As states begin to open and economies sputter back into something resembling fuller operation, a hampered housing market waits in the balance.

Covid-19 has not only impacted the mechanics of homebuying and homeselling, but has driven high unemployment, which reduces the number of capable buyers and made consumers, in general, skittish about pursuing large transactions, such as those involving a home.

Home sales have plummeted close to 50 percent in April, according to multiple reports, while prices are holding steady.

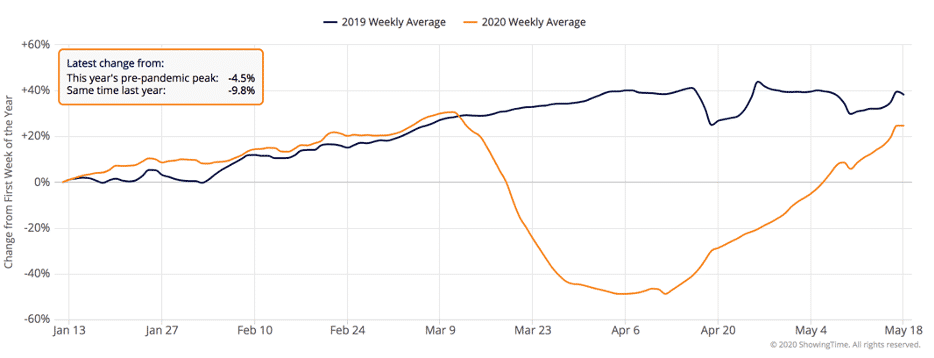

However, as many areas of the nation begin to open and virtual showings become more prevalent in May, showings are rising, according to data from showing software provider ShowingTime. Through May 18, showings have steadily climbed after a steep decline led to a low in early-to-mid-April.

Source: ShowingTime

This showing data reveals that demand still exists for homes. However, sales, which drives the residential real estate brokerage industry, will determine when the industry fully rebounds.

With these big questions looming, T3 Sixty reached out to four prominent housing economists for their take: Lawrence Yun, NAR chief economist; Skylar Olsen, Zillow senior principal economist; Michael Fratantoni, Mortgage Bankers Association chief economist; and Danielle Hale, realtor.com chief economist.

| Expert | 2020 U.S. Total Existing Home Transaction Side Outlook (% change from 2019’s 5.34 million) | 2020 U.S. GDP Outlook (% change from 2019’s $21.43 trillion) |

| Lawrence Yun | Low: 4.0 million (-25.1%) High: 4.8 million (-10.1%) | Low: -10% (from 2019) High: -4% (from 2019) |

| Skylar Olsen | 4.3 million (-28%)* | -4.9%** |

| Michael Fratantoni | 5.1 million (-4.5%) | Low: -8% High: -9% |

| Danielle Hale | 4.5 million (-15.7%) | -5% |

*Includes new-home sales, which totaled 638,000 in 2019. **Zillow did not formulate its own number, but used Goldman Sachs’ March 30 forecast, noted in the chart.

Lawrence Yun, National Association of Realtors chief economist

What key stats are you watching in assessing a recovery?

Days-on-market to see if newly listed homes are quickly attracting buyers. A fast-moving market implies that 70 percent of workers who are presumed to have a secure job are ready to get going in light of record low mortgage rates.

When will the market turn back on? How will we know when it’s back?

Many would-be homesellers have postponed listing and should be ready to list with the opening of the economy. If buyers quickly take inventory, then getting back to normal will happen sooner – perhaps even by year’s end.

When will the market return 100 percent back to normal? What’s normal look like?

Home sales in 2019 were 5.3 million nationwide. Getting back to normal will mean home sales reaching back up to this level – the monthly sales stat on an annualized basis. This should be combined with stable home prices to limit foreclosures.

Skylar Olsen, Zillow senior principal economist

What key stats are you watching in assessing a recovery?

Specific to housing, we are tracking pending sales and mortgage applications as indicators for sales volume, new listings for signals of seller confidence from existing homeowners, construction levels for longer run indicators, among others.

For the economy at large, job openings, unemployment claims, the yield curve, interest rate spreads and sentiment indicators are some of what we are watching. In this environment, the research and public data community is crucial.

When will the market turn back on? How will we know when it’s back?

Having reformed after the Global Financial Crisis, U.S. real estate is resilient. We’re already seeing signs of a bounceback. New listings and pending sales are inching up from record lows, and pageviews on our site are higher than they were last year, all signs that people are easing back into the market.

People still need to move, and agents, buyers and sellers are adapting to social distancing requirements. As one example, the number of 3D home tours created on our site was about six times higher in April than it was in February.

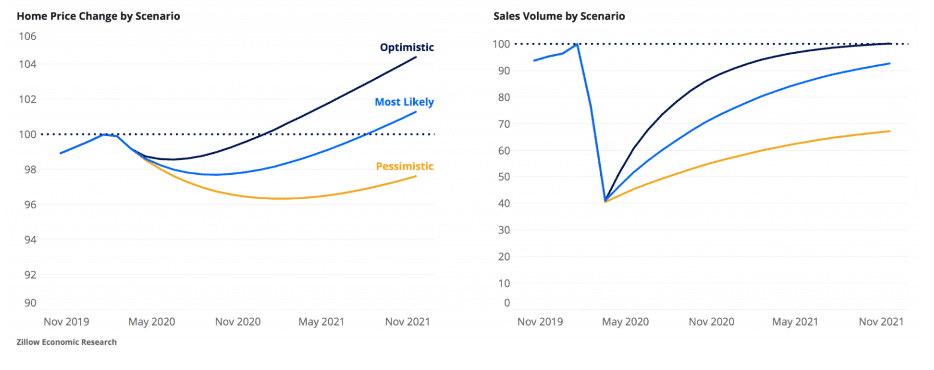

Zillow’s home price and sales volume outlooks as of May 4, 2020. Source: Zillow.

When will the market return 100 percent back to normal? What’s normal look like?

In terms of transaction volume and prices, we expect those to recover to pre-pandemic levels (themselves a strong high water mark for housing) by the end of 2021. Normal before this crisis looked like strong interest from a large generation of millennials hitting life’s homebuying milestones — getting married and having kids.

This generational demand continued to drive available inventory down. Unfortunately, we had only just reached “normal” in terms of the building of new single family properties — a rate of 1 million units per year. The confidence of homebuilders may take longer to bounce back.

What’s your outlook now for total transactions in 2020 (low and high side outlook)?

We think we are near the bottom for transaction volume and it will begin to rebound by about 10 percent a month through the end of next year under our most likely scenario. Even under our more optimistic and pessimistic scenarios, we think we’re near the bottom. The difference would be in the speed of the recovery. In our optimistic scenario, which we think is the least likely possibility, sales volume would recover about 19 percent each month and be near pre-pandemic levels by the end of the year. Our pessimistic scenario shows about a 5% recovery each month, lasting into 2022.

Zillow updates its forecasts here.

Michael Fratantoni, Mortgage Bankers Association chief economist

What key stats are you watching in assessing a recovery?

Purchase applications, housing starts and home sales increasing again on an annual basis.

When will the market turn back on? How will we know when it’s back?

Rising consumer and household confidence leading to increased home sales and more homeowners listing their home on the market to buy a new one.

Danielle Hale, realtor.com chief economist

What key stats are you watching in assessing a recovery?

A housing market recovery depends on a number of factors, and my team monitors and analyzes myriad trends. We’re watching economic data closely, particularly jobs data, since workers who have income will drive a housing recovery. To assess the housing market, we track total inventory, days-on-market, median listing and selling prices, new listings, and mortgage financing trends.

When will the market turn back on? How will we know when it’s back?

All real estate is local, and market recoveries will vary across the country. For example, we have seen overall volumes of newly listed properties decrease over the past few weeks, a sign that sellers are still on pause, but more than two thirds (75 of 97) of large metros are seeing smaller declines, including large markets like Dallas, Chicago and Atlanta (as of the week of May 2). This means that, in some areas, sellers are gaining confidence to get back into the market, but we’re still a long way from normal.

When will the market return 100 percent back to normal? What’s normal look like?

We’re in an economic crisis induced by a public health emergency. Addressing the root cause — defeating the virus or neutralizing its threat with effective treatments or a vaccine will be key to restoring confidence in person-to-person interactions that drive a lot of economic and housing activity. No one can predict exactly when that will happen, but as various areas make progress against Covid-19, we expect them to begin to recover at different paces.

Realtor.com updates its forecasts here.

Takeaway

These experts outline what metrics we should be watching to determine when and how the nation’s real estate markets will recover. Taken as a whole, it is clear that brokerages and agents should prepare for a long, sustained recovery that continues well into 2021.