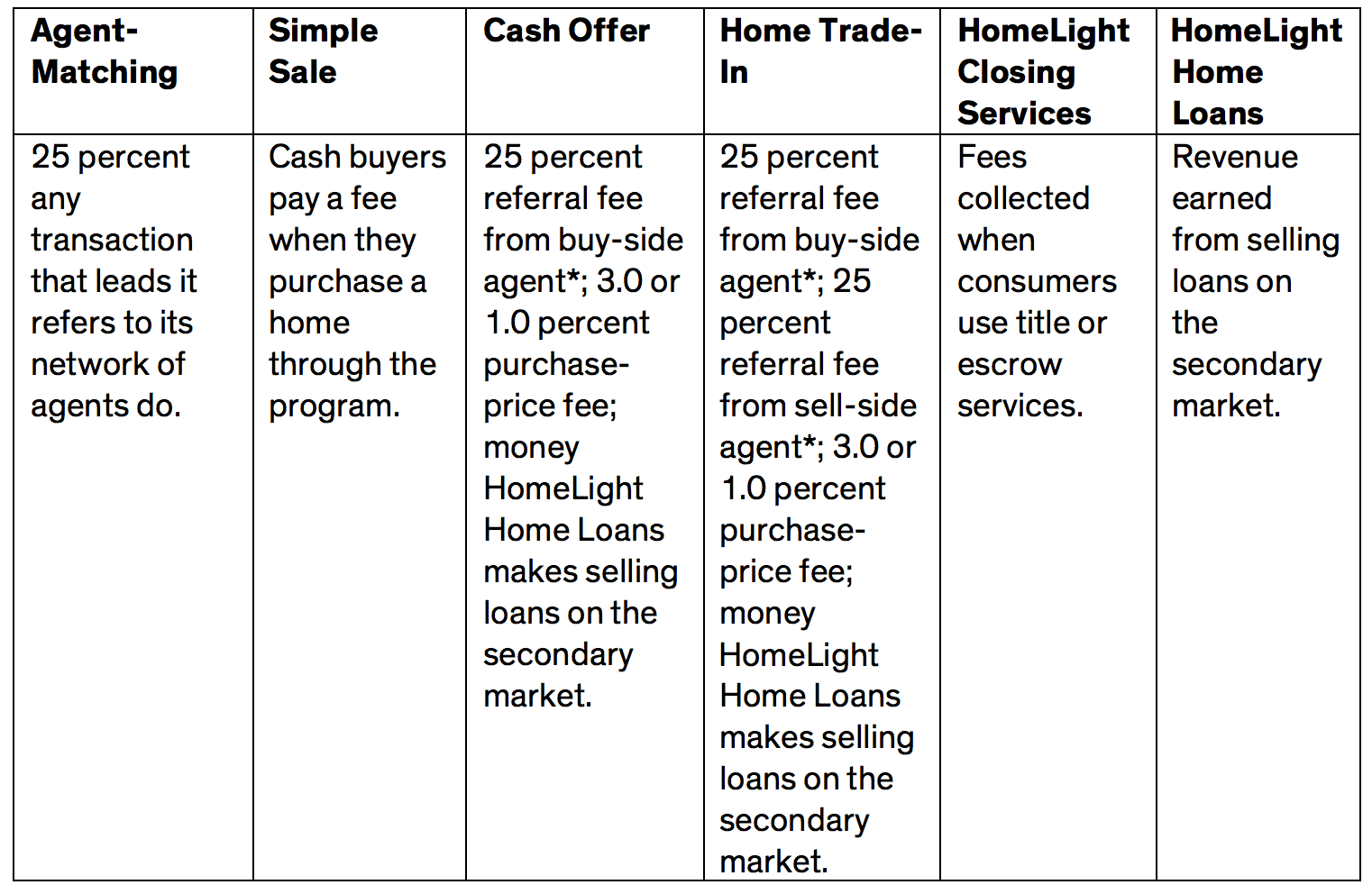

How HomeLight makes money as an iFunder

*If HomeLight introduces the consumer to the agent. If agents introduce consumers to the program, they pay no referral fee.

HomeLight Trade-In works like Cash Offer except that with Trade-In the consumer has a home to sell in addition to one they’d like to buy. In this case, HomeLight makes a guaranteed offer on the seller’s home for less than what it thinks it can sell the home for. Then the seller goes hunting for their next home. When they have an offer accepted, HomeLight then purchases their existing home itself at the guaranteed offer amount (functioning as an iBuyer), which gives the seller cash they can use for the down payment and other expenses on their new home. Then HomeLight preps and lists their old home with a third-party agent in HomeLight’s network; if it sells for over the amount HomeLight guaranteed the seller, it gives the upside to the seller, less selling costs and program fees (more on that below).

As with Cash Offer, HomeLight incentivizes sellers to use HomeLight Home Loans on their new purchase by charging a lower fee for participation in the Trade-In program. HomeLight charges Trade-In sellers 1.0 of the purchase price if they use HomeLight Home Loans on their next purchase and 3.0 of the purchase price if they do not.

Because HomeLight weaves third-party agents into the model, agents can effectively leverage the company’s iFunding proposition into their marketing. For example, those certified in the HomeLight Cash Close program can advertise the Cash Close feature to clients, which can help win them business, and if those consumers end up using the HomeLight service, they pay no referral fee.

Takeaway

Diving into HomeLight reveals one way the broad iFunding experiment is unfolding. Successful traditional brokerages have long focused on funneling transaction clients to their ancillary services. This effort is not new, but what is, is the powerful messaging of a fast, easy, certain sell, the financing tools and model to back it up, and a model centered on brokerages winning the consumer first and then backing into transaction, funding and agent services. Smart brokers will develop programs and strategies that compete with portions of this powerful messaging and model.

Edit: This story has been updated with information on how HomeLight Home Loans makes money as a lender.